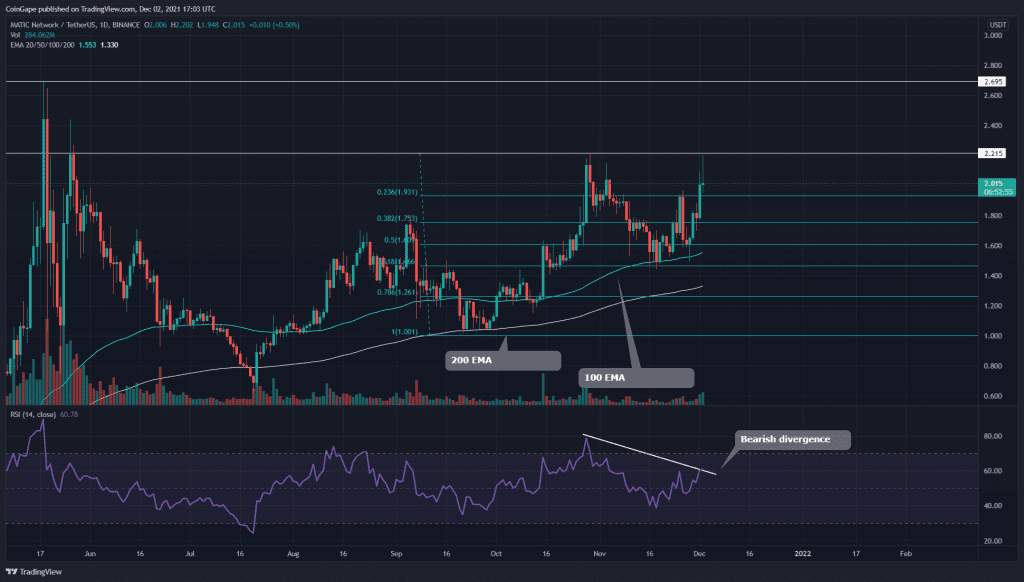

The technical chart of MATIC/USD shows a steady uptrend for this coin. The price currently is in a recovery phase where to aims to breach the overhead resistance $2.2 mark. Moreover, there are few recent news that would interest the crypto investors about this coin; click here to read more.

Key technical points:

- The MATIC daily RSI line shows a bearish divergence in its chart.

- The 100-day EMA provides good support to MATIC price

- The intraday trading volume in the MATIC coin is $3.58 Billion, indicating a 56.68% hike.

Source- MATIC/USD chart by Tradingview

As mentioned in my previous article on MATIC/USD, the coin indicated a classic rally of higher highs and lower highs in its chart. The last time the price was in a retracement phase, it made a new lower low to the 0.618 Fibonacci retracement level, i.e., the $1.45 mark.

After bouncing back from this level, the price displayed an impressive V-shaped recovery in this chart and returned to retest the previous swing high resistance.

The crucial EMA levels(20, 50, 100, and 200) confirm the coin’s bullish trend. The 100 EMA is providing strong support to the price. However, the Relative Strength Index(60) indicates a bearish divergence, suggesting weakness in this rally.

MATIC/USD 4-hour Time Frame Chart

Source- MATIC/USD chart by Tradingview

To continue this rally, the MATIC coin has to breach this overhead resistance of $2.2. However, the bearish divergence in RSi cannot be ignored, and therefore the crypto traders should follow their risk management for entering a new long position.

According to the traditional pivot level, the crypto trader can expect the next resistance level at $2.2, followed by $2.4. And on the flip side, the support levels are $1.92 and $1.7