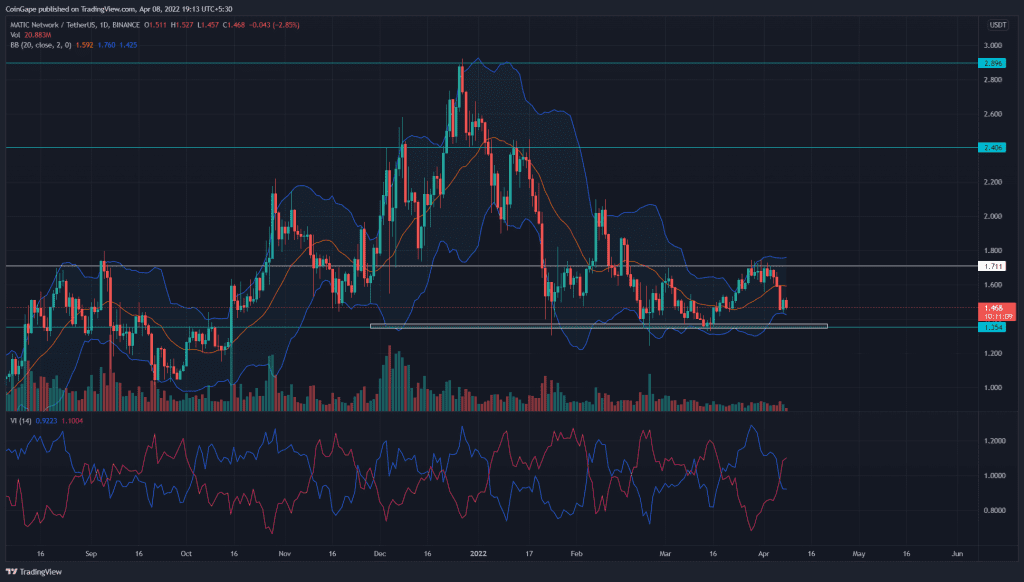

The MATIC chart showed several higher-price rejection candles near the $1.7 resistance zone, indicating the sellers have mounted a strong defense. The resulting reversal dumped the altcoin to $1.45 support, just above the $1.35 support. Can this bottom support renew the exhausted bullish momentum?

Key points

- The MATIC price maintains a bearish alignment among the EMAs(20, 50, 100, and 200)

- The coin buyers are defending the $1.45 support.

- The intraday trading volume in MATIC is $562.2 Million, indicating a 37% loss.

Source- Tradingview

Source- Tradingview

A bullish breakout from the descending triangle pattern on March 18th set out a new recovery for MATIC. The post-retest rally pushed the altcoin to $1.7 monthly resistance, providing a 17.14% gain.

However, the price action went sideways for the next week as buyers couldn’t surpass the $1.7 mark even after multiple attempts. The sellers eventually pressurized the MATIC price for a bearish reversal and tumbled it by $12.3%.

Currently, the altcoin trades at the $1.478 mark and is gradually approaching the $1.35 bottom support. This support level served as a strong assumption level during the last quarter, and traders can expect a similar behavior this time.

A possible bullish reversal from $1.45 or $1.35 support would continue the range-bound rally. However, a genuine breakout from the $1.7 or $1.35 is needed to confirm a direction rally.

Technical Indicators

Vortex Indicator -A bearish crossover among the VI+ and V- lines encourage additional selling in the market.

Bollinger band: The MATIC price action resonating within the sideways moving upper and lower band accentuates a consolidation phase.

- Resistance levels- $1.7 and $1.9

- Support levels- $1.35 and $1.44