Mutant Ape Yacht Club (MAYC) continued to record impressive volume due to increased sales that pushed the NFT collection to the fourth-highest by all-time sales volume.

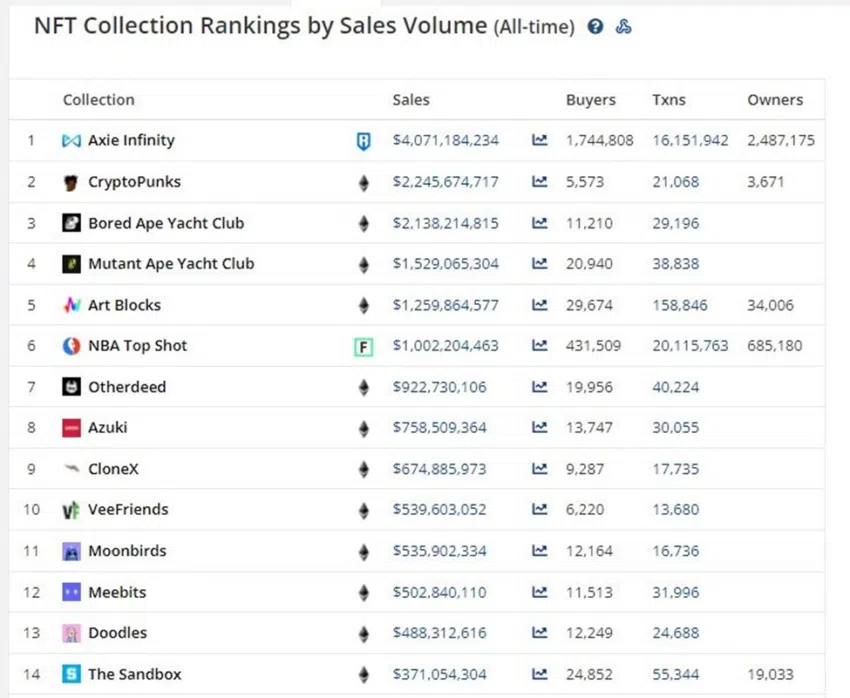

According to Be[In]Crypto research, as of May, the NFT collection yielded an overall sales volume of $1.53 billion. The latest milestone placed Mutant Ape Yacht Club above some of the space’s most successful NFTs projects including Art Blocks, NBA Top Shot, Otherdeed, Azuki, CloneX, VeeFriends, Moonbirds, Meebits, Doodles, and The Sandbox.

MAYC still trails its sister projects Bored Ape Yacht Club (BAYC), CryptoPunks, and Axie Infinity on the all-time sales volume rankings.

Mutant Ape Yacht Club is a collection made up of 20,000 Mutant Apes which are created when existing Bored Apes are exposed to a vial of Mutant Serum.

Mutant Ape Yacht Club’s soaring volume

Since August 2021, the NFT project has experienced significant growth in total transaction counts reaching 6,452 unique monthly users, 10,676 transactions, and approximately $218.05 million at the end of that month.

Although unique buyers and total transactions have fallen over the months, average sales value has increased in the process.

Average sales value increased by 185% from $20,423.86 (6 ETH) in August 2021 to $58,287.34 (around 18.9 ETH) in January 2022.

During the first month of 2022, MAYC sales volumes were in the region of $252.33 million.

In April 2022, the NFT project reached a new all-time high monthly sales volume of approximately $252.63 million, with an average sale value of $92,878.32.

Mutant Ape Yacht Club NFTs were trading at a floor price of $36,745.87 (around 17.99 ETH) at the time of press.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.