BeInCrypto takes a look at on-chain indicators for Bitcoin (BTC), more specifically the number of addresses with a non-zero balance and the number of coins they are holding.

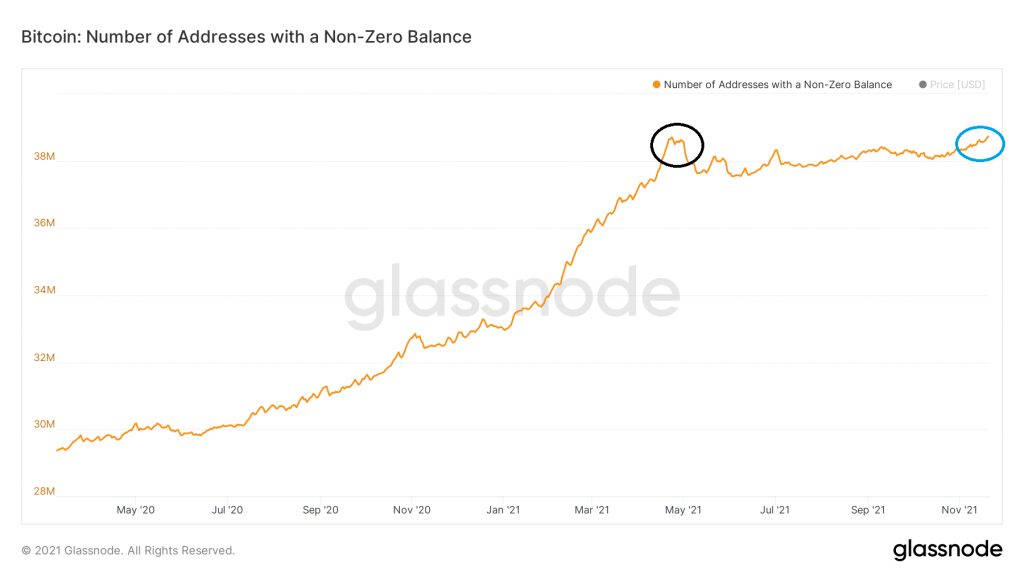

The number of BTC addresses has been steadily moving upwards since March when it was below 30 million.

On April 23, it reached a new all-time high of 38,704,373 (black circle). The all-time high nearly coincided with the then BTC price all-time high of April 14.

While the number of addresses dipped throughout May and September, it eventually reached a new all-time high of 38,734,240 (blue circle) on Nov 20. This means that the increase in the BTC price was also accompanied by an increase in new market participants, as evidenced by the number of new addresses.

Small and medium BTC accounts

The increase is especially prevalent in small accounts (those holding between 0.01 and 1 BTC).

Accounts with more than 0.01 are shown in black, while those with more than 0.1 are shown in grey. Their movement mostly mirrors that of the total number of addresses.

However, a look at accounts holdings between 1 BTC and 100 BTC paints a different picture.

Accounts with more than one (light blue) and those with more than 10 (blue) are considerably far from their all-time highs. Interestingly, accounts with more than 10 BTC reached an all-time high in March, prior to the all-time high of the BTC price.

This makes sense intuitively, since large accounts usually accumulate during downtrends, while small accounts do so closer to the top when large accounts are distributing. Therefore, one increases while the other decreases.

With this in mind, it’s important to note that both have been moving upwards since the July lows.

Large accounts

Finally, the number of accounts with holdings of more than 100 BTC is similar to the medium-sized accounts.

The main difference is that large accounts reached their all-time highs considerably prior to medium accounts between October and December 2020.

However, large accounts also increased their holdings after the July lows. Therefore, a look at the number of addresses with different balances shows that the addresses with large sizes added considerably in the July dip, while those with small sizes are currently adding to their holdings.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.