Real estate has gone virtual and now, your next summer or winter home could be in the metaverse. As virtual land plots sell in the millions and estimates suggest that $1 billion in sales is plausible this year itself, some analysts are naturally worried that a correction – or a crash – could be on the cards.

Going Apesh*t

The Bored Ape Yacht Club’s [BAYC] newly introduced ApeCoin [APE] is arguably having its moment in the sun. Especially after even TIME Magazine announced it would accept the token for digital subscriptions.

Congrats to the ApeCoin DAO on the rollout of @ApeCoin & thrilled we can announce that @TIME will be accepting $APE for digital subscriptions in the coming weeks on https://t.co/tiBU5fsE5B ⏰❤️🍌🦍

— TIMEPiecesᵍᵐ ⏰ (@timepieces) March 20, 2022

That being said, APE is still in its early days. At press time, the token was trading at $10.72, having risen by 971.56% over the last seven days. Even so, it has also fallen by 7.61% in the past 24 hours. At the time of writing, it was the 45th biggest crypto by market cap. What is certain, however, is that more time is required to study its price trajectory.

Furthermore, what does APE say about the ascent of the NFT industry as a whole?

Stop trying to make “fetch” happen!

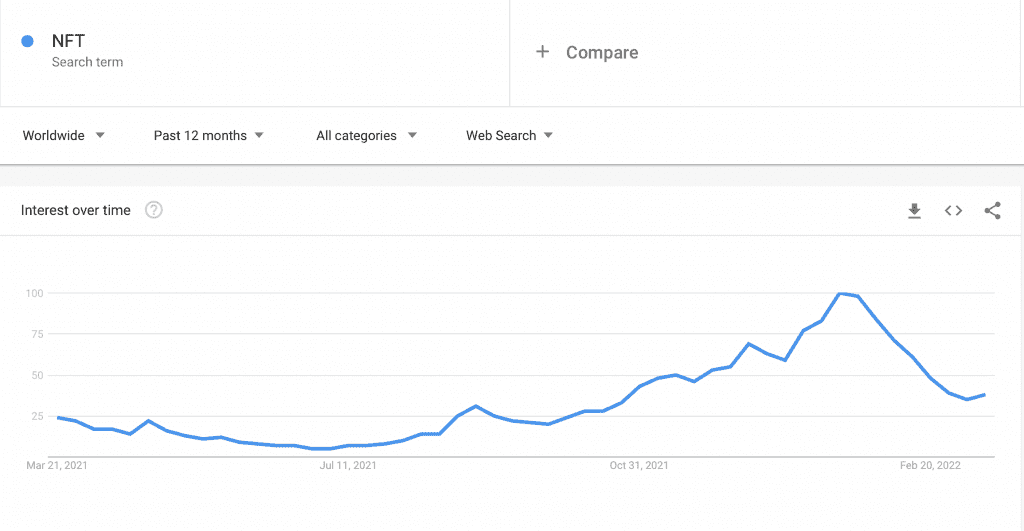

In March, the NFT industry went through a whole host of reactions as Google Trends revealed a drop-off in the number of searches involving “NFT” as a term. Interest levels matched those last seen in October 2021, but the launch of APE shows that an uptrend could be a possibility again.

Source: Google Trends

However, the close of 2021 recorded a series of high-value sales of real estate in the metaverse. For example, land in the Axie Infinity universe was sold at $2.33 million while an estate in Decentraland sold at $2.4 million.

Crypto-researcher Max Maher admitted there was a lot of hype surrounding metaverse land markets, but also warned that a metaverse enjoying investor attention right now might not stay popular – or even exist – when more tech-savvy rivals enter the game. Also warning about the lack of scarcity when it comes to metaverse platforms, Maher said,

“This means users might decide to abandon one metaverse and move on to another. This makes it extremely hard to guess which metaverse is the one worth investing in. We can’t necessarily say the first will be the biggest.”

A change in the ranking order

It has been an interesting week for NFT collections as DappRadar showed that the top collections by volume were Terraforms and Meebits. Meanwhile, BAYC and CryptoPunks came in the fifth and sixth, respectively.