NFT Market detailed report Q3/2022 and forecast future potentials.

Key Takeaways

- The problems with the business model of the projects started to go wrong when the number of daily users dropped heavily.

- Large companies are showing signs of turning away from NFT

- Fierce competition among NFT Marketplaces is happening

- Controversy about NFT royalties

- OpenSea’s policy is still controversial

Introduction

The third quarter continued to be a disappointing quarter for the NFT market. The total revenue of the whole market fell to the lowest level of 2022.

However, this is also a good time for projects to continue to improve their platform, roadmap, and human resources in a better way to prepare for the next cycle.

On-chain Overview

Quarterly Volume

Let’s zoom out to see where we are relative to the NFT bull run last year. We’re having the lowest Ethereum NFT trading volume quarter since it hit ATH a year ago. The bad influence of the macro economy as well as the potential for war made investors withdraw their money from all markets.

Solana NFT had a short bull run at the end of Q3, with the number of new collections increasing rapidly. However, Solana NFT took quantity to compensate for quality. They may have succeeded when the total sales volume crosses $1 billion for the first time, but the teams developing the projects have yet to show the necessary investments for long-term growth. Although not a scam, this increases the possibility of scam many times and makes investors invest in NFT just for the initial profit by flipping the floor price, regardless of how the project is later.

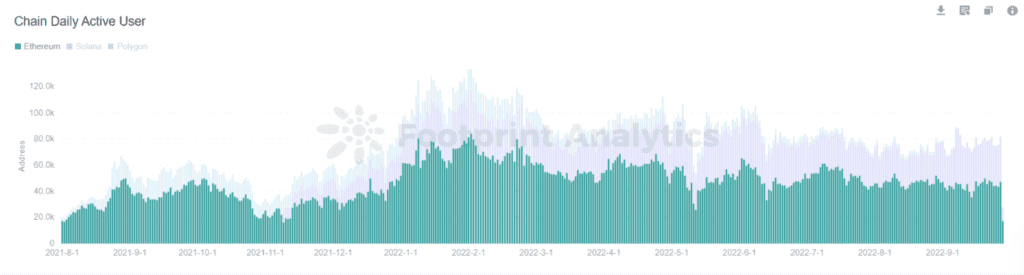

Quarterly User

There was a slight decrease in users compared to Q2 for Ethereum NFT. The anxiety about the floor price drop as well as the poor liquidity caused holders to leave the market and traders were also more cautious in flipping NFTs.

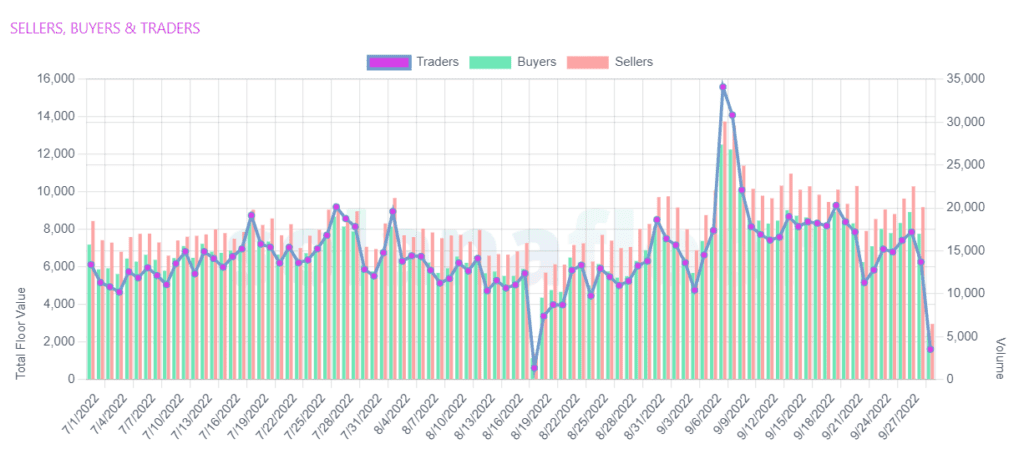

The number of Solana NFT sellers significantly exceeds that of buyers. The reason may be that the early September hype of Solana NFT left many buyers stuck at high prices but did not have enough liquidity to exit. In addition, the fact that the number of sellers has surpassed buyers for such a long time shows that the long-term trust of holders in Solana NFT is still unclear.

