Non-fungible tokens (NFTs) are the new kid on the crypto block. Released into the wild in May 2014, they have made waves with their unique properties and uses.

NFTs offers users a more bespoke way to interact with virtual items than the standard token system. Instead of simply buying a company’s coins or tokens and storing them to use at a later date, users can directly purchase specific in-game items. These NFTs are individual units of value rather than universal cash tokens like utility or security tokens.

In this article, we take an in-depth look at Non-Fungible Tokens and explain why they are so important for the future of gaming!

What is NFT Staking?

NFT staking is the process of locking your non-fungible tokens in a smart contract. In exchange, you enjoy rewards, among other privileges.

The more of your tokens that are staked, the more income you’ll make. That’s why NFT holders earn a passive income while maintaining NFT their NFT ownership.

The tokens are automatically sold when they are unstaked, so you can use them as usual while they’re being used to make revenue. This is an ideal system for gamers and collectors who want to earn passive income without transferring ownership of their NFTs.

Center to the success of NFT is a company named OpenSea. CNBC News actually coined the company as the “Amazon of NFTs” because this place permits the creation, selling, and buying of Non-Fungible Tokens.

NFT staking is a great way to earn crypto while playing games or collecting items. You can put your items to work without ever needing to sell them, which is especially helpful if you’re a collector.

Conventional ways of making money from crypto are often highly risky or require a significant time investment. Trading or mining, for example, is a dangerous way to make money because your earnings might fluctuate wildly.

Staking is much more stable than these methods and doesn’t require you to give up your tokens. You’re staking and earning a regular income if you hold your tokens and don’t sell them.

How to stake NFT?

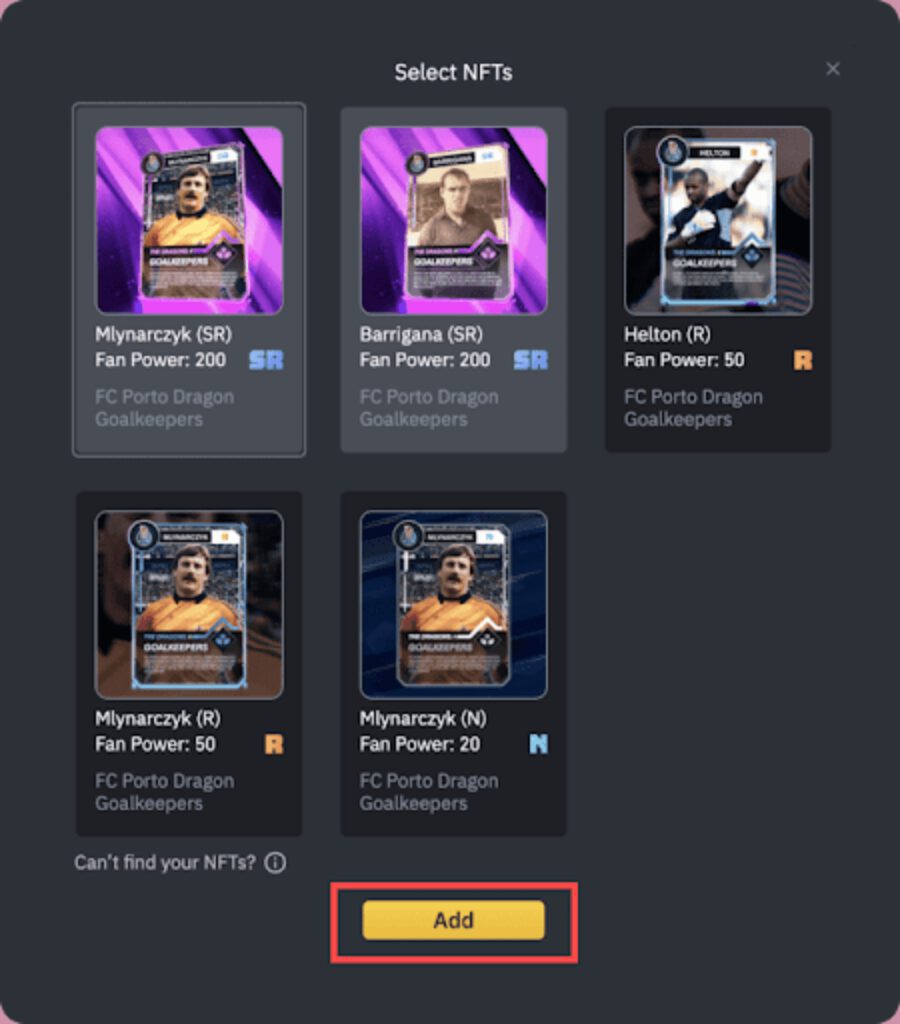

With so many projects now offering to stake, choosing the best one can be daunting. Luckily, most projects have made the process simple and straightforward, making it painless to start. You’ll need to set up an account with the project and then transfer your tokens to the smart contract.

