The Bitcoin network hash rate notched a new all-time high of 248.11 million terahashes per second (TH/s) on 13 February. It rose from 188.40 EH/s to its new all-time high in just one day, according to Blockchain.com data. In the previous few hours, it hovered around 209.6M TH/s. The recent increase added another layer of protection against so-called ‘double spending‘.

Good meets bad

Well, while the aforementioned development might sound positive, here’s the caveat. Bitcoin’s hashrate hike lead to lower profitability of mining. Competition among miners increased proportionally with hashrate as more devices were activated to compete to find the next block.

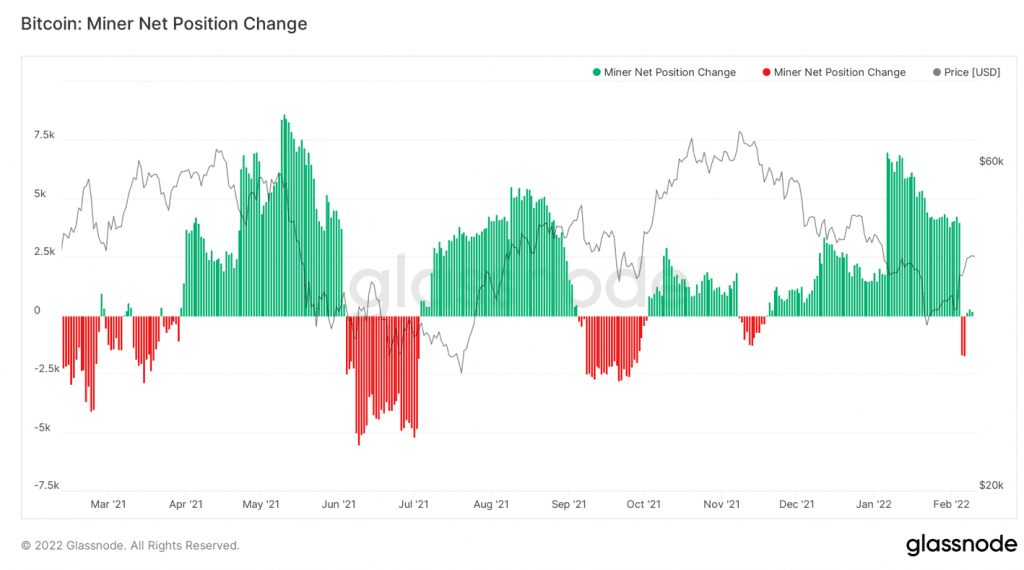

Bitcoin (BTC) miners turned into net sellers of Bitcoin, with miner inventories dropping to levels as seen in the chart below. However, miners weren’t necessarily turning bearish “en masse,” although some did look to offload excess inventory.

Here, the red dip hinted at Bitcoin miners becoming net sellers, after being net hodlers for months. Could this affect Bitcoin directly or indirectly? Well, the possibility looked extremely high.

Possible price correction?

At press time, Bitcoin was trading at $43,500, about 33% below the all-time high (ATH) of about $69,000. CryptoQuant, a data analysis platform looked at similar possibilities using a few metrics. Mining pools played an important role in BTC as they were in charge of supplying new BTC by mining. But they also trigger the price drop when there’s a supply pressure hike (BTC) in exchanges.

Consider the graph below, every hike in ‘Miner Outflow‘ metric was supplemented by a price correction. This time was no different.

In addition to this, all exchanges reserve remained proportional to the supply of cryptocurrencies. It was an important indicator to determine the future value of cryptocurrencies, possibly as a precedent indicator of price changes.

Source: CryptoQuant| All Exchange Reserve

The increased selling pressure suggested that more investors or rather miners deposited their coins for withdrawals to fiat. Because of this, the supply on exchanges was often considered as the “selling supply” of the crypto.

An analyst for wealth management firm D.A. Davidson told Bloomberg on 14 February that miners had ideological and business reasons for being reluctant to sell Bitcoin:

“Big miners would rather sell equity, because their shareholders want them to hold their Bitcoin and not even think about selling it.”

Nonetheless, electricity and equipment bills are piling up.