Bitcoin has been under major pressure over the last week and facing strong resistance currently at $60,000 levels. As of press time, Bitcoin is trading 1% down under $57,000 with a market cap of $1.075 trillion.

Although Bitcoin remains under pressure its on-chain fundamentals signify signs of major strength and accumulation. As on-chain data provider Glassnode explains:

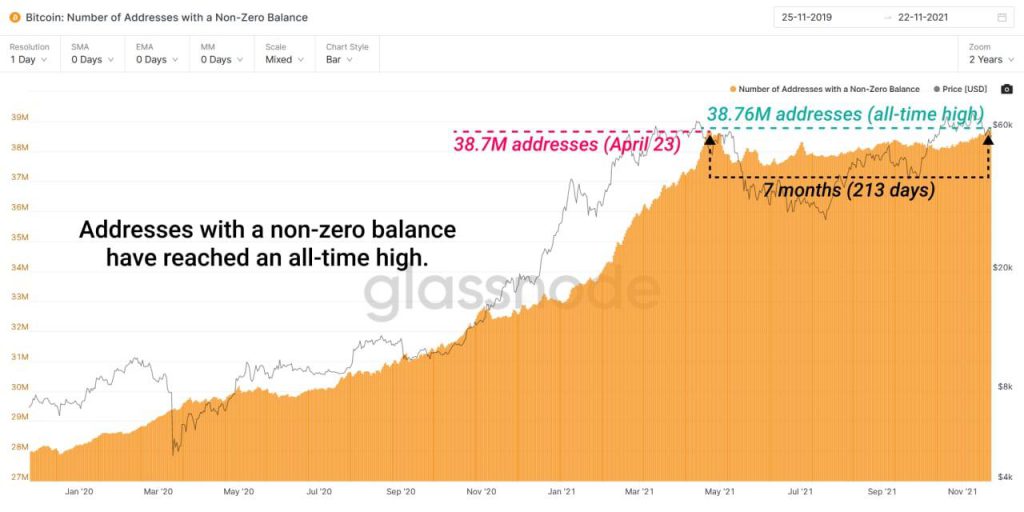

The number of #Bitcoin addresses with a non-zero balance has reached a new all-time high of 38.76 million addresses. The previous high of 38.7 million was set seven months ago on April 23rd, taking 213 days to fully recover.

On-chain data provider Santiment reports that despite Bitcoin trading under pressure, the Bitcoin supply has been moving off-exchanges lowering the sell-off risks. Furthermore, the USDT supply on the exchanges has been increasing while indicating strong buying power.

📉 #Bitcoin has sunk -5.5% in the past 24 hours and is on the verge of dropping below $56k once again. Despite this, $BTC‘s supply continues moving away from exchanges, lowering selloff risk. $USDT also remains high on exchanges, indicating high buy power. https://t.co/wWHIdYxzNs pic.twitter.com/4dkr086zqM

— Santiment (@santimentfeed) November 22, 2021

During the recent price correction, Bitcoin’s short-term holders have been selling as well. The Bitcoin short-term holders have been taking profits at the highs while capitulating at the lows. As Glassnode explains, there’s a 15% drop in the Bitcoin supply in profits and is currently in the bull/bear transition zone.

Bitcoin Short-Term Holders Responsive to Price Action

Furthermore, Glassnode adds that short-term holders have been the most responsive to price actions. It notes:

Short term holders (STH) are most responsive to price action due to a combination of having a higher relative cost-basis, a higher time preference, and potentially a lower degree of conviction in the asset. This week’s price action was no exception, as STHs played a role in setting both the highs and the lows.

On the other hand, the Bitcoin funding rates on Binance have neutralized during the broader market correction. On-chain data provider Santiment reports that it usually leads to strong bounceback.

📊 When #Bitcoin was well above $60k from mid-October to mid-November, #Binance‘s funding rates for most assets were well in positive territory. This is indicative of trader over-confidence, and prices often overcorrect. Now, things look far more neutral. https://t.co/8xUDv6k7YF pic.twitter.com/kLoABe6MhL

— Santiment (@santimentfeed) November 22, 2021

All on-chain indicators suggest that the BTC price is poised for the next rally. Thus, it could be a good buying opportunity as of now.