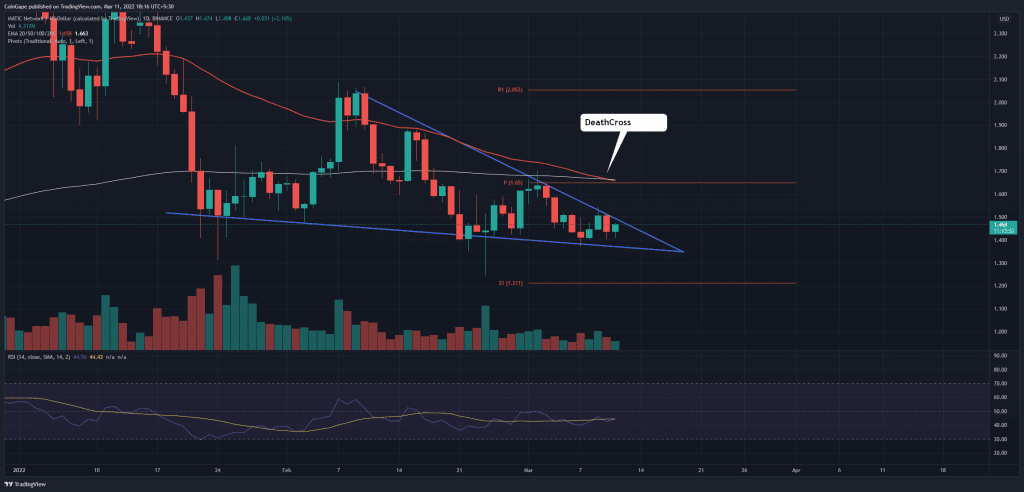

The MATIC price gave a bearish candle from the wedge pattern’s utmost resistance trendline resulting in a 4.64% fall. However, the anticipation of a bearish continuation was sabotaged by the lower price rejection followed by a jump of 1.65%.

Key technical points:

- Polygon price trend remains trapped within the falling wedge.

- The bullish retracement within the bearish pattern hints further recovery

- The crucial EMAs in the daily chart gives a dearth cross.

Source- Tradingview

The MATIC/USD daily chart shows a falling wedge pattern with the price trending below the psychological mark of $1.50. The downtrend fills the falling wedge indicating a breakout rally shortly.

.OffersRow {

display: flex;

flex-wrap: wrap;

}

.offersads{ display:none;}

.Optile {

text-transform: uppercase;

font-weight: 700;

font-size: 16px;

margin: 0 0 14px;

padding: 0 5px;

text-align: left;

}

.offerDv {

padding: 25px 8px 10px;text-align: left;

}.offersads {

padding: 0 13px;

margin: 0 -15px;

background: #f4f4f4;

padding: 20px 5px;

}

.twitter-tweet .offersads {

margin: 0 -40px;

padding-bottom: 20px;

}

.OffersRow .Items {

width: calc(33.3% – 10px);

margin: 0 5px;font-family: montserrat,sans-serif !important;

background: #fff; border-radius: 4px;

box-shadow: 0 1px 3px 0 rgba(0, 0, 0, 0.13);

position: relative;

overflow:hidden;

}

.Items span {background: #0aac29;color: #fff;position: absolute;left: 0;top: 0;border-radius: 0px 0px 2px 0px;padding: 0 12px; font-size:12px;}

.OffersRow .h5ad {

font-weight: 600 !important;

color: #1a419a !important;

font-size: 15px !important;margin:0 !important;

}

.offerSd {

color: #222222;

font-size: 12px;

font-weight: 500;

}

.GetthisDeal a {

display: block;

text-align: center;

font-weight: 600; font-size: 12px;

color: #079321;

}

.GetthisDeal {

border-top: 1px dashed #9b9b9b;

padding: 8px 0 0 0;

margin: 10px 0 0;

}

@media(max-width:600px){

.offersads{display:block;} }

The opposing trendlines seem to be of equal strength as they have kept the trend momentum trapped for more than a month now. Therefore, the breakout of either side will result in a significantly volatile move.

The death cross of the 50 and 200-day EMA project a rise of bearish influence of the price pattern and increases the chances of fallout.

Despite multiple attempts, the daily RSI slope shows a flattish movement with a bearish nudge as it fails to rise above the 50% mark.

MATIC/USD: Weekly Timeframe Chart

Source- MATIC/USD chart by Tradingview

The MATIC/USD weekly chart shows Doji formations near the 50-period EMA at $1.41. A potential bearish wedge breakout in the daily chart will result in the 50-week EMA fallout. Therefore, a downfall move of almost 30% is possible.

The MATIC price action squeezes between the descending trendline and stiff support at $1.4. The buyers need to breach and sustain above the dynamic resistance to obtain their first sign of recovery.

- Resistance levels- $2 and $2.4

- Support levels- $1.33 and $1