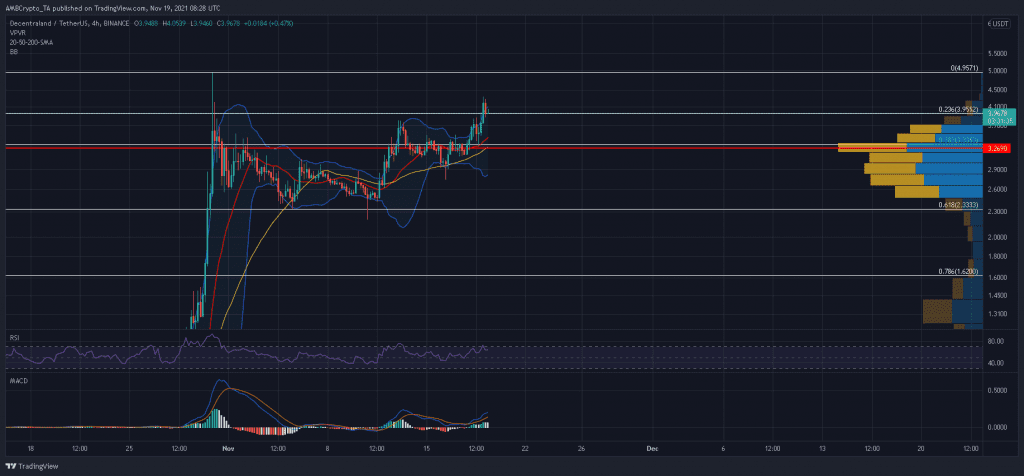

MANA was positioned for a near-term correction after flashing overbought readings on the 4-hour RSI and Bollinger Bands. The 20-SMA (red) and 50-SMA (yellow) along with the Visible Range’s POC at the 38.2% Fibonacci level were MANA’s best bet for an immediate recovery and an ideal long entry for bullish traders.

At the time of writing, MANA traded at $3.96, up by 9.6% over the last 24 hours.

MANA 4-hour Chart

The last 30 days have accounted for over 60% gains as MANA continued to put up consistent buy volumes following a wedge breakout. Now as per the 4-hour indicators, MANA was in line for a correction after trading on the extreme ends of its Bollinger Bands.

On 13 November, MANA suffered a near 30% sell-off after flashing similar readings. The price eventually found support at the confluence of its lower band and 50-SMA (yellow). Current readings on the RSI and MACD presented some near-term threats as well.

The RSI traded in overbought territory- a region which invites selling pressure, while the MACD was exposed to a potential double top formation. Should investors cash out on the rally, MANA could decline by 18%-20% to a defensive region at the 38.2% Fibonacci level.

The area was backed by the 20-SMA, 50-SMA and Visible Range’s POC at $3.26. Ideally, this confluence would cushion sell pressure and allow MANA to initiate the next leg forward. Another support area lay the 61.8% Fibonacci level and the same could counteract a deeper sell-off.

Conclusion

MANA threatened a near 20% sell-off following extreme readings on the RSI and Bollinger Bands. The MACD was closing on a potential double top as well. Hence, expect MANA to move south over the coming sessions and find support slightly below the 38.2% Fibonacci level. The aforementioned region should serve as an ideal region for traders to go long before the next rally hits the market.