MakerDAO [MKR] received a proposal revolving around a partnership from leading cryptocurrency exchange Gemini on 29 September.

In a tweet by the decentralized stablecoin creator, Gemini offered to have GUSD run on the protocol’s ecosystem. GUSD acts as a fiat-backed stablecoin of the Gemini exchange.

A look at the original proposal showed that Gemini’s co-founder, Tyler Winklevoss, was the lead actor in the proposition. Tyler mentioned that both organizations had a solid partnership since August 2020.

According to him, increased use of GUSD on the MKR ecosystem meant the exchange would contribute 1.25% of all GUSD to the protocol. Hence, this would allow the GUSD operation not to hinder the use of DAI, Maker’s stablecoin.

Where does this leave MKR?

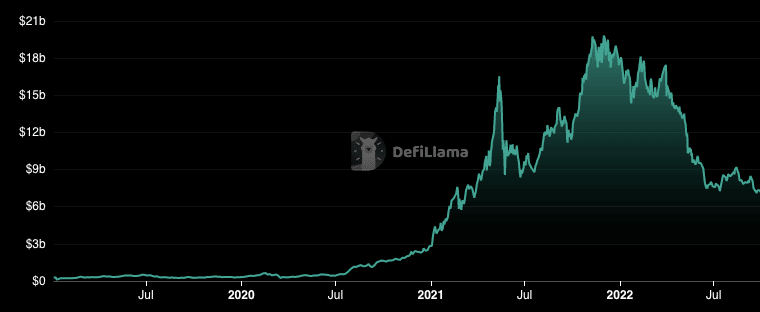

Interestingly, the development couldn’t stop MKR from losing 2.38% of its Total Value Locked (TVL). Based on reports from DeFi Llama, MKR’s TVL was $7.18 billion at press time. The current value meant that MKR’s TVL had lost 10.18% in September alone.

Despite that, it did not affect investors’ confidence in the protocol. This is because Curve [CRV], the second-ranked protocol, was nowhere close to MKR’s TVL at $6.08 billion.

As for on-chain events, MKR investors may have reasons to sell off some of their holdings.

This was due to the current state of the Market Value to Realized Value (MVRV) ratio. According to Santiment, the MVRV ratio was 4.165%. At this rate, MKR could potentially be trading at the top. At press time, MKR was trading at $770.26—a 6.62% uptick from its worth on 29 September.

As per its volume, MKR had risen above $30 million within the same period. With this condition, MKR investors seemed to have increased their participation in using the protocol’s token. However, there was no confirmation that the MKR uptick would continue.

In the short term, MKR investors could remain comfortable with fewer expectations of a massive loss of their holdings. The current volatility rate supported this take. According to the crypto market intelligence platform Messari, MKR’s volatility was 0.69, at the press.

Still, this situation was no guarantee that there would be higher returns. The crypto market intelligence platform also revealed that MKR’s transaction count had increased to 6,600, improving from 5,800 on 29 September.

While an increased interest means positive news for investors, expecting a likely fade was not out of the possibilities.

Finally, comments from the MKR community showed that many supported the Gemini proposals. In the same vein, Tyler made efforts to address some of the questions raised. Responding to a question about MKR or DAI reward selection, Tyler said,

“Customers are able to select DAI and MKR as their reward to earn instant crypto rewards on the Gemini Credit Card.”