Bitcoin saw a good rally which extended beyond $43k. After a brief retracement in the following 24 hours, BTC returned to the offensive and reclaimed $44,000. The uptrend continued in the past 24 hours, and the cryptocurrency reached and briefly exceeded $45,000, its highest price tag since 2 March.

Accumulation underway

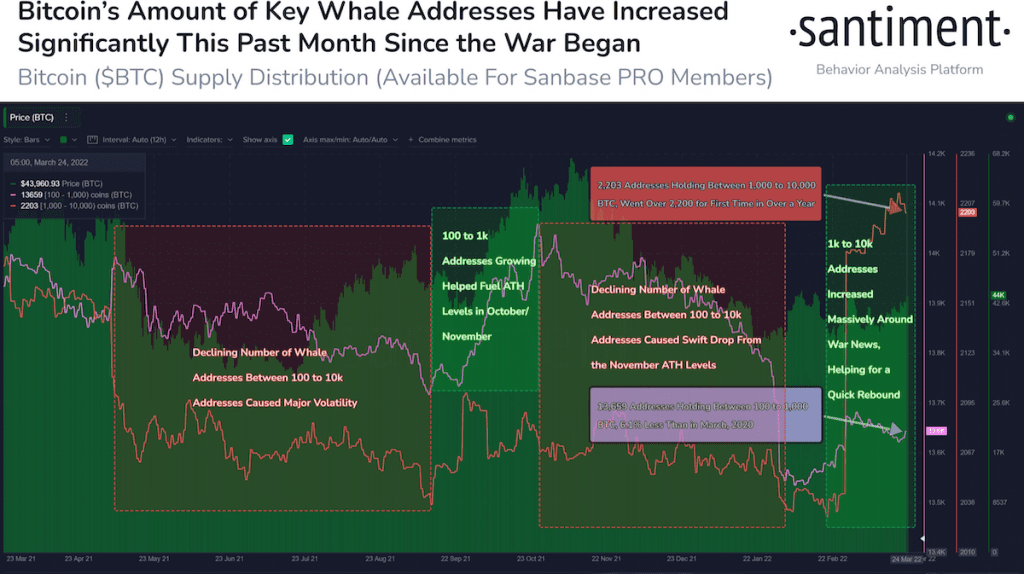

Whales activity revolving around the most prominent cryptocurrency was an interesting one to note ever since Russia-Ukraine conflict began. Addresses with 1,000 to 10,000 BTC saw the number of coins within their wallets jump by 8.3%.

According to on-chain analytics firm Santiment, the 2,203 addresses stood at a one-year high while holding between $44.2 million and $440.2 million worth of BTC each.

The amount of BTC addresses holding 1k to 10k $BTC jumped by 8.3% since the Russia–Ukraine conflict went underway.

That said, historical data shows, along with the group of addresses containing between 100 and 1,000 BTC, had “historically foreshadowed price moves.”

The tweet stated:

“The 2,203 addresses are at a 1-yr high. Both this tier & the 100 to 1k $BTC tier have historically foreshadowed price moves.”

The aforementioned group were the “ones we look at to show what the top active traders are doing with their funds. Anything higher is typically an exchange address,” the tweet added.

Other data suggested the flagship cryptocurrency’s price was ready to move shortly. For instance, following this development, the rate of capital flowing into risk-on asset classes had accelerated. To expand on this, the Co-founder of Glassnode, compared this rise to US Government Bonds’.

Rate of capital flowing into risk-on asset classes accelerated. #Bitcoin is back at Jan levels $44k. Meanwhile, the US10 yield rose rapidly.

We expand on #Bitcoin ‘s comeback and the rotation of capital in our latest Uncharted 👇https://t.co/VB2a0BHthe pic.twitter.com/O4DlnwT5MW

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) March 24, 2022

In addition, there was a substantial outflow of the popular digital asset from various crypto exchanges. In only 15 days, around 61,000 Bitcoin were taken off exchanges. According to a chart by the on-chain analytics platform Glassnode, the chart looked like:

Source: Glassnode

Based on the price of Bitcoin at press time, the amount that left exchanges equates to roughly $2.6 billion. The last time BTC experienced a large outflow, it was followed by significant rise in price. This marked a clear indicators of mounting bullish narratives around the king coin.

Furthermore, according to Bloomberg analysts, US Lawmakers could approve spot market Bitcoin ETFs. Bloomberg financial strategists James Seyffart and Eric Balchunas shared light on this narrative. SEC’s recent proposal to expand the legal definition of “exchange” might signal the regulatory agency was ready to approve spot BTC ETFs sometime in 2023 after rejecting numerous requests during the last year.

New note out on why we think spot bitcoin ETFs will get approved in early Summer 2023. The SEC is proposing to expand the definition of “exchange” which would bring crypto platforms under SEC reg. After that (which could take a year) look for ETFs to get green light via @JSeyff pic.twitter.com/TtFgFXrJ8h

— Eric Balchunas (@EricBalchunas) March 24, 2022

Now, having discussed some bullish trajectories, the next significant on-chain resistance for BTC could arise from the short-term holder ‘Realized Price’, trading at $45.9k. One shouldn’t also forget that bearish resistance comes from STHs seeking to get their money back.