Staking is best done with projects that are currently running. This is because new projects have no users, so they have no one to sell tokens to and, therefore, no way to generate revenue. Staking with a project that is already generating revenue is much more likely to lead to a profit.

NFT staking is still at the beginning of its time when compared to other DeFi yield farming concepts. However, they function very similarly.

You only need to lock your NFT on your desired platform and wait until you get rewards based on factors such as the staking duration, amount of NFTs staked, and annual interest rate. Other times, you find NFT staking opportunities in P2E gaming and metaverse platforms.

To stake your NFT, you need to place your NFT tokens in a cryptocurrency wallet. While waiting for it to yield, you help support the operations and maintain the security of your chosen blockchain network.

There is a mechanism known as the Proof-of-Stake (PoS), in which you give the consensus for your tokens to be used as collateral by locking your stakes in exchange for rewards and increased ownership over time.

How much income can you make with NFT Staking?

If you’re just getting started with crypto, staking is a great way to get your feet wet. It’s a low-risk, low-effort way to earn money from crypto.

However, it’s important to note that staking is not an exact science, so it’s hard to say exactly how much money you’ll make. NFT staking projects are different from one another and have different ways of calculating your returns.

The amount of money you can earn through staking varies from project to project. You can expect to earn anywhere from a few percentage points up to 100% of what you put in. However, your rewards will depend on various factors.

As mentioned above, the annual percentage yield, the amount of NFTs you decide to stake, and the duration of staking will determine how much you can make. You should also consider the platform you chose for staking to know your expected income.

The best thing you can do is choose a project generating revenue that has a proven track record for its crypto NFTs income. Staking can be a great way to make money while playing your favourite games. It’s a great way to earn while still getting to enjoy your games without any additional effort.

The best NFT staking projects

These are currently the best non-fungible crypto projects to stake with. The top-rated ones are summarized below:

- Etheremon – Etheremon is a decentralized world where you can capture, trade, and train your own monsters. This is a top-rated game with millions of users. By staking your tokens, you can earn money by helping the network run.

- CryptoKitties – Among the first NFTs to ever be created, CryptoKitties is one of the most popular blockchain games in existence. You can turn your digital cats into real money by staking them.

- Decentraland – This virtual reality world is currently in beta. You can stake your MANA tokens to help provide the server capacity needed to run the game.

- Kyber Network – Kyber Network allows you to exchange any crypto tokens instantly, anywhere in the world. You can earn money by staking your tokens and helping to run the decentralized exchange.

The best NFT staking platforms

There are many different NFT staking platforms that you can use to earn passive income. However, some are better than others, and some are more reliable than others. Here are some of the best platforms for staking:

- Binance NFT PowerStation – Binance is among the most notable names in the world of crypto. Through this outlet, you can stake your NFTs by supporting sports teams of your liking. Token holders are privileged to be prioritized during ticket sales and participate in club decisions.

- Doge Capital – They welcome Woofers to showcase their collection of 5000 pixel-art NFTs. These NFTs were minted via the Solana blockchain. The perks of being a part of the club are that their staked NFTs can earn them rewards in DAWG tokens daily. DAWG token is the platform’s native token.

- Band NFTs – We’ve mentioned staking for your favourite sports teams, but have you heard of an NFT market for buying music NFTs? Yes, you read it right. Band NFTs is a music-focused platform dedicated to staking in royalty pools to get a share of the generated revenue from the album you bought.

Conclusion

Non-fungible tokens are proving to be a beneficial type of blockchain token. They allow creators to create more bespoke virtual items that can be put to more specific uses. NFTs are also a more stable store of value than utility or security tokens, making them ideal for gamers. Staking is one of the most valuable ways of using NFTs.

It allows users to earn money while still enjoying their tokens. Staking is a low-risk and low-effort way to profit from crypto, and it can be done with almost no risk. Choosing a project with a proven track record of generating revenue is best.

FAQs

How much does it cost to create an NFT on OpenSea?

OpenSea declares that creating an NFT under their company is free. You can partner with them in making your non-fungible token, provided they receive a 2.5% of the sale price.

Is there security in NFT staking?

Yes. You can trust and deploy your tokens on your desired staking platform. Trust that the Proof of Stake works as the foundation of your security. There are also blockchain protocols that secure your NFT ownership.