Maker (MKR) recently stole the limelight from all the cryptos with a higher market capitalization as it showed commendable performance over the last week.

The altcoin became the highest gainer in the last week as its value grew by over 17%, followed by Elrond and Polygon, which also gained 13.4% and 13.2%, respectively.

Top 100 @CoinMarketCap 7 Day Gains 🚀

🥇 Maker $MKR +14.8%

🥈 Elrond $EGLD +13.4%

🥉 Polygon $MATIC +13.2%

4. Convex Finance $CVX +12.8%

5. XRP $XRP +9.5%

6. Stellar $XLM +8.3%

7. Reserve Rights $RSR +7.8%#Crypto #Cryptocurrency #CryptoNews pic.twitter.com/RZIW9EahYb— 🥷 Gokhshtein Media (@gokhshteinmedia) October 5, 2022

At press time, MKR was trading at $839.62. The excitement in the community of MKR holders was clearly visible as they anticipated better trading days ahead.

However, despite the unprecedented surge in the past few days, a look into Maker’s metrics revealed a different story altogether.

The beginning of the fall?

Not only did Maker outperform most of the major cryptos last week, but it also made it onto the list of the cryptos that the top 500 Ethereum whales were holding. This is yet another green flag for Maker as it represents the increased confidence of whales in the coin.

🐳 The top 500 #ETH whales are hodling

$142,269,528 $SHIB

$76,541,080 $BIT

$63,992,490 $UNI

$49,893,461 $MKR

$49,723,861 $LINK

$47,569,520 $LOCUS

$39,777,703 $MANA

$37,837,200 $MOCWhale leaderboard 👇https://t.co/tgYTpOm5ws pic.twitter.com/cGik3ReuNn

— WhaleStats (tracking crypto whales) (@WhaleStats) October 5, 2022

Interestingly, amidst all this, Marker posted a tweet to provide more information related to the proposals that it received with the aim of diversifying MakerDAO’s revenue streams.

In recent months, the Maker community has seen multiple proposals pursuing initiatives to invest the stablecoins allocated in the PSM with the aim of diversifying MakerDAO’s revenue streams.

What are these proposals and how are they doing?

🧵↓

— Maker (@MakerDAO) October 4, 2022

Nonetheless, the tables might soon turn against MKR as on-chain metrics indicate the possibility of a trend reversal in the coming days.

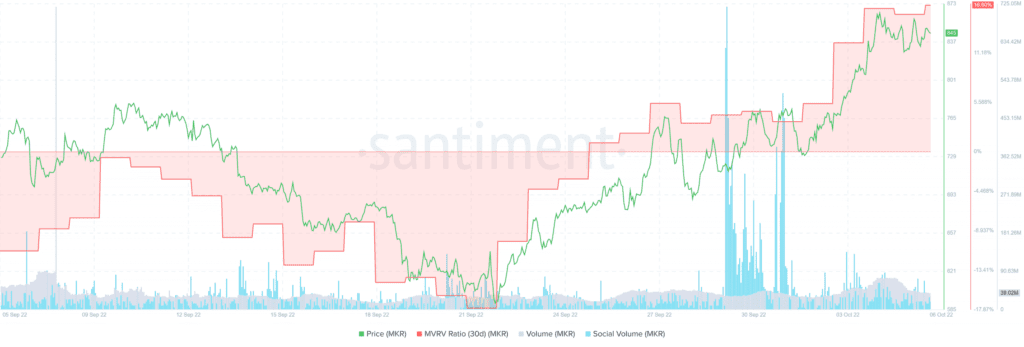

For instance, MKR’s MVRV Ratio registered a continuous increase over the last few weeks, which might indicate a possible market top, leading to a price plummet soon.

Here’s AMBCrypto’s Price Prediction for Maker (MKR) for 2023-24

Even Maker’s volume also spiked last week, but after that it registered a decline, further increasing the chances of a downfall. The social volume followed the same route and decreased in the past seven days. It simply represents decreased popularity of the alt in the crypto community.

Furthermore, CryptoQuant’s data revealed caution signs for Maker holders. The coin’s Relative Strength Index (RSI) and stochastic were at overbought positions, which might soon reflect on MKR’s chart.

In fact, at the time of writing, Maker was already down by 0.51% in one hour. Therefore, considering all the aforementioned metrics, investors should be cautious before making a decision on Maker.