MicroStrategy, the business-intelligence software company that has cemented its position as the largest corporate holder of Bitcoin, is exploring potential ways to generate income from its massive trove.

Here Is What MicroStrategy Could Do With Its Bitcoin Holdings

After amassing 122,478 Bitcoin as of December 10, MicroStrategy might seek to make its money work for it.

Speaking during a call with investors on Thursday, the company’s CEO Michael Saylor noted that it could lend some of its Bitcoin to a “trustworthy counterparty” to generate income.

Lending has become one of the most popular cryptocurrency services in the nascent industry. As a holder, you can lend your crypto asset out to borrowers for an opportunity to earn interest. Crypto lending is especially very popular in the decentralized finance (DeFi) sector where investors deposit their assets to liquidity pools.

During the call, Saylor explained how lending could be profitable for his company: “That could become a good source of income for us, or we could develop it with some kind of interesting applications.”

MicroStrategy could also put a mortgage against its Bitcoin cache and generate some long-term debt under “favorable circumstances”.

In August 2020, MicroStrategy declared it would adopt Bitcoin as its treasury reserve asset, describing the cryptocurrency as a reliable store of value and investment opportunity with greater long-term return potentials than holding fiat money.

Since then, the Virginia-based firm has issued convertible senior notes and junk bonds to finance purchases of the cryptocurrency. Following the frequent bitcoin buys since the first major purchase in the third quarter of last year, MicroStrategy now owns over half a percent of all the Bitcoin existence worth approximately $5.7 billion.

Saylor also discussed the possibility of MicroStrategy putting a portion of its Bitcoin into some kind of partnership with a big tech firm or banking institution. He, however, clarified that no serious steps had been taken towards implementing any of these possible initiatives.

MicroStrategy To Continue Its Bitcoin Buying Spree

MicroStrategy’s Saylor is a well-known bitcoin evangelist who oftentimes touts the pioneer cryptocurrency on social media as a one-of-a-kind invention. He also frequently defends his company’s strategy to invest aggressively in BTC.

During the call, the CEO indicated the firm would continue issuing corporate debt and equity in order to scoop up more Bitcoin. He also spoke about the possibility of Bitcoin-backed bonds coming to the market.

The idea of Bitcoin-linked bonds was previously floated by El Salvador President Nayib Bukele. Bitcoin maxi Bukele announced last month that the Central American nation would be issuing a billion-dollar Bitcoin bond with a 10-year maturity on Blockstream’s Liquid Network. The proceeds generated from this offering will be used to build a “Bitcoin City” near a volcano and the rest will be used to buy more Bitcoin.

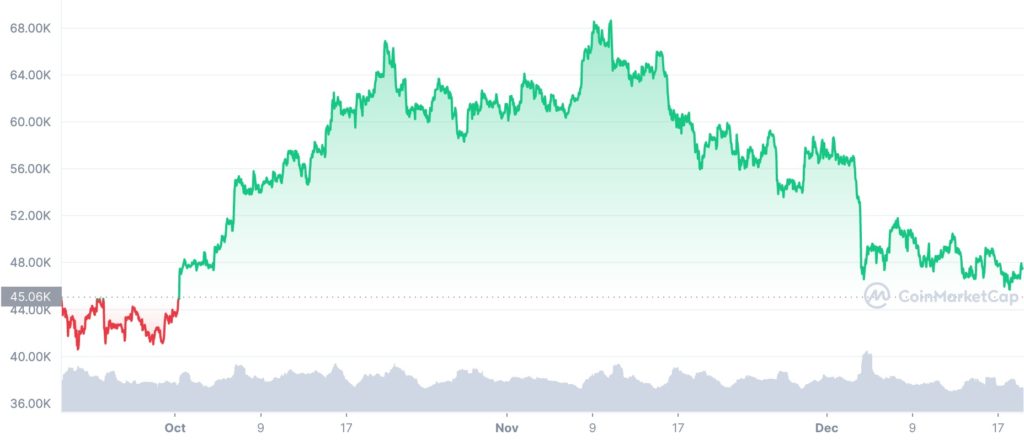

The price of Bitcoin has plummeted 32% from its November all-time high of $69,044.77 to roughly $47,547.43 today. But Saylor and MicroStrategy still believe Bitcoin is the best asset. Expect more huge purchases to come.