BeInCrypto takes a look at on-chain indicators for Bitcoin (BTC), more specifically the Market Value To Realized Value (MVRV) and Net Unrealized Profit Loss (NUPL)

MVRV Z-score

MVRV is defined as the ratio between the market and realized capitalization levels. Values higher than one specify that the market cap is larger than the realized cap. The MVRV Z-score uses a standard deviation in order to normalize the values.

On Jan 24, the indicator reached a value of 0.85. The low is the first time that the indicator has fallen inside the 0.80 -1.20 range since Sept 2020, when the current bullish cycle was just beginning. Historically, values above this area have been associated with bullish trends, while those below have transpired during bear markets.

Therefore, in order for the cycle to remain intact, MVRV has to bounce and move outside of this area. A breakdown below 0.8 would confirm that the long-term trend has turned bearish.

NUPL

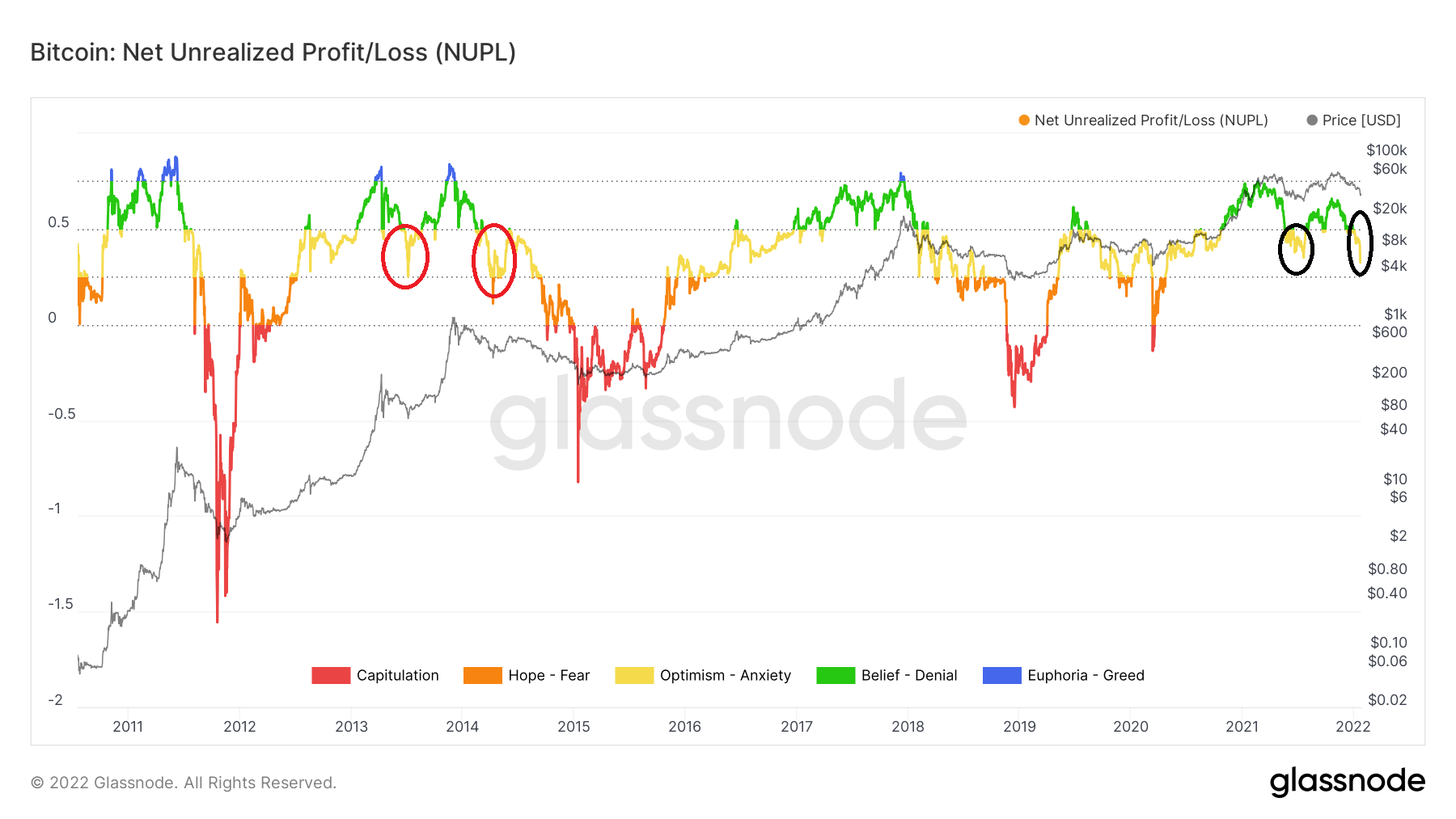

NUPL is an indicator that measures the total amount of profit or loss for investors. A reading below 0 means that the market is in aggregate loss, while one above 0 indicates that the market is in aggregate profit.

During the previous market cycle, values above 0.75 (blue) have been linked with tops. Conversely, those below 0.25 (red) with bottoms.

In the beginning of Jan, NUPL fell below the 0.5 region. This was a bearish development, since it was the second time it fell below this level, after that of July 2021 (black circle).

In the previous market cycles, NUPL fell below the 0.5 level only once after previously moving above it while the trend was bullish. Therefore, the second decrease below 0.5 market the end of the bullish trend (red circle).

However, it is worth noting that the current cycle is the first one in which NUPL did not increase at all above 0.75. Therefore, if the current bullish cycle has ended, it would mark the only time in which NUPL has not crossed above 0.75. If not, it would mark the first time that the indicator fell below 0.5 twice before reclaiming the line.

Therefore, the ensuing movement is crucial in order to determine the future trend. Another reclaim of the 0.5 line would go a long way in suggesting that the trend is bullish, while a decrease below 0.25 would all but confirm that the trend has become bearish.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.