Market Breakdown

Here are some highlight events in Q3/2022:

July:

- Microsoft said no to NFT & NFT Worlds refused to integrate NFT because of the speculative aspect of NFT.

- Tencent’s NFT Marketplace shut down because of legal issues in China.

- BAYC’s all-time sales reached ATH at $2.3B because of cheap $ETH

- High-end collections with high trading volume; There are many million-dollar bid orders with BAYC and Cryptopunks

- OpenSea’s daily volume hit its lowest level since September last year, with only 1800 $ETH.

- The hype of ENS started to bump because some domain names are trading at incredibly high prices.

For more details: https://twitter.com/NFTDaily/status/1551761840287678464

- Optimism launched NFT

- Unstoppable Domain raised more than $65M, raising the company’s value to $1B

- Kucoin became the First CEX to launch NFT ETF Trading

August:

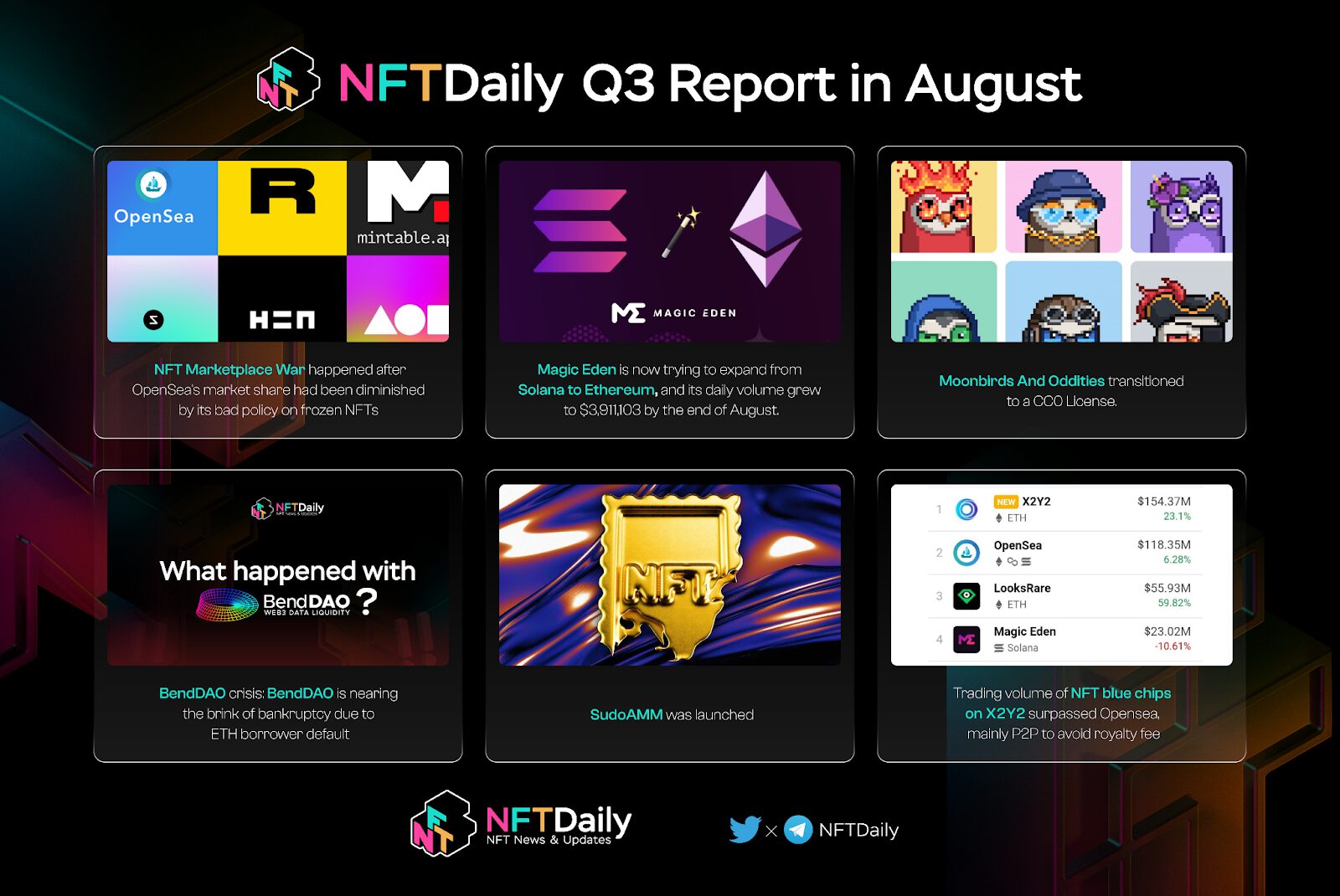

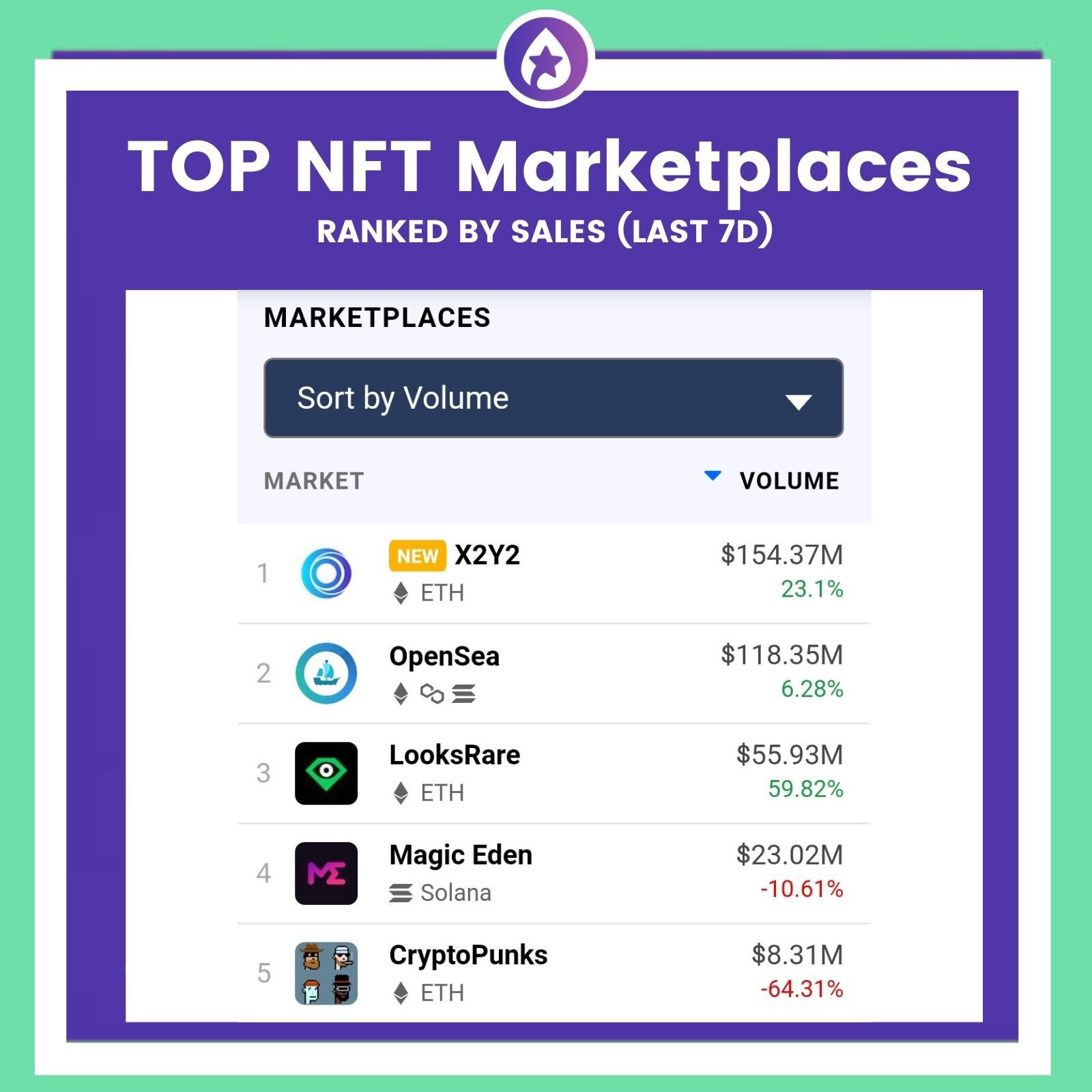

- NFT Marketplace War happened after OpenSea’s market share had been diminished by its bad policy on frozen NFTs and high royalty fees, giving smaller competitors such as Magic Eden, X2Y2, LooksRare, and the rise of P2P marketplace like SudoSwap. However, OpenSea continues to dominate in terms of users and revenue, while Magic Eden and X2Y2 lead in transaction count and transaction volume.

- Magic Eden is now trying to expand from Solana to Ethereum, and its daily volume grew to $3,911,103 by the end of August, 40-50% higher than the average daily volume in July.

- Moonbirds And Oddities transitioned to a CC0 License. This is legal, but holders aren’t happy. They say that there’s no way they can sell their Moonbird for a profit due to the lesser value because now anyone now has commercial rights.

- BendDAO crisis: BendDAO is nearing the brink of bankruptcy due to ETH borrower default, and their BAYC collateral in BendDAO is illiquid, leading to a high probability that these NFTs will be sold at liquidation prices, causing a sharp drop in floor prices, adversely affecting the whole NFT market

