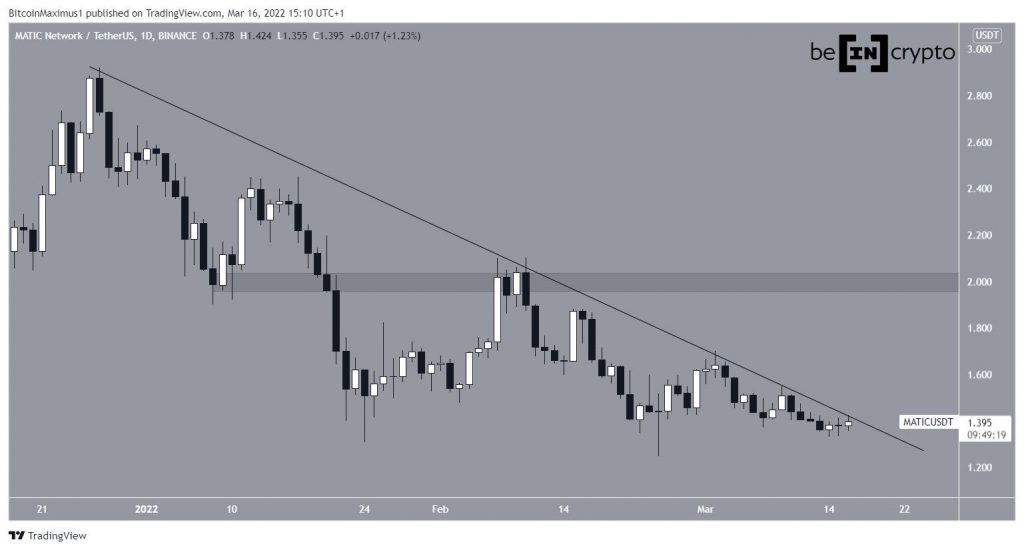

Matic Network (MATIC) has reclaimed a short-term horizontal support level and is in the process of breaking out from a descending resistance line.

MATIC has been decreasing alongside a descending resistance line since reaching an all-time high price of $2.92 on Dec 27. So far, it has reached a low of $1.24 on Feb 24.

Despite following a descending resistance line, MATIC has shown bullish signs by creating two long lower wicks (green icons), which are considered signs of buying pressure. The wicks were created as soon as the price briefly dropped below $1.30, indicating that there is strong support near that level.

If a breakout occurs, the closest resistance would be at $2.

Reclaim of support

A closer look at the movement shows that MATIC has reclaimed the $1.34 horizontal support area. It did so after deviating below it on Feb 24 (red circle). Such reclaims are also considered bullish developments.

Furthermore, MATIC is in the process of breaking out from a shorter-term descending resistance line (dashed), which has been in place since Feb 7.

Furthermore, moving back to the daily time-frame, both the RSI and MACD have generated significant bullish divergences (green lines). Such divergences often precede bullish trend reversals. When combined with the long lower wicks and reclaim of the $1.34 support, they suggest that a breakout from the login-term resistance line is expected.

MATIC/BTC

Despite the relative bullishness of the USD pair, the MATIC/BTC chart is not as bullish.

The price has been falling since creating a double top pattern on Dec 26 (red icon).

On March 14, the price also fell below the 3,550 satoshi area, which is now expected to provide resistance.

Therefore, the most likely outlook has it dropping towards the next closest support area at 2,600 satoshis.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.