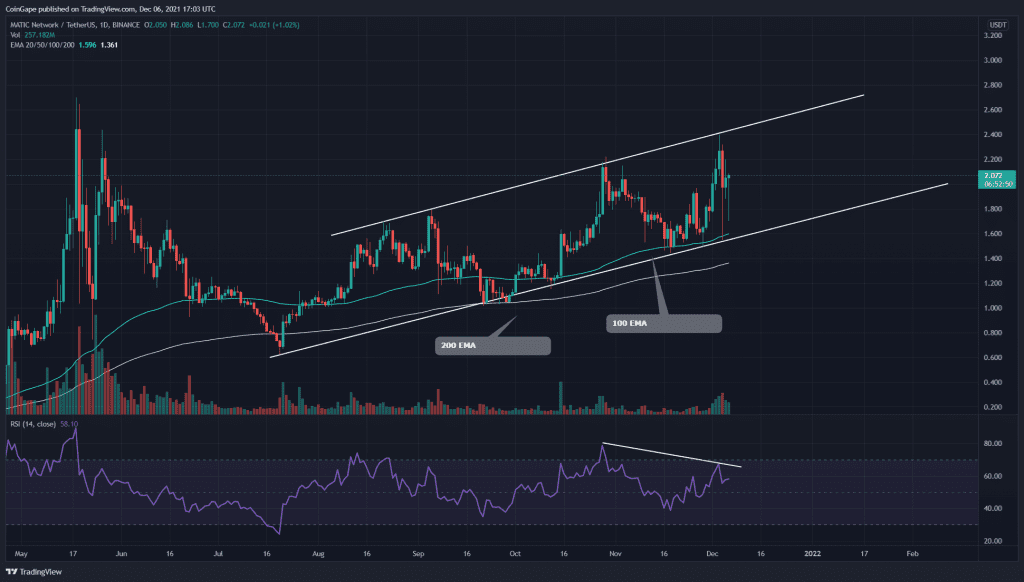

The overall correction in the crypto market led to the failure in MATIC coin price to sustain near the resistance trendline of the rising channel. However, the recent fightback from the bulls to sustain the demand for the coin keeps the chances of a bullish reversal alive. Moreover, many Venture Capital (VC) investors are looking to invest in Ethereum scaling Polygon through an investment between $50 million to $150 million, as per a report from TechCrunch.

Key technical points:

- The MATIC coin maintains an uptrend within a rising channel in the daily chart.

- The intraday trading volume in the MATIC coin is $3.17 Billion, indicating a 15% fall.

Source- MATIC/USD chart by Tradingview

As the entire crypto market fell on December 4th, the MATIC coin price had to share the same fate. The coin price failed to sustain at the top of the rising channel, and by obtaining strong rejection from this overhead resistance, the price started to fall again.

However, instead of taking proper support from the bottom ascending trendline, the price displayed several lower price rejection candles on the midway, indicating the intense buying pressure in the coin.

The crucial EMA level (20, 50, 100, and 200) reflect a strong uptrend in action with their bullish alignment. Moreover, the Relative Strength Index(55) displays an influential underlying bullishness controlling the trend.

MATIC/USD 4-hour Time Frame Chart

Source- MATIC/USD chart by Tradingview

This lower time frame chart also indicates the MATIC/USD chart forms a double bottom pattern with the support of the 200 EMA line. With this bullish pattern, the price could again retest the dynamic resistance above or even an upside breakout in favorable conditions.

The important levels for the coin on the upside are at the $2.30 and $2.50 mark. And, on the lower side, the support levels are at 1.75 and $1.50 mark.