NEAR price continues to print gains for the second session in a row. The price shows an ascent of nearly 17% in the past two days indicating a strong bullish undercurrent.

- NEAR surges, by 7% as the weekend begins.

- The buyers can expect the continuation of the rally to all-time-highs placed around $20.50.

- The volumes gain 41% in the past 24-hours indicating strength in the current price action.

NEAR price continues north

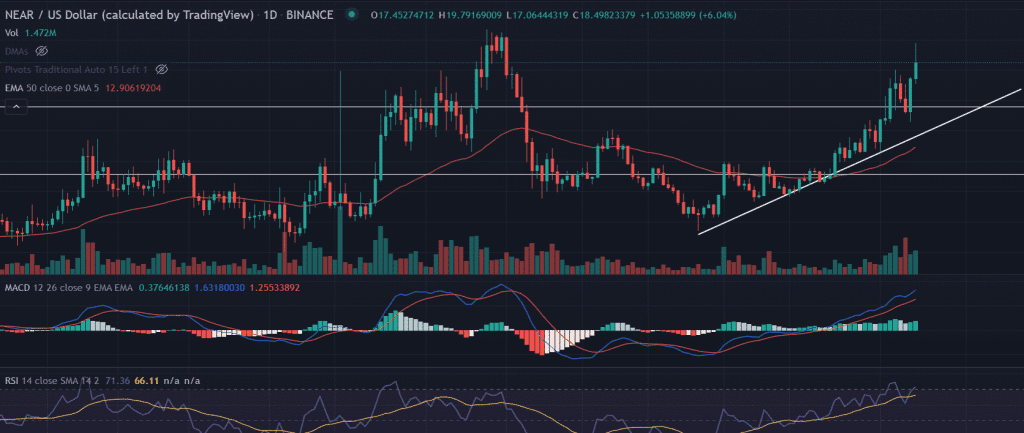

NEAR price rallied 152% since February 24, indicating the presence of sustained buying pressure. This move comes after NEAR managed to hold the $10.80 to $12.0 supply zone. The swing high and low during this uptrend marked as local top and bottom, forming a perfect upside channel.

The ascending trend line, which is extending from the lows of $7.39 acts as a support for the bulls. Furthermore, the price breached the critical horizontal resistance level at $15.80. The move was supported by above the average volumes.

Now, a continuous buying pressure would bring the record highs of $20.46 made on January 16 back in action.

advertisement

On the contrary, a shift in the buying sentiment along with a daily candlestick below the session’s lows would invalidate the bullish outlook. In this case, the first downside target could be found at the lows of April 1 at $12.55.

A break below the bullish slopping line will accelerate the selling toward the horizontal support at $11.10.

As of press time, NEAR/USD reads at $18.82, up 5.98% for the day. The 24-hour trading volume gains more than 41% in the 24-hours to $2,905,572,243.

Technical indicators:

MACD: The Moving Average Convergence Divergence stands strong above the central line with a bullish bias.

RSI: The daily Relative Strength Index approaches at 71. Although the oscillator trades just near the overbought territory, still it has the scope to stay in the zone for a longer period of time in the case of a highly bullish scenario.