The DeFi space has some fierce rivals in its different categories ranging from DEXes such as Uniswap and SushiSwap to NFT marketplaces like OpenSea and Magic Eden.

In the lending category, AAVE has domination in terms of the Total Value Locked (TVL) on it, holding $6 billion. Following it is JustLend, Tron’s own lending Dapp. And, right after it comes Compound, the tenth biggest DeFi protocol in the world with $2.74 billion locked on it.

Compound vs MakerDAO

In the midst of these Dapps stands MakerDAO-natively a CDP protocol- which has found an audience in the lending market as well.

Plus, being the biggest DeFi application with more than $7.6 billion locked on it also helps.

As a result, MarkerDAO has been consistently competing with Compound in all but one aspect, which is the borrowing of the protocol.

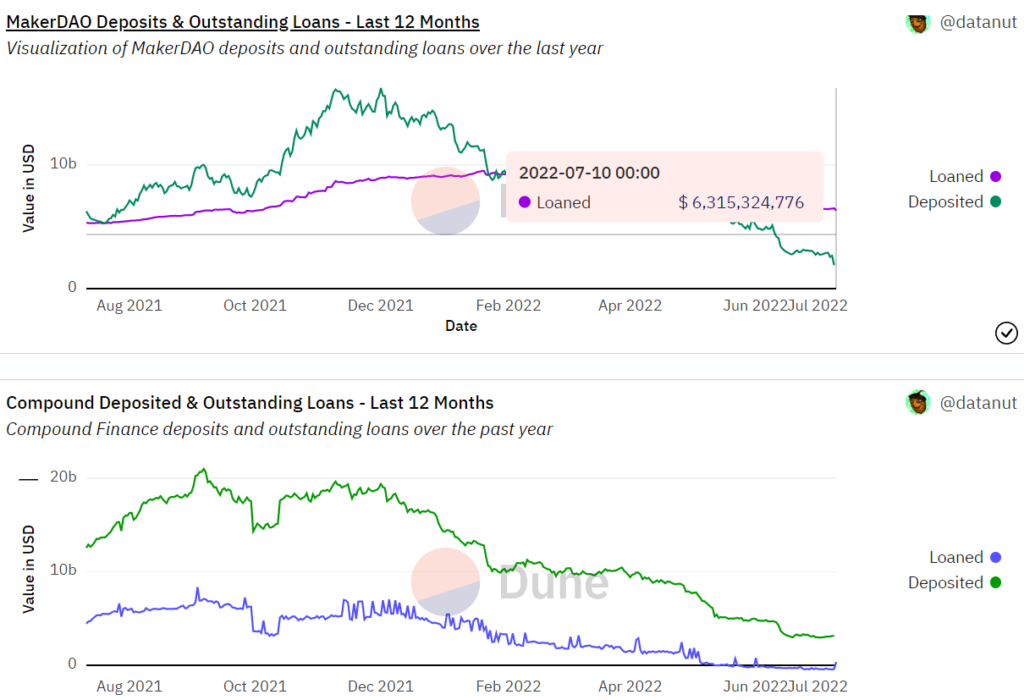

The total deposits on Compound since the beginning of this year have been declining, with just $3 billion left on the platform out of $13 billion.

At the same time, MakerDAO’s deposits have also reduced from $10.8 billion to just $1.8 billion.

Compound and MakerDAO Deposit and Loans | Source: Dune – AMBCrypto

However, MakerDAO as a lending protocol is performing better because the outstanding loans on the platform exceed that of Compound by a mile.

Compound, up until 10 July, was noting negative outstanding loans, which stood at $360 million at the time of writing.

A part of this growth came from the 17.68% rally that COMP observed on 9 July, which helped the altcoin officially close above the $50 mark.

Compound price action | Source: TradingView – AMBCrypto

Even so, it came nowhere close to MakerDAO’s $6.3 billion worth of outstanding loans (ref. Compound and MakerDAO Deposit and Loans image).

This is why in the last 12 months, while Compound’s Loan to Value (LTV) ratio sank to -12%, MakerDAO’s rose to 243%. Thus, sitting at 343% at the time of writing.

Compound and MakerDAO LTV | Source: Dune – AMBCrypto

All this goes to say that Compound might need to gather a much larger audience to compete with MakerDAO, or else it will continue lingering in the lower zones.