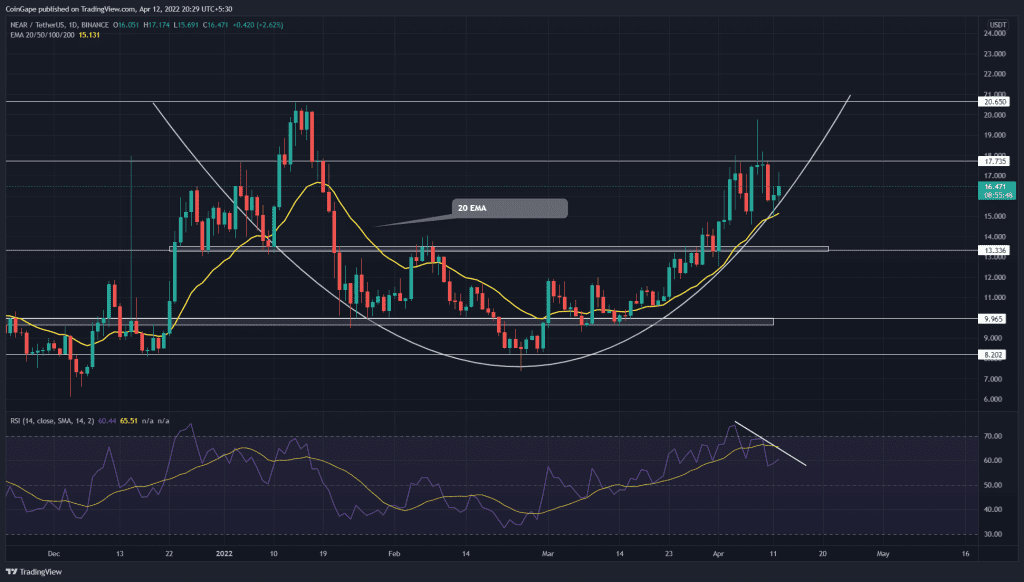

The failed attempts of NEAR price to breach the $17.7 resistance triggered a minor pullback to the $15 mark. This psychological level aligned with 20-day EMA dynamic support provided a dip opportunity for long traders, and surged the altcoin by 10%. If buyers overcome the negative influence of the RSI indicator, the coin price would reclaim the $17.7 mark.

Key points:

- The RSI slope displays negative divergence in the daily time frame chart

- The 20-day EMA gives pullback to support to NEAR price

- The intraday trading volume in the NEAR is $1.09 Billion, indicating a 36% hike.

Source- Tradingview

The NEAR/USDT pair gradually rises under the influence of the rounding bottom pattern. The recovery rally reached the $17.7 mark, its highest level in the past 11 weeks. However, the buyers struggle to overcome this resistance, indicating a strong supply region ahead.

Last weekend, the crypto market witnessed a significant sell-off which triggered a minor correction in NEAR price. The 15% retracement hit the rising 20-day EMA and stalled the sellers at $15 psychological support.

As a result, the NEAR price rebounded from the 20 EMA support with a morning star candle and continued its charge to All-Time High resistance at $20.6.

Furthermore, the rounding bottom pattern would encourage buyers to breach the ATH resistance($20.6).

Technical indicator

The rising 20-day EMA provides dynamic support to the NEAR rally. Until this support EMA is intact, the traders’ can maintain a strong bullish sentiment.

However, the RSI slope displays a lower low formation in contrast to trending price action. This bearish divergence indicates weakness to the bullish rally, which could trigger a longer price correction.

- Resistance levels- $17.5, $20.65

- Support levels- $13.3 and $10