- MakerDAO’s new developments may reduce risk for its users

- Its TVL witnesses a slight decrease, but MKR’s price continues to appreciate

MakerDAO‘s latest update might help its users reduce their exposure to more risk via increased liquidity.

Read MakerDAO’s Price Prediction 2022-2023

In a tweet made by MakerDAO’s official twitter account on 10 November, it was stated that if the current executive vote passes, there will be certain changes made to the MANA A vault that will reduce its exposure to risk to more manageable levels. If the risk continues to decline, reductions in stability fees will be considered in MakerDAO’s future.

Important notice to MANA-A users.

If the current Executive Vote passes, the following changes will be deployed to the MANA-A vault type:

• Increase Stability Fee from 4.5% to 7.5%

• Decrease Debt Ceiling from 17 million DAI to 10 million DAI

🗳 https://t.co/iGSrRRHYGt pic.twitter.com/KuBmqj8a8p

— Maker (@MakerDAO) November 9, 2022

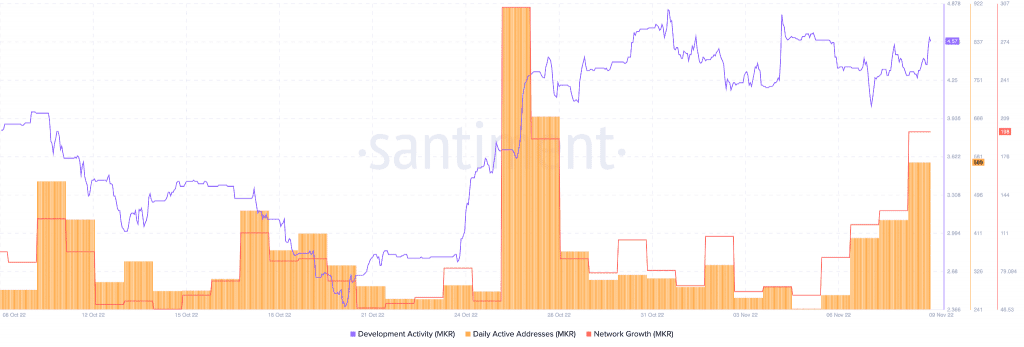

Furthermore, over the past few weeks, the development activity for MakerDAO showed significant growth. This would indicate that the team at MakerDAO was making massive contributions to its GitHub. This spike in development activity suggests that the new upgrades and updates for MakerDAO may be on their way.

The number of daily active addresses on MakerDAO witnessed a drawdown over the past month. However, in the last few days, the number of daily active addresses improved.

In fact, MakerDAO’s network growth metric also witnessed an uptick during the same time period. Thus, indicating that the number of new addresses that transferred MKR for the first time had increased.

Interestingly, whales too have been showing interest in the MKR token.

According to WhaleStats, an organization responsible for tracking crypto whales, the top 1000 whales were holding $59 million worth of MKR.

🐳 The top 1000 #ETH whales are hodling

$79,363,758 $SHIB

$59,285,174 $MKR

$51,708,656 $LOCUS

$43,369,205 $UNI

$42,701,026 $BIT

$36,674,765 $LINK

$32,372,424 $BEST

$30,445,193 $MATICWhale leaderboard 👇https://t.co/jFn1zIOXPB pic.twitter.com/fOODnkwEbL

— WhaleStats (tracking crypto whales) (@WhaleStats) November 10, 2022

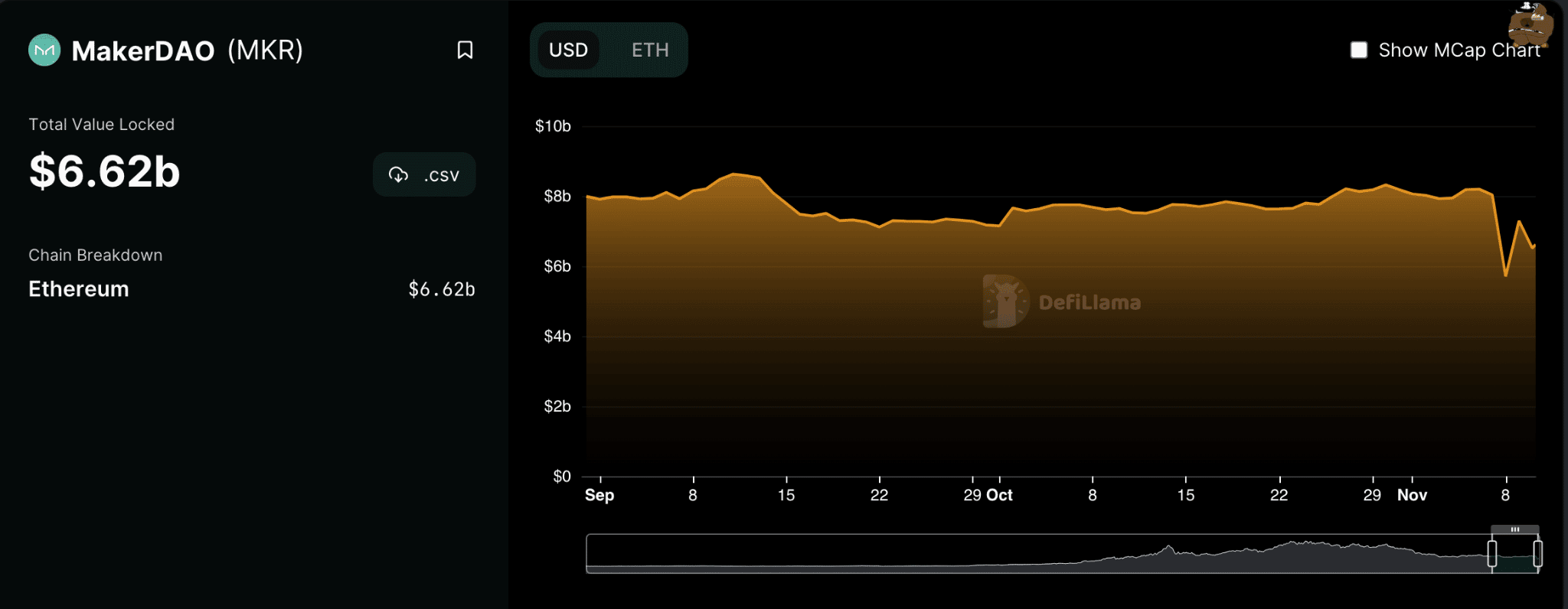

On the other hand, MakerDAO’s TVL witnessed a slight decline. As can be seen from the image below, the total value locked on MakerDAO observed a slight decline in the past few days. At the time of writing, MakerDAO’s TVL was $6.62 billion.

Much to the surprise of the investors, the total revenue collected by the network also depreciated, according to data provided by DeFILlama. At press time, the total fees collected by MakerDAO was $31 thousand.

MKR’s price action, however, remained unaffected by the current FUD surrounding the crypto space.

At the time of writing, the token was trading at $761.96 and had appreciated by 14% in the last 24 hours. Its volume, however, continued to decline, and depreciated by 6.57% in the same time period.