NEAR has been one of the best performing tokens at a time when the rest of the market was in a humdrum. It began recovering from the end of February and has been steadily rising since.

It isn’t as if there hasn’t been any red day. NEAR has rather moved in a steady higher high, higher low manner, distinctly representing market conviction. Rising by 21% over the past two days, NEAR has flipped both Litecoin and Dai in terms of market cap.

Steady price action

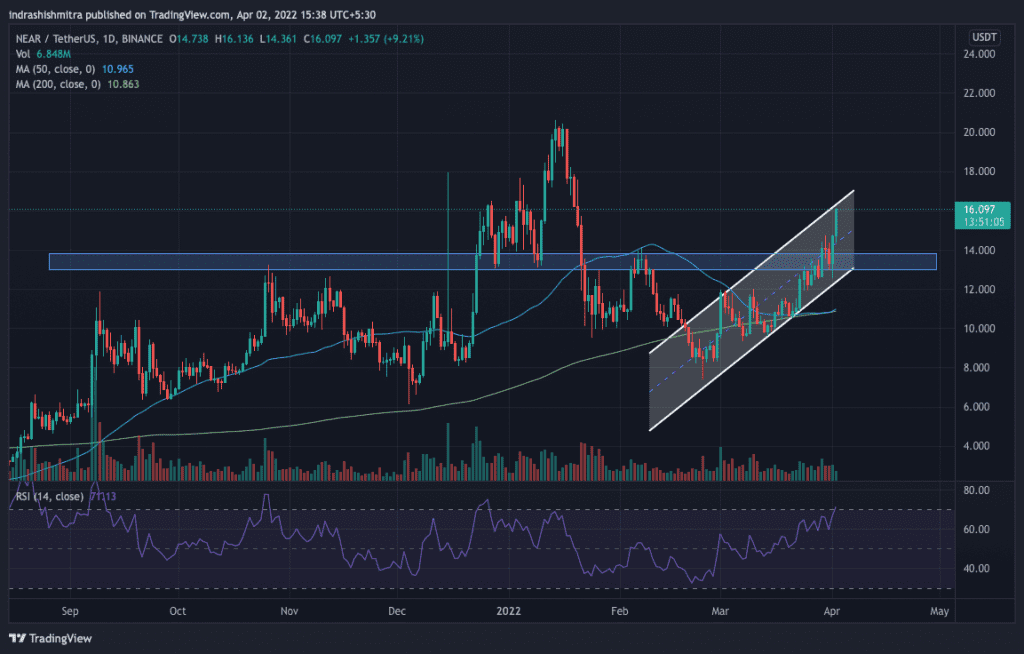

Currently, trading at a close to $16, NEAR has crossed several crucial hurdles in its way. After strongly breaching the 50 and 200 DMA around 20 March, it rallied and tore through the $13-14 region which has been a historical level of support/resistance (marked in blue). Furthermore, in the past two days, it has shown conviction above both of those.

Also, considering the fact that RSI is still below 70 on the daily chart, a further upward move may be seen from hereon until it reaches the overbought zone. Some profit booking at those levels shouldn’t affect the broader structure. And, it is, in fact, expected to continue soon after the cooldown period. The next logical resistance level after this would be the ATH around $20.5.

On-chain metrics for the coin have been positive, albeit of a mild nature. Nothing to suggest an immediate run-up like the way some other altcoins are right now. For instance, on-chain volumes have been steadily increasing along with the price recovery. A recovery supported by volumes as a rule of thumb bodes well for the price action.

Development activity for NEAR has been moderate too. It fell from its highs in early February 2022 but since then has managed to keep the status quo and continue at a steady pace.

Sourced from Santiment, the development activity metric can help us understand a project’s dedication to its product, and in turn – its end users. Consistency in this regard is a good sign.

Here’s the caveat

However, there is one point of contention that can hurt its positivity going forward. According to data from Coinglass liquidations data, despite the recent recovery in price, there have been more long liquidations than short liquidations.

This goes on to suggest that investors in this coin are looking to book profits at higher levels.

Typically, a rally that is accompanied by short liquidations bodes well since the bears in the market are booking their losses and are exiting, thus giving more strength to the bulls.

So, overall it seems, an investor looking to HODL might consider skipping NEAR for now. Its fundamentals appear manageable at best and day trading along the way can be the way to go. Until the fundamentals change for the better, there’s no particular reason so far to invest in it for the long term.