The last month was marked by positive price corrections in the cryptocurrency market, which sent the price of alts like Dogecoin [DOGE] rallying by 100%. According to data from CoinGecko, global cryptocurrency market capitalization grew by 9% in the last 30 days.

However, NEAR decoupled from the rest of the market and posted a price decline instead.

Here’s AMBCrypto’s price prediction for NEAR for 2023-2024

A month ago, NEAR traded at a high of $3.68, but eventually declined to $0.28 by 2 November. However, since then, its price has rallied by 10%, according to data from CoinMarketCap.

This price rally coincided with the commencement of a new bull cycle toward the end of October. Observed on a daily chart, this was when NEAR’s Moving Average Convergence Divergence (MACD) line intersected with its trend line in an upward direction.

NEAR’s movements on the price chart revealed a consistent growth in buying pressure since 2 November. Furthermore, its Relative Strength Index (RSI) was 58 at press time after breaking above the 50 neutral region two days ago. Also, its Money Flow Index (MFI) was spotted in an uptrend at 56, indicating that token accumulation had climbed steadily.

NEAR in Q3

In a new report titled “State of NEAR Q3 2022,” Messari assessed NEAR Protocol’s performance in Q3 2022. This revealed that the smart contract platform suffered a significant blow to its revenue within the three-month period.

Revenue on the NEAR Protocol stood at $220,000 between July and September, which was an 82% decline from Q2’s $1.19 million. Messari further found that the sharp fall in revenue resulted from a “35% drop in transactions paired with sub-one-cent transition fees.”

