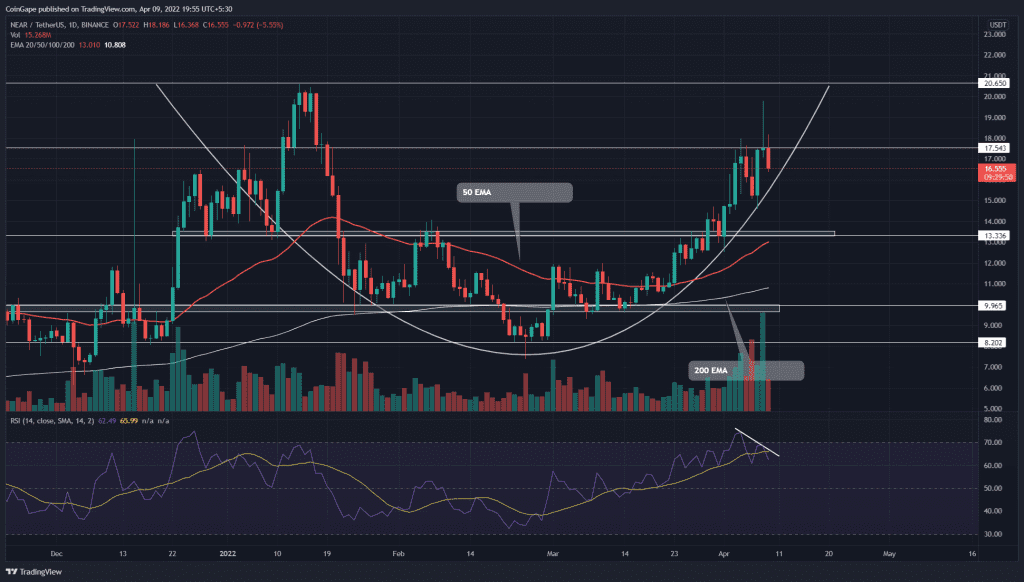

In midweek, the Near Protocol(NEAR) price experienced a significant inflow due to the launch of a new stablecoin, USN. The bullish rally teased a breakout from the $17.5 resistance Amid the announcement. However, the sellers reverted the coin price immediately, initiating a minor pullback.

Key points:

- The RSI slope shares a bearish divergence in the daily time frame chart

- NEAR chart displays an evening star candle at $17.5

- The intraday trading volume in the NEAR is $1.09 Billion, indicating a 36% hike.

Source- Tradingview

Following the path of a rounding bottom pattern, the NEAR/USDT pair is gradually nearing the All-Time High resistance of $20.6. This recovery rally initiated during the latter part of March has sliced through a monthly resistance of $13.3 and registered a 104% gain from the $8 bottom support.

The news-driven rally encouraged the buyers to breach the following resistance of $17.5; however, the sellers undermined the demand pressure and forced a candle closing below the resistance. A 12% rejection tail attached to the daily candle indicates the aggressive selling on the higher levels.

Today, the NEAR price is down by another 4%, forming an evening star candle pattern at $17.5 resistance. Therefore, the minor retracement may drop to 20-day EMA dynamic support before continuing the bullish rally.

Note: The coin holders can maintain a strong bullish sentiment until this EMA support is intact.

Technical indicator

A bullish sequence among the rising EMAs(20, 50, 100, and 200) maintains a solid bullish trend for NEAR. These emails can provide strong support to coin price during the occasional pullback.

However, a Daily-RSI slope displays a bearish divergence concerning the two upswings at $17.5. The downsloping RSI line nosedived below the 14-SMA leading to a minor correction.

- Resistance levels- $17.5, $20.65

- Support levels- $13.3 and $10