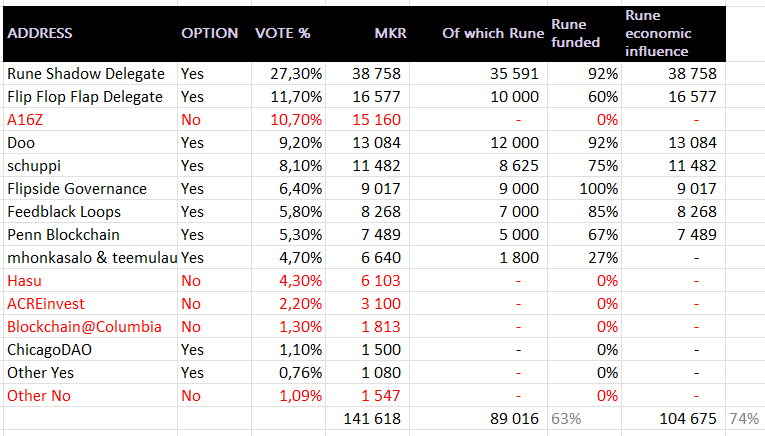

MakerDAO (MKR) members voted in favor of founder Rune Christensen’s “Endgame Plan” by an overwhelming majority of 80%. Some observers criticized the voting process for a lack of decentralization. They claimed Christensen influenced 63% of the votes backing his proposal.

In May, Christensen published Endgame Plan, a roadmap detailing his plan for restructuring MakerDAO to achieve decentralization over the next 10 years. The founder has spoken against Maker’s governance model since the dissolution of the Maker Foundation in 2021.

He criticized the lack of interest from community members to vote on key protocol proposals as a major factor limiting Maker’s ability to manage difficult financial agreements. So, he proposed to unbundle Maker into several self-sustaining units called “MetaDAOs.“

Each MetaDAO would have its own token managed by a committee that is separate from Maker’s broad-based governance system. It means more decentralization. The new structure is designed to neutralize the effect of competing interests within the MakerDAO community.

MakerDAO community votes on several proposals

Earlier in October, Christensen put forward a series of proposals to a community vote. Voting closed on Oct. 24. Members ratified a proposal to transfer $1.6 billion in USD Coin, or USDC, to Coinbase Prime to earn an annual yield of 1.5%

They also approved plans to unbundle MakerDAO’s Real World Finance Core Unit. The unit is responsible for driving the protocol’s real-world investments into things such as government bonds or treasury bills.

Similarly the Events, and the Strategic Happiness Core Units were approved. MakerDAO has since ploughed around $500 million from its $8.83 billion reserve into corporate bonds and government treasury securities.

It’s part of a deliberate plan to diversify the collateral backing Maker’s DAI stablecoin, a $6.24 billion token.

Overdependence on USDC

Christensen is worried about DAI’s dependence on USDC, a sanctionable crypto asset. DAI is 38% backed by USDC. It is the single-largest collateral asset backing the token.

To this extent, MakerDAO members approved another proposal to move $500 million worth of USDC to hedge fund Appaloosa and crypto broker Monetails. Collaterized by Bitcoin and Ethereum, the USDC will be sent over to Coinbase as a loan at a yield of up to 6% per year.

Members also gave the go-ahead for the creation of a vault of stETH, a type of derivative for Ethereum, as backing for DAI. Again, part of a plan to spread the stablecoin’s reserve risk.

In all, Christensen’s proposals received overwhelming support from the MakerDAO community. Its alliance with centralized institutions like Coinbase, however, raised eyebrows.

Apart from the above, Christensen has also announced plans to insulate the protocol from regulators and censorship. He plans to float DAI, allowing the stablecoin to “depeg” from the U.S. dollar over the next two to three years.

In the meantime, he will aggressively accumulate Ethereum (ETH) to help secure the DeFi protocol.

Christensen influence questioned

MakerDAO is a crypto lending platform built on Ethereum. The protocol has more than $7.98 billion in total value locked (TVL) and is arguably the most influential in decentralized finance (DeFi).

While Christensen’s ‘Endgame’ passed the governance vote with ease, the process itself has been criticized for a lack of decentralization.

Sébastien Derivaux, the Head of Asset Liability Management at MakerDAO, claimed that the founder influenced, in some way, 63% of the 122 addresses that took part in the poll. He also said Christensen had an economic influence of more than 74% in the vote.

Only a very small section (6%) of those that voted in favor were not captured or under the Christensen’s influence.

“Most big voters are delegates (a cool system). They are paid in line with the amount of MKR they get delegated,” Derivaux tweeted. “So it is fair to say that when your biggest sponsor is 51%+ of your compensation, you listen. Which, oddly enough, brings centralization.”

“It does not have to be this way as MKR is quite decentralized in holdings, just people don’t vote nor delegate. A16z is one of those who does it a little,” he added.

MakerDAO and Endgame

Andreessen Horowitz (a16z), a significant holder of the MKR token, voted against Endgame.

“The Core Unit structure is arguably already legally decentralized,” said the venture capital firm. “Introducing MetaDAOs likely does not change this analysis, nor lead to more organizational resiliency from a strictly legal perspective.”

Hasu, strategy lead at Flashbots and researcher at Paradigm, voted “no” to Endgame. He explained his decision on Twiter:

“The Endgame Plan is an exceptionally bad proposal. It’s really sad for Maker that it passed the signal (shoved through by Rune singlehandedly in face of strong and justified criticism). It is really sick that a proposal that so dramatically changes core vision, strategy, economics, really every part of the protocol, can pass with less than 15% vote participation. At the very least there should have been a quorum.”

MKR, the native token of the MakerDAO ecosystem, rose 1.3% to $944, as of press. The token has slumped 85% since its peak of $6,292 in May 2021, according to CoinGecko.

Got something to say about MakerDAO or anything else? Join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.