Bitcoin’s flash crash and the larger market’s consolidation have presented an interesting opportunity for certain altcoins to rally. While altcoins independently rallying isn’t an unusual phenomenon anymore, when one of the tokens on the Ethereum blockchain moves unexpectedly, independent of ETH, the same brings attention to the coin.

Consider this – Quant (QNT), an Ethereum-based token that aims to bring interoperability between blockchains, noted major gains over a 24-hour window before corrections set in and the larger market consolidated.

Ergo, the question is – What pumped the alt’s recent rally, and is it an attractive investment?

Fractals painting a bullish structure

Historically, larger market flash crashes have been a good time to rally for Quant. Notably, in September this year, Quant rallied by over 84% as the larger market dipped. In fact, from July to September, Quant rallied by over 480%, rising from $65 to its all-time high of $429.

Over the last four days, before corrections set in over the last few hours, amid another bearish market spell, Quant has risen by over 40%.

The altcoin registered the single largest daily candle uptick of over 28% and its RSI too saw an almost vertical uptick. In fact, this was also the highest RSI spike since early September when the altcoin hit an ATH.

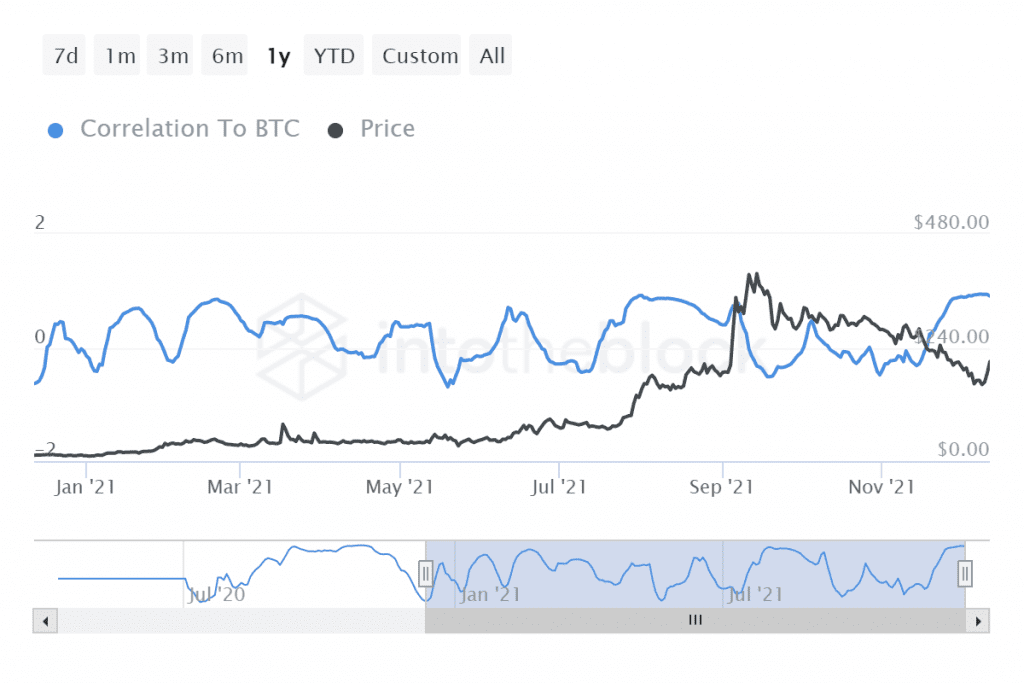

A huge factor behind the aforementioned bullishness could be the coin’s higher stable correlation to Bitcoin, something that has acted in favor of the crypto.

For QNT, as seen previously, a high positive correlation with Bitcoin has been ideal for rallies.

That, however, isn’t all, as a steady rise in large transaction volumes for the altcoin is a sign of how bigger players might have made a return to the scene – A good sign.

The altcoin’s trade volumes too have seen a consistent hike from mid-November, indicating higher retail interest in the alt.

Additionally, whales make the largest number of owners by concentration – Another good sign for the coin’s long-term growth.

Eyeing all-time highs?

While the coin’s trajectory seemed bullish over the aforementioned window, it will need to establish itself above the $225-mark. That level would be good support for QNT in the mid-short term and it could also act as a good entry point.

The coin’s Sharpe ratio, however, still seemed to oscillate in the negative zone. This meant that its performance, compared to a “risk-free” asset, hasn’t been so good. While the Sharpe ratio did see a considerable uptick, it would need to enter the positive territory before QNT truly looks prime for rallying.

On the contrary, the coin’s low volatility remains a plus point, and QNT’s rally might continue well with apt retail support in the near term.