The non-fungible token (NFT) industry went mainstream last year with buyers pumping billions into the market, but with it came a huge rise in fraud.

According to a survey by digital security company Privacy HQ, nine out of 10 respondents said they had experienced some form of scam, half had lost access to their NFTs at some point, and two-thirds had panic-sold in the past.

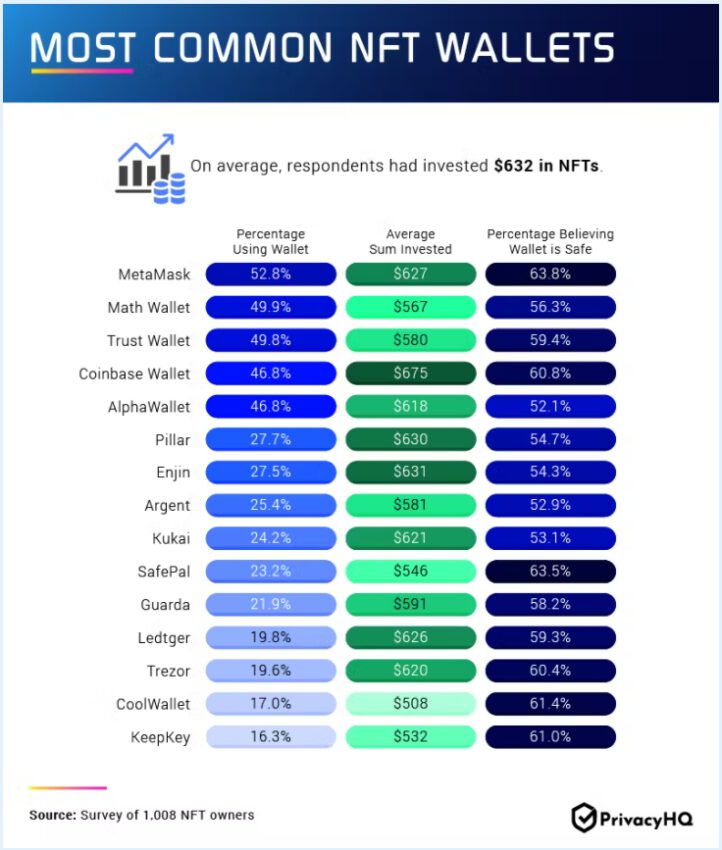

The survey showed the majority (52.8%) of token holders use the MetaMask wallet. However, Coinbase’s wallet was first in terms of total investment, with an average of $675 held on a wallet.

Privacy HQ points out that Coinbase (the parent of Coinbase Wallet) has more than 73m users compared to MetaMask’s 21m.

While MetaMask left users feeling more secure than any other wallet, only 63.8% of people felt their investments were safe there.

The majority of respondents gravitated toward desktop computers as banking on mobile devices tends to be less secure, because devices travel, are easy to lose, and are more often connected to public Wi-Fi.

One of the most common methods used to hack NFTs is guessing passwords

Of the 1,008 respondents polled, 47.8% felt their NFTs are “very secure” by using different security measures like 2-step authentication, backup, VPN, etc. However, 37.6% believe their assets are somewhat safe, while 14.6% do not feel secure at all.

“Most often, people tried complex passwords and passphrases – a great first step. One of the most common methods hackers use to get into online accounts is guessing passwords, so it’s vital this digital key is as strong as possible,” the report says.

“Two-factor authentication was also employed by 65.2%, while more than half said they kept their recovery information in a secure place. Evidently, even stringent cyber security practices like these are not enough for everyone to feel very secure.”

The most common scam was the NFT provider shutting down or changing the URL

Furthermore, 50% of the respondents said they have lost access to their NFTs with 48.9% of them recovering their assets. 43% said they have recovered some of their tokens while 8.1% got nothing back. “The losses of this group totaled an average of $245 in lost NFTs.”

Only 10% of the NFT owners polled have so far avoided a scam. Moreover, the most common scam respondents have faced was the NFT provider shutting down or changing the URL of the assets.

NFT sales reached $17.6bn last year, an increase of 21,000% over 2020. In addition, the number of people buying digital collectibles rose to 2.3m from 75,000 in one year.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.