Dogecoin (DOGE) is trading inside a bullish pattern and is showing strong signs of a potential bullish reversal. However, the upward movement has not yet begun.

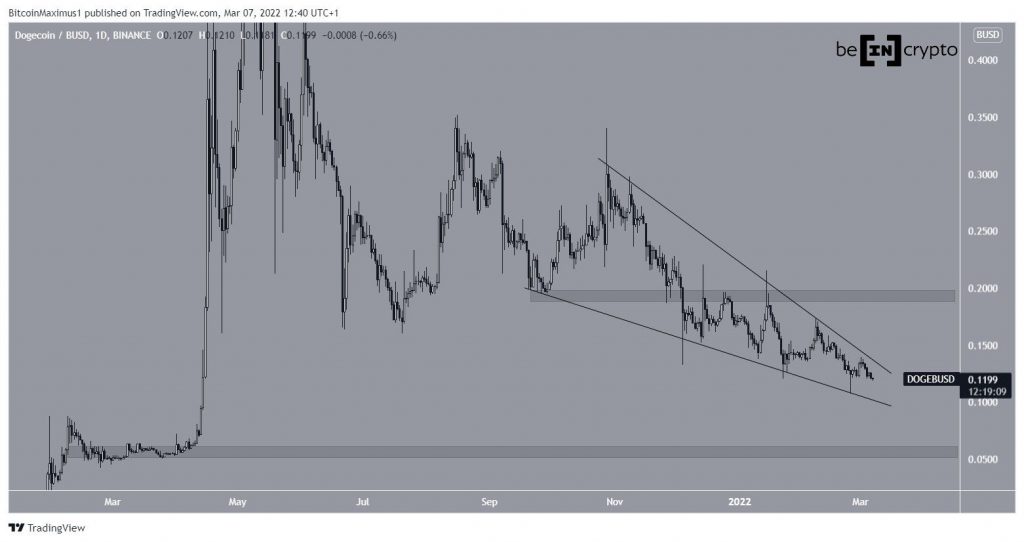

DOGE has been decreasing since Aug 16. More specifically, it has been falling inside a descending wedge since Oct 29. The wedge is considered a bullish pattern, meaning that a breakout from it would be the most likely scenario.

Currently, the price is approaching the point of convergence between support and resistance, at which point a decisive movement is expected.

If a breakout from the wedge occurs, the closest resistance area would be at $0.195. The level had previously acted as support but turned to resistance on Jan 2022.

Conversely, the closest support area is all the way down at $0.055.

Cryptocurrency trader @AltcoinSherpa tweeted a DOGE chart, stating that the price is approaching a strong support level at $0.055. The area coincides with that which we have outlined.

Potential breakout

Technical indicators in the daily time-frame are showing some mixed signs.

On one hand, both the RSI and MACD have generated very significant bullish divergences. This is a sign that often precedes bullish trend reversals. It gains more legitimacy by the fact that DOGE is trading inside a bullish pattern.

However, both indicators are decreasing, which is a sign of weakening momentum. Therefore, technical indicators in the daily time-frame provide a mixed reading.

DOGE/BTC

The DOGE/BTC chart is slightly different, since the price is not trading inside a descending wedge.

However, there is a similar bullish divergence that has developed in both the RSI and MACD.

Nevertheless, DOGE is still trading below the 340 satoshi resistance area, a level that previously provided support.

Until DOGE reclaims it, the trend cannot be considered bullish.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.