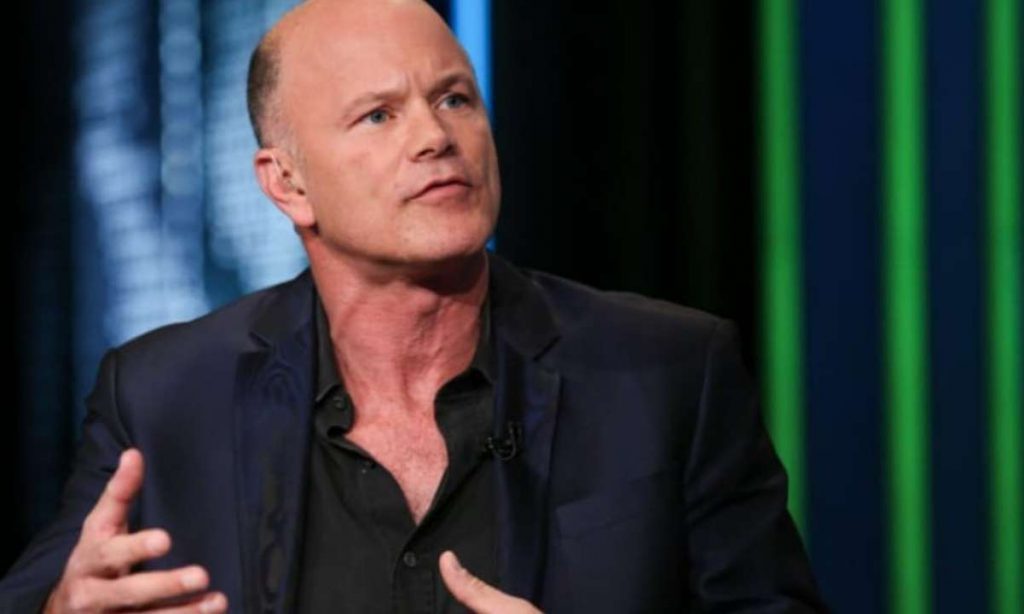

Mike Novogratz – billionaire investor and CEO of Galaxy Digital – has issued a statement addressing the recent meltdown of the Terra ecosystem. He highlights lessons he’s learned from the situation but reinforces his faith in the crypto economy as a whole.

The Idea That Failed

In a letter to shareholders and the crypto community, Novogratz lamented the loss of over $40 billion in wealth suffered by LUNA and UST investors alike. The UST stabilization mechanism meant to maintain its dollar peg only ended up devaluing LUNA into worthlessness.

“UST was an attempt at creating an algorithmic stable coin that would live in a digital world,” wrote Novogratz. “It was a big idea that failed.”

Not only has the collapse “dented confidence in crypto and DeFi,” but it also burned part of Galaxy Digital’s own balance sheet. The company bought LUNA in March of 2020 citing “significant growth potential”, as one of South Korea’s top finance apps was already built upon Terra.

However, Novogratz claims that the Federal Reserve’s tightening in the face of record-high inflation has caused the crypto market to unwind. This, he claims, placed immense price pressure on LUNA – the reserve asset backing UST, ultimately ending in a bank-run style death spiral for the coin.

While the investor does not believe the bearish macroeconomic backdrop will end anytime soon, he remains confident in the crypto ecosystem. That said, he re-stressed some core tenets of crypto investing to stay cautious, including diversification and risk management.

Many in the online community awaited Novogratz’s commentary on the matter, who famously had a LUNA-themed tattoo emblazoned on his arm in January. “My tattoo will be a constant reminder that venture investing requires humility,” he said.

Novogratz clarified that his company’s treasury “does not utilize algorithmic stablecoins.”

Re-Examining Terra’s Collapse

Most top figures within the Terra ecosystem agree with Novogratz that the network unwound due to its flawed UST stabilization mechanism. However, many also theorize that UST was initially de-pegged because of a deliberate short attack, executed by a handful of wealthy actors.

A post retweeted by Terra co-founder Do Kwon claims that nearly 300 million UST were dumped on Curve finance prior to its destabilization. This was followed by numerous shorts on LUNA, and Twitter posts echoing negative sentiment about the cryptocurrency.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.