Ripple, the fintech firm runs its platform, RippleNet, which allows anyone to send and exchange cryptocurrencies or make cross-border transactions. This emerged as a direct competitor to the SWIFT (Society for Worldwide Interbank Financial Telecommunications) banking system.

Ripple versus SWIFT

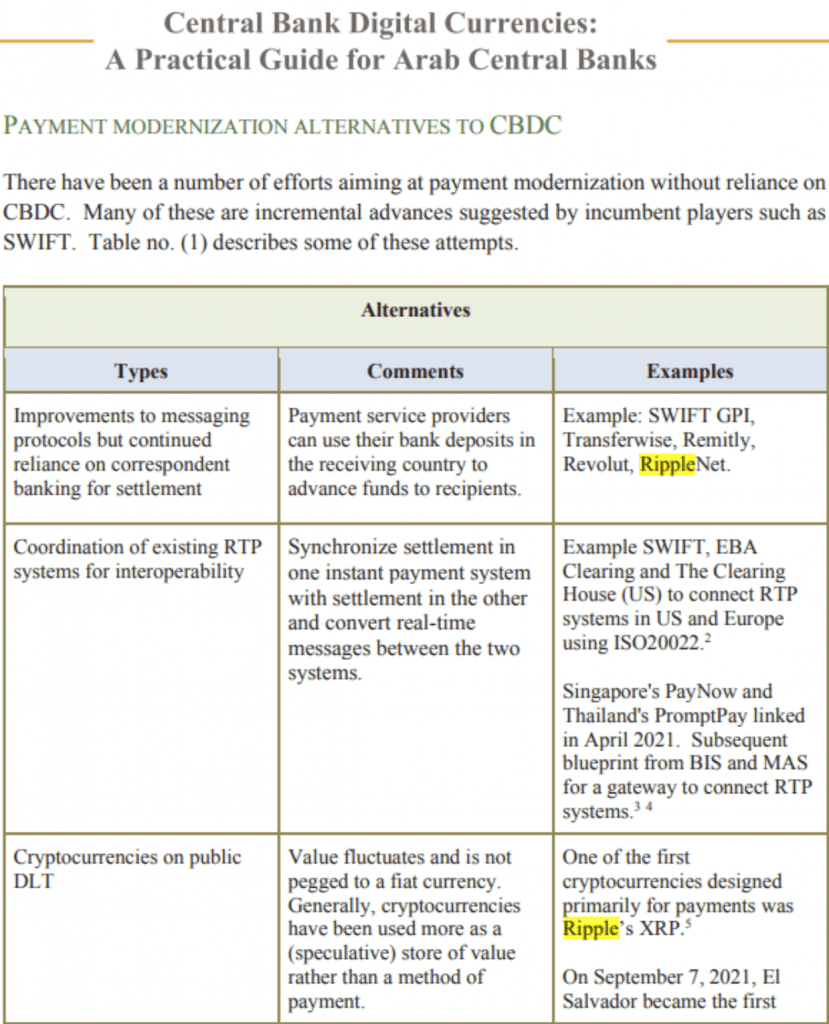

Arab Regional Fintech Group report on Central Bank Digital Currencies on 18 March released a “Practical Guide” for Arab central banks looking to understand the nuances of the burgeoning digital assets market. Surprisingly, in the report, it mentioned RippleNet as a direct alternative to SWIFT. Not once but at two places.

Source: Twitter

A pseudonymous Twitter user, WrathofKahneman, had shared this observation on the social media platform with over 30k followers. This development came in after the working group advised Arab central banks to improve their “messaging protocols” using systems such as SWIFT GPI and, significantly, RippleNet.

This indeed was a bullish development for fintech firm, Ripple which had suffered immensely amidst the on-going lawsuit. Although, the timing of the development was an interesting one.

This came just two days after the Clearing House, a known Ripple partner, collaborated with Wells Fargo (an American multinational financial services company) to challenge the dominance of SWIFT with a new instantaneous payment system.

Huge #XRP News!

Earlier I posted a video about a guy who revealed that Wells Fargo has been training on a #SWIFT replacement.

Now, I got a online service agreement update👇from WF, talking about Real Time Payments by Clearing House, a #Ripple partner!

Strap in! 🚀 1/2 pic.twitter.com/PuYcrs5vnS

— Esoteric XRP 🇺🇸 🚀✨ (@Naturalmed777) March 15, 2022

In addition, Ripple became a part of an internationally renowned authority, Digital Euro Association (DEA) to work on CBDCs. The mission was “to contribute to the public and political discourse through research, education, and by providing a platform and community for policy-makers, technologists, and economists to discuss digital money-related topics.”

Following this development, there was some hike in the liquidity index as seen on the Liquidity Index Bot. Liquidity Index for Bitstamp XRP/EUR (84-day moving trend), for instance, witnessed a 29% surge.

Liquidity Index for Bitstamp XRP/EUR (84-day moving trend)

Day progress: 29%

Today so far: 11,811,434

All Time High: 11,805,381

Data: https://t.co/JSWxJdUsLO pic.twitter.com/bxbogmhRn3— Liquidity Index Bot (@LiquidityB) March 18, 2022

ODL transactions via RippleNet originated from markets including Australia, Japan, the Philippines and Singapore, with other markets to follow. Overall transaction count on RippleNet had increased substantially in 2021. In fact, it further plans to reciprocate the same in 2022.

All aforementioned evidence hinted that Ripple’s future would become increasingly secure.