MakerDAO was seen witnessing some dominance in the DeFI market as of 15 October. And one of the reasons for this development could be the constant introduction of new proposals to improve the protocol on the whole.

_____________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for MakerDAO for 2022-2023.

_____________________________________________________________________________________

Storm incoming!!

According to a tweet that was posted by MakerDAO’s twitter account on 14 October, the latest executive proposal’s approval would entail a set of auction risk parameter changes for specific vault types. Furthermore, this also included a reduction in the debt ceiling and reduction of fees for certain protocols as well.

The latest Executive Proposal was successfully approved and its proposed changes to the Maker Protocol are ready to be executed.

What are these changes?

↓

— Maker (@MakerDAO) October 14, 2022

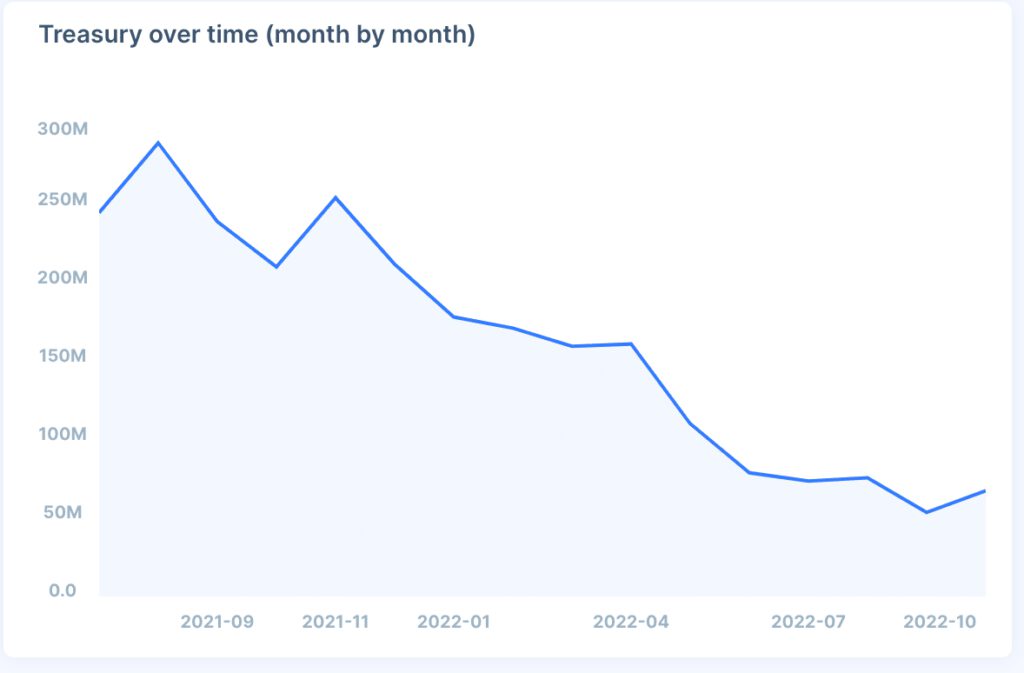

Despite MAkerDAO’s constant efforts to create proposals to instigate growth, things didn’t look great just yet. MakerDAO’s treasury’s funds kept declining.

Additionally, as can be observed from the image below, MakerDAO’s treasury funds depreciated significantly as compared to 2021. Thus, for MakerDAO to witness some growth it was essential for the team to have the funds required to incentivize progress and positive changes.

Source: DeepDAO

The declining treasury funds, however, did not hamper MakerDAO’s control over the DeFi market. According to DeFiLama, MakerDAO ranked number one in terms of TVL compared to other protocols as of 15 October.

However, it remains to be seen whether MakerDAO can continue its reign as there was a decline observed in terms of fees and revenue generated over the past two months. This could thus, be a cause of concern for MakerDAO’s team.

Despite the decline in revenue and fees, the MKR token managed to remain popular among the whales.

According to WhaleStats, a whale activity tracking platform, the MKR token was one of the most used smart contracts by the top 500 ETH whales as of 15 October. This continued interest from whales could have a positive impact on the MKR token.

Are things getting “DAI”cy?

The growth of MakerDAO can be considered as congruent with the success of the DAI stablecoin. According to analytics on Dune, DAI ranked second in terms of transfer volume in the past 30 days.

Furthermore, the DAI stablecoin also accounted for 28.1% of the total transfer volume of stablecoins, coming second to USDC.

It also appeared that DAI’s growth did have an influence on the MKR token. As of 15 October, MKR’s price increased by 3.66% over the last 24 hours. The market cap appreciated by 3.00% during the same time period as well.

However, its volume witnessed a depreciation of 21.15% which could imply that MKR’s price may take a bearish position in the near future.