Along with the rest of the market, NEAR climbed up the price charts and managed to seal a sizable growth. However, the network of late has been observing unfavorable changes.

NEAR closer to profits?

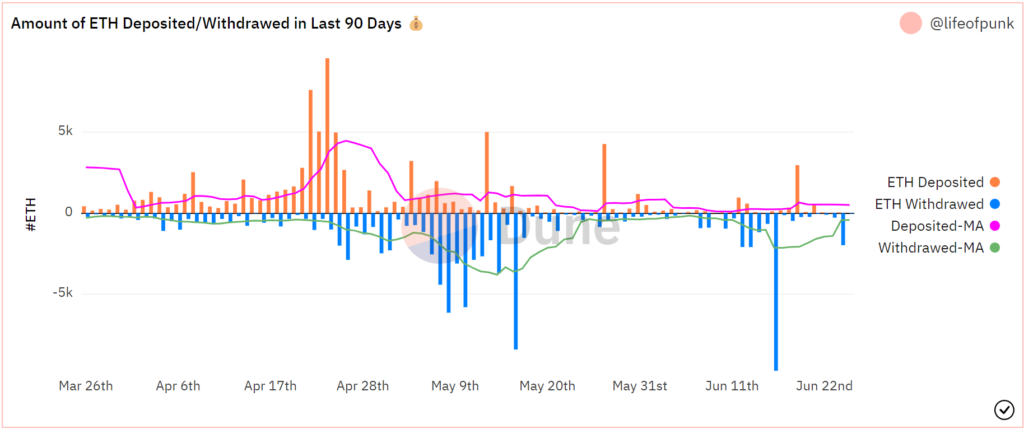

Investors are not waiting for a moment before making a move. According to on-chain data, NEAR’s bridge with Ethereum has noted the withdrawal of almost 2,000 ETH worth almost $2.4 million, with ETH trading at $1,200.

Although this isn’t the first instance of such a huge withdrawal. It is the first instance during a rally that has started of late.

Axie Infinity Rainbow bridge activity | Source: Dune – AMBCrypto

Back on 16 June, exactly on the day that NEAR slipped by 15% in a single day, the same bridge registered the withdrawal of $11.8 million worth of ETH with barely a 113 ETH worth of deposit observed.

This withdrawal could have been an opportunity for investors to book profit as soon as they could before the market’s rising volatility results in a price swing for NEAR, in the opposite direction of preference.

This could result in the altcoin losing 35.69% of its rise over the last week.

While NEAR is poised for a further rise, it still has almost 82.3% worth of losses to recover. For now, the price indicators are in its favor, which could be beneficial for NEAR to maintain its recent uptrend.

NEAR price action | Source: TradingView – AMBCrypto

For starters, the bullish crossover which took place this week reaffirmed investors’ confidence in the green bars. And further back, this is the active uptrend observed on the Parabolic SAR after its white dots moved underneath the candlesticks three days ago.

But apart from the ongoing changes in NEAR’s ecosystem, investors have resorted to older methods of placing their money in USDT over USDC.

According to the Rainbow Bridge stablecoin inflow data, up until the end of April, USD Coin (USDC) had domination of 62.4% over the total volume of stablecoins that were deposited on the bridge.

However, since then, despite Tether’s (USDT) depegging, the USDC’s dominance has reduced to 57%, and USDT’s has grown by 5%.

NEAR Rainbow Bridge stablecoin inflow | Source: Dune – AMBCrypto

Thus, Tether seems to be maintaining its demand in the stablecoin space still.