For more details: https://twitter.com/NFTDaily/status/1562928494027640832

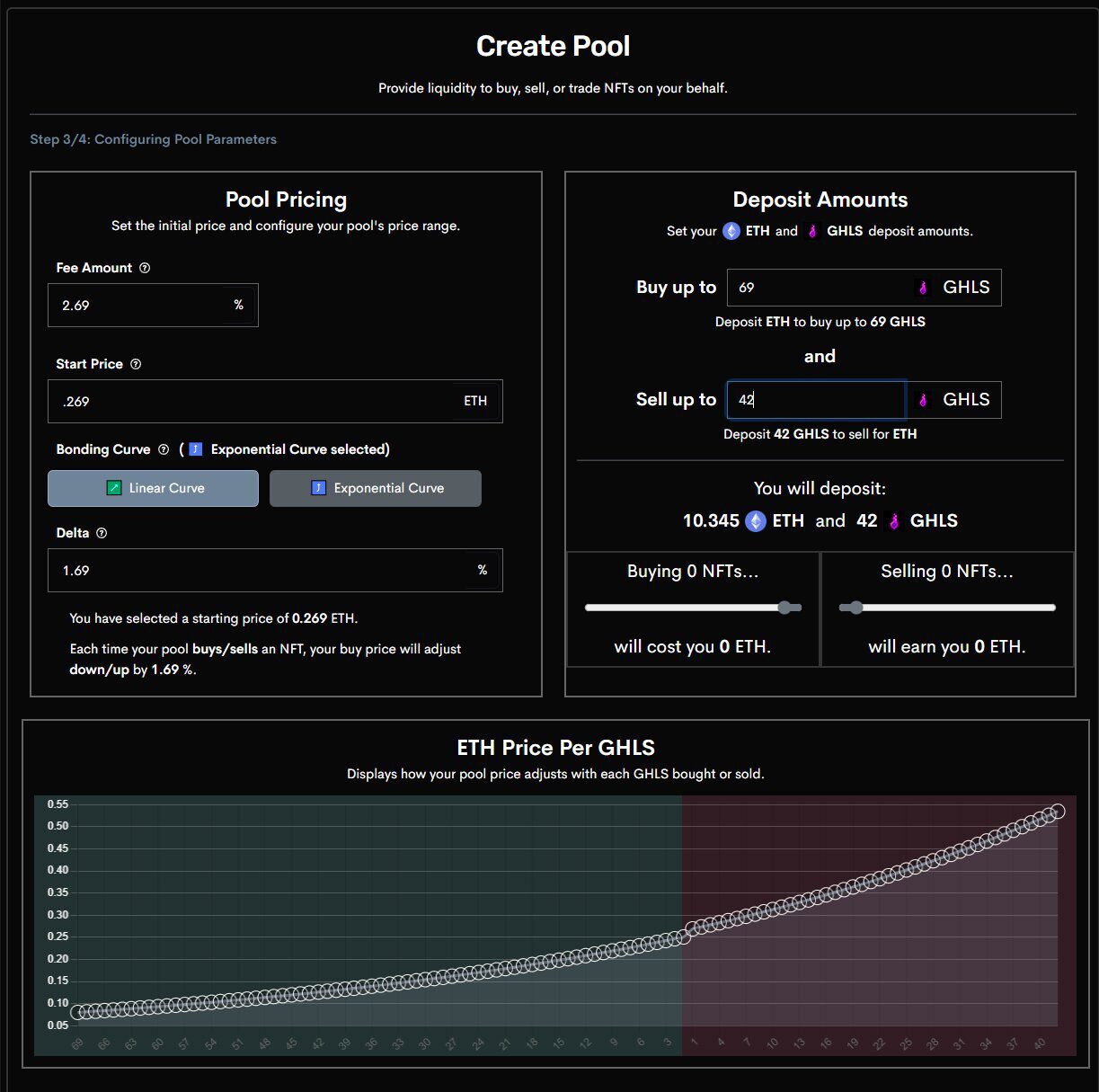

- SudoAMM was launched. SudoAMM is Uniswap but for NFT and it lets users specify their LPs. It brings better liquidity via LP, lower fee and extremely low slippage

For more details: https://twitter.com/NFTDaily/status/1561076260847099904

- Trading volume of NFT blue chips on X2Y2 surpassed Opensea, mainly P2P to avoid royalty fee

September:

