- Moon Rabbit’s protocols and verticals to draw more generations of crypto users.

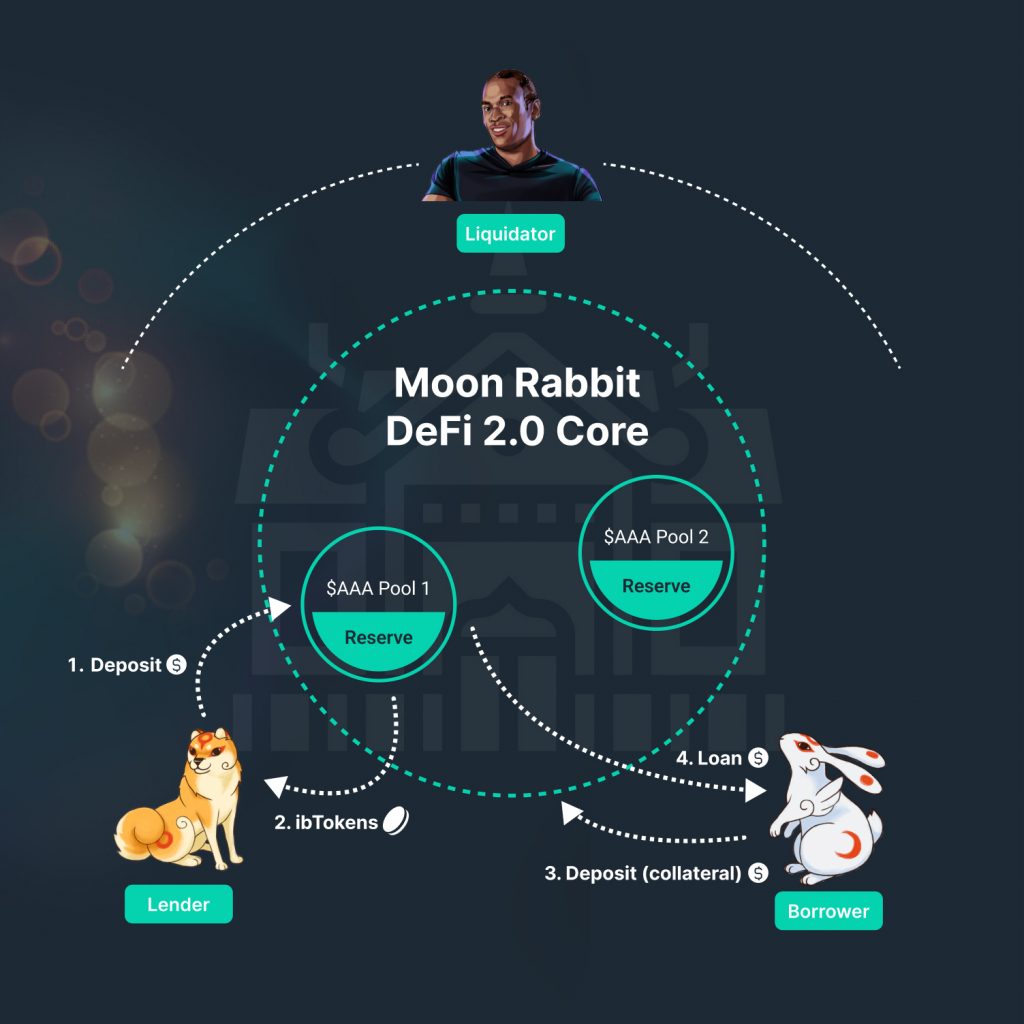

- It intends to accomplish this through its DeFi 2.0 Jurisdiction.

- Users will get rewarded with AAA tokens.

Moon Rabbit, a Layer0 Substrate-based metachain that allows vast scalable cross-chain interaction across many independent layer1s, has reached the next stage of development.

According to the data collected by CoinQuora, the team says it plans to implement cross-chain liquidity protocols across its DeFi 2.0 Jurisdictions in phases across the first quarter of this year given that it has established a new form for the transfer of fungible and non-fungible tokens amongst EVM Networks.

The Jurisdiction will help maximize yield potency on inactive capital by tapping into opportunities across different chains. The DeFi 2.0 vertical wall will include depositing/lending, borrowing, stablecoin, swapping, farming, and oracles at the beginning of the project.

The aforementioned will serve as the building blocks that others including Rad Rabbit NFT-backed loans, credit delegation for increased yield on in-game items in the Bunniverse, cross-functional DAOs, and decentralized exchange (DEX), can be developed.

$8,888,888,888 AAA will be disseminated at the initial stage of the DeFi 2.0 Jurisdiction liquidity distribution. Even more, each user will get AAA benefits for lending and borrowing aside from the income they will get.

Additionally, it will introduce AAA on Polygon and Binance Smart Contract to increase its network link and solve the enormous gas charge of Ethereum Mainnet, which prohibited lots of people from engaging in its NFT ecosystem and marketplace. It will also use its Metabridge to connect Moon Rabbit EVM to these networks.

As per the team’s report, it is also hiring cybersecurity and pen-testing professionals to stress-test its bridges and DeFi infrastructure, and also offer a $100k bug reward in AAA. Not to mention, it will either connect its DeFi 2.0 vertical with these projects or develop its Decentralized Exchange to accelerate the liquidity pools required for stablecoins and other elements to work.

Specifically, any project that improves its DeFi 2.0 suite may be provided trustless liquidity pools. As such, the network is looking for developers or intending DeFi protocol and DAO inventors that want to either launch or port their product to the ecosystem.

All in all, the DeFi 2.0 is intended to be backed by a stablecoin that will not be tethered to the US dollar. Alternatively, it will be tied to a stable fiat of an advanced country like the Swiss Franc, whose buying capacity has stayed robust during numerous economic crossroads and is widely credited by its people and the international world (CHF).