Published 10 mins ago

The parabolic recovery in ETH/USDT pair surged the prices by 101% from mid-June to August and formed a local top at the $200 mark. Furthermore, during this bull run, the coin price witnessed several pullbacks, which replenished the bullish momentum for further gains.

advertisement

Key points ETH analysis:

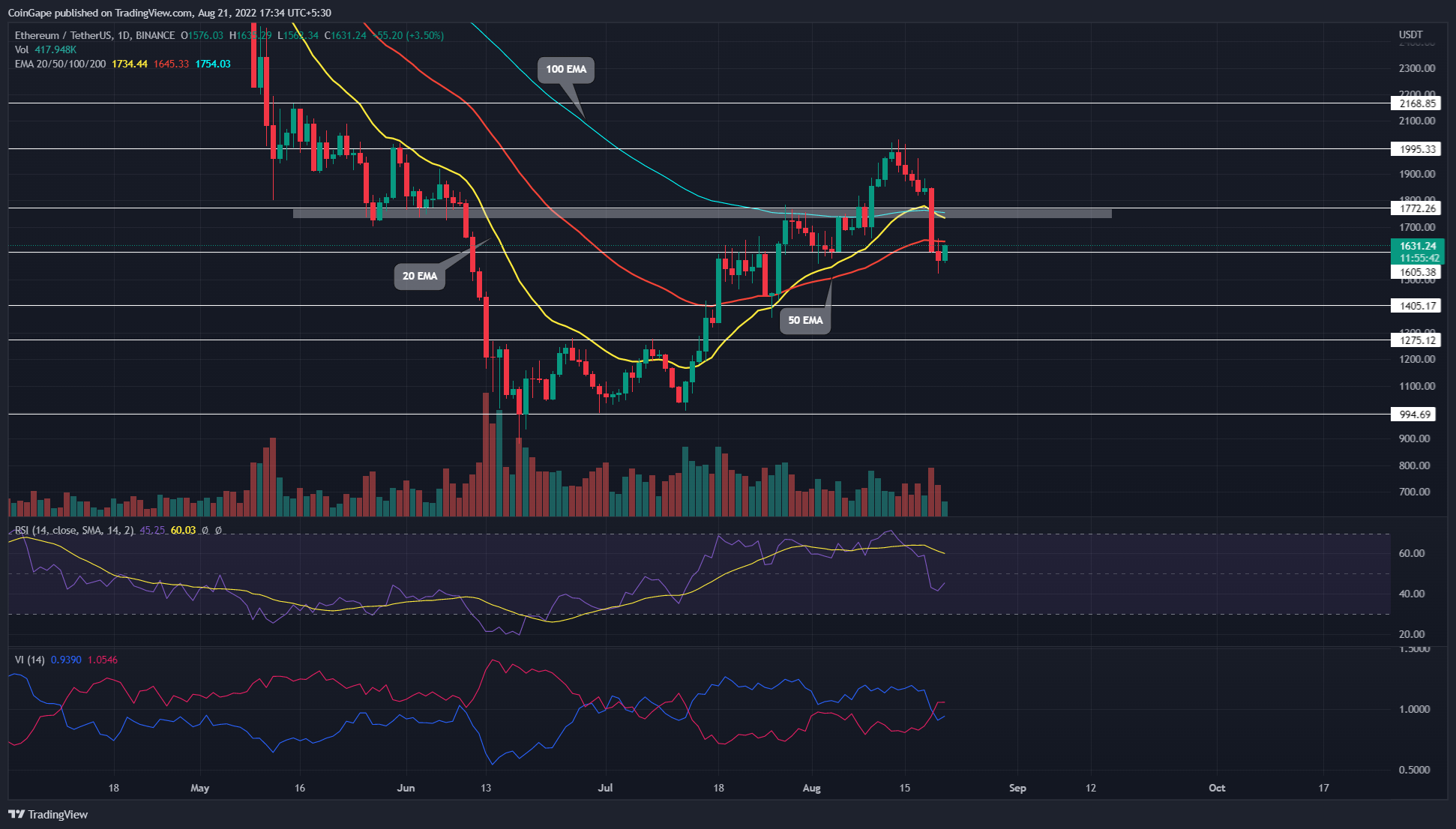

- Higher price rejection at 50-day EMA supports price sustainability below the $1600 mark

- The bearish crossover of the 20-and-100-day EMAs will strengthen the current correction

- The intraday trading volume in Ethereum is $18.6 Billion, indicating a 2.89% loss

Source- Tradingview

On August 14th, the ETH price reverted from the $2000 resistance level, suggesting an occasional price correction. The fresh news that the US Fed plans to increase the rate hike in September by 0.75% accelerated the bearish momentum.

Thus, in the past seven days, the ETH price depreciated 21% and plunged below $1775, and the previous swing low of $1600. However, the coin price is 3.3% up today and plans to test the $1600 mark as potential resistance.

Trending Stories

Moreover, the 50-day EMA moving at the same level puts an additional barrier against buyers. If by the end of the day, the altcoin gives a candle closing below the $1600 mark, the potential downfall may slump the ETH price 12.5% down to the $1400 psychological level.

However, even if buyers push the price higher today, the immediate combined resistance of $1775 and 100-day EMA will encourage sellers to follow the above setup.

On a contrary note, a bullish breakout from the $1775 resistance weakens the possibility of this bearish theory and provides a breakout opportunity from the swing high resistance of $2000.

Technical indicator-

Relative strength index: the daily-RSI slope nosedive below the neutral line from the overbought regions indicates a sudden turnaround in market sentiment.

advertisement

Vortex indicator: the VI+ and VI- slopes last showcased a bearish alignment before mid-July. Thus, a bearish crossover among these slopes offers a sell signal for interest traders.

- Resistance level- $1600 and $178

- Support levels- $1400 and $1275

Share this article on:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.