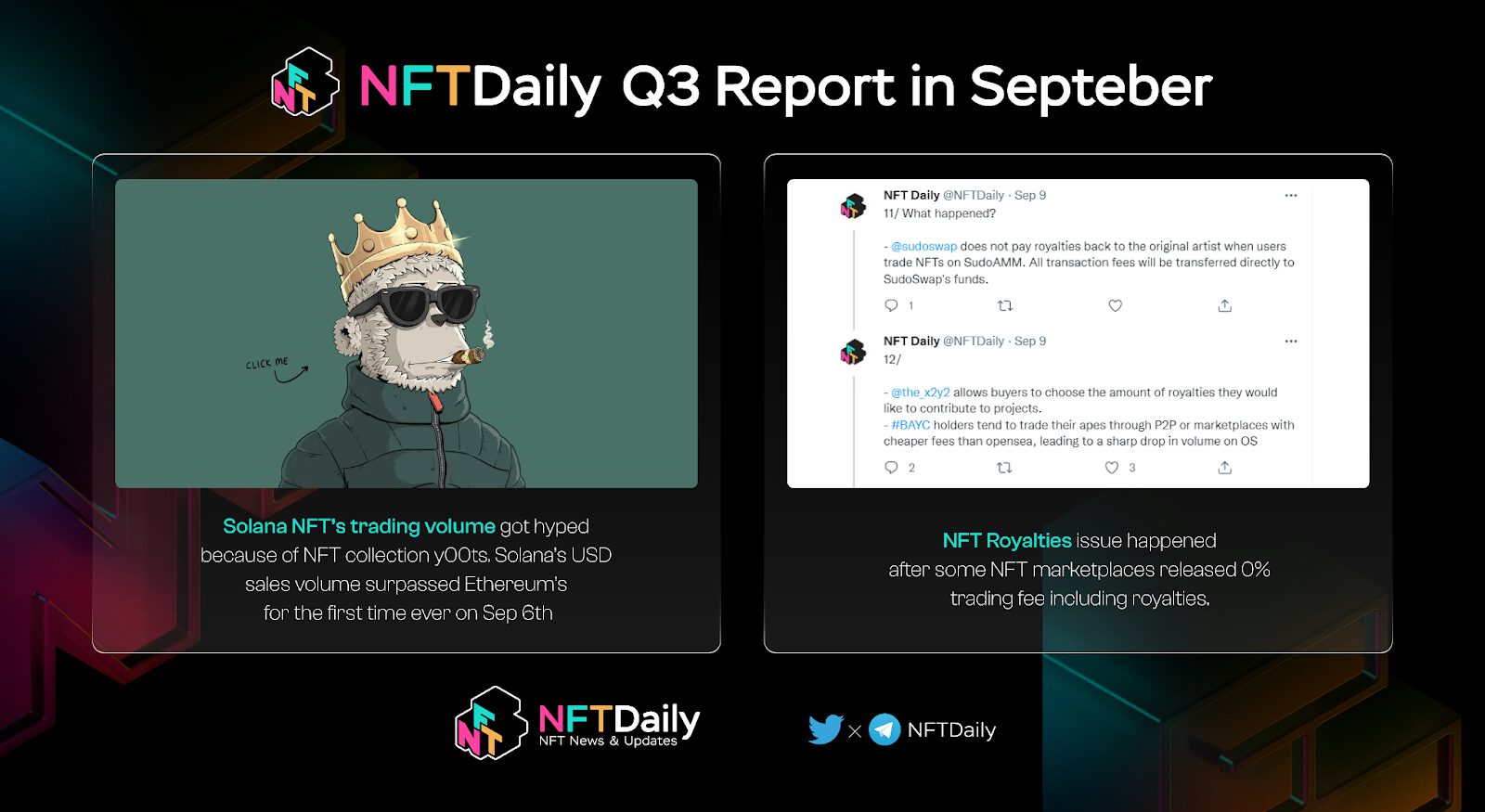

- Solana NFT’s trading volume got hyped because of NFT collection y00ts. Solana’s USD sales volume surpassed Ethereum’s for the first time ever on Sep 6th

- NFT Royalties issue happened after some NFT marketplaces released 0% trading fee including royalties.

For more details: https://twitter.com/NFTDaily/status/1568270180161126403

Projection

In the context that the Fed will continue to raise interest rates until 2023, Europe’s energy crisis and Europe’s finances are in trouble, money continues to withdraw from investment markets. There is a high probability that there will be no more bull run season in the last quarter of 2022, so that we have a complete year needed for the bear market.

However, this will be a good opportunity for those who can afford to buy high-end NFT collections at extremely cheap prices. During the first days of Q4, there were several million dollar transactions coming from Cryptopunks collection. The big players are still spending money to buy quality big NFTs. Small or unpopular collections will be less likely to be noticed, so it’s the duty of these collections to preserve their reputation and price floor through the end of this Q4.

There is one way to judge if an NFT project less than 1 year old can survive through 2023, is whether they maintain their activity for the community or not. Continuing to update the roadmap and organize side events for the community is a sign that the team really wants to continue the development of the project. So take a look at all the projects that come to your attention. Put your trust in the right person.

Conclusion

We are in the quietest phase of the NFT market, when there are no new projects or big news. Markets are all affected by macroeconomics. However there are hundreds of thousands of people working day and night to build the next foundation for the future of NFT. Don’t worry at all, work to earn, go out and touch the grass, do something better for yourself first. Save a certain amount of money to prepare for the next bull run season.