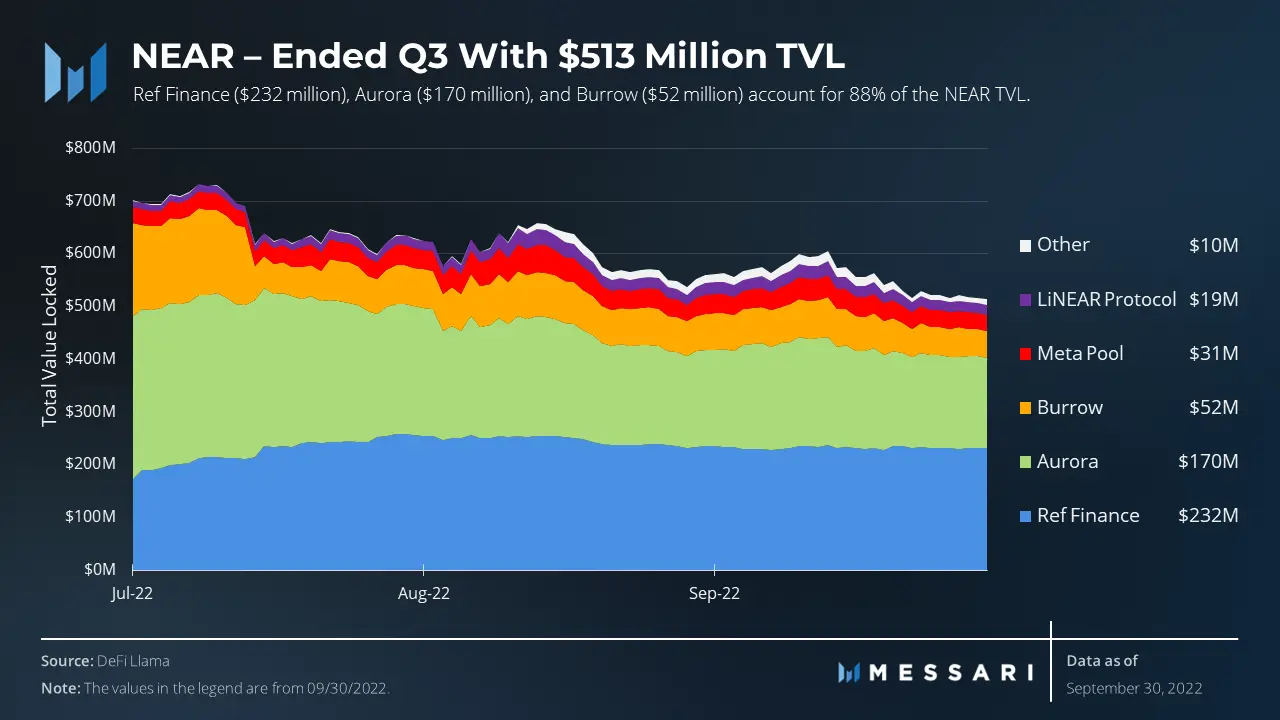

Besides a decline in revenue, DeFi TVL on the network also fell by 30% within the period under review. However, while its TVL fell on a QoQ basis, Messari found that the TVL of the smart contract platform was up 10X on a YoY basis. NEAR closed Q3 with a TVL of $513 million.

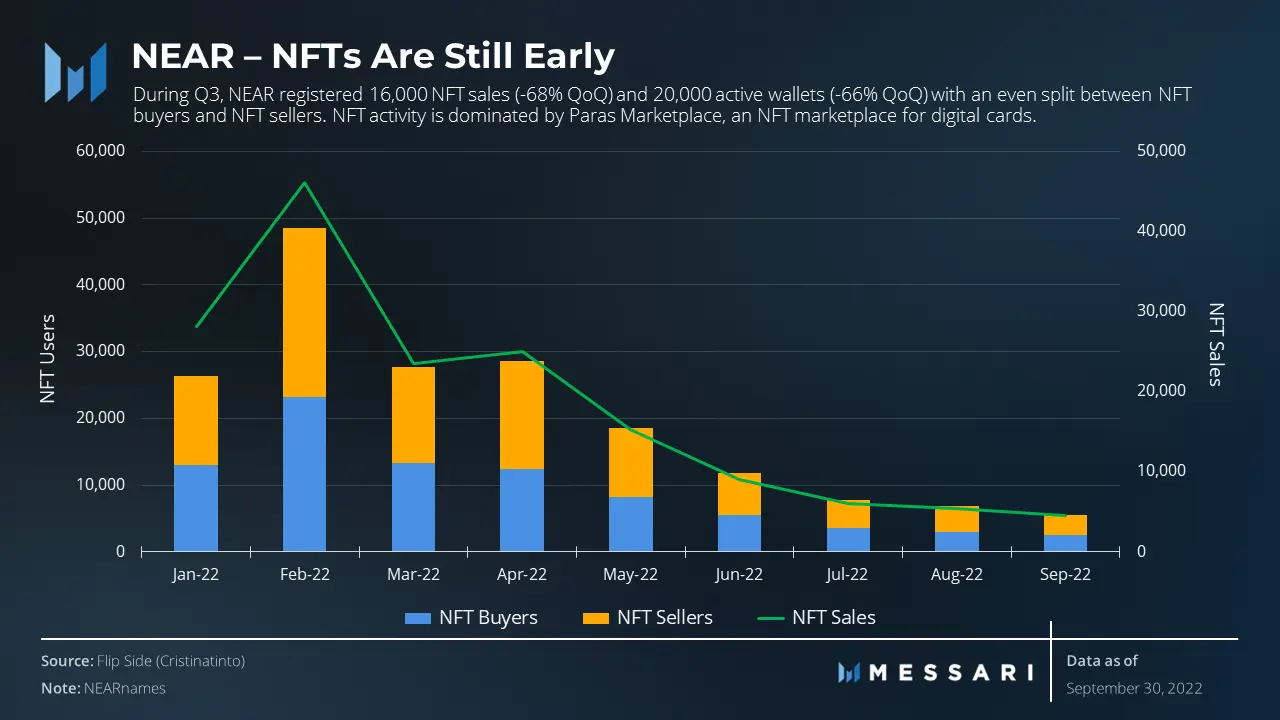

Messari further reported that NFT sales on NEAR have been consistently declining since the beginning of the year. NEAR also “registered 16,000 NFT sales (-68% QoQ) and 20,000 active wallets (-66% QoQ) with an even split between NFT buyers and NFT sellers.”