BeInCrypto takes a look at on-chain indicators, more specifically the NVT (Network Value to Transaction) in order to determine if the Bitcoin (BTC) network is properly valued.

NVT is an on-chain indicator that measures the ratio between market capitalization and transaction volume. It was created by Willy Woo.

A high indicator reading suggests that the network value is outpacing its transaction volume. It is considered a bearish sign, since an increase in market value has to be supported by a relatively proportional increase in transaction volume.

For a more detailed analysis of NVT, click here

Current reading

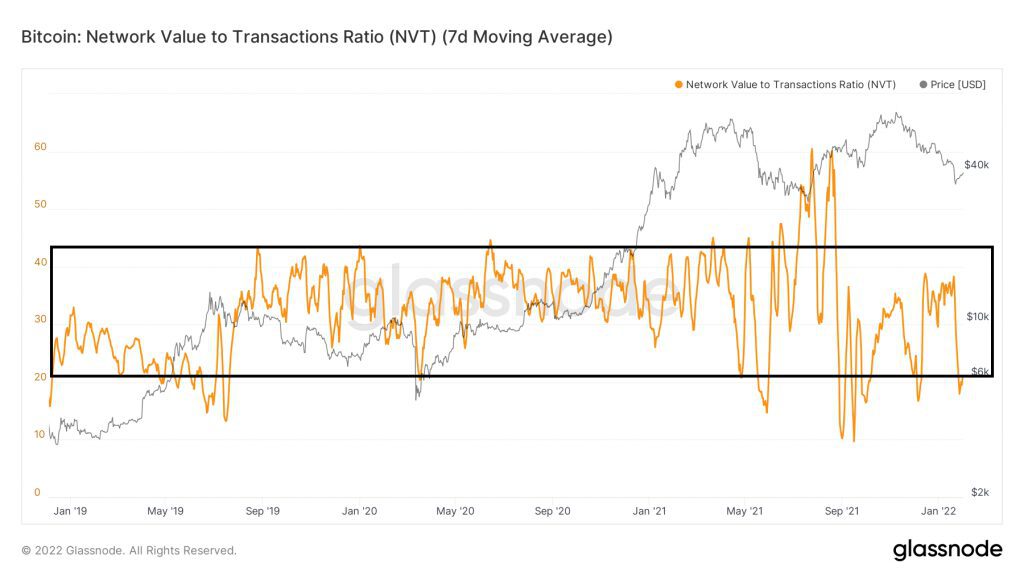

Since the beginning of 2019, NVT has generally traded in a range between 20 and 40, with a few deviations above and below this level.

The deviations started becoming more pronounced near the end of 2021. At the time, the BTC price was approaching its all-time high.

On Sept, NVT deviated below it range low before reclaiming it.

More importantly, the indicator has been falling alongside the BTC price since Dec 2021. This is considered a bullish sign, since despite the price drop, transactions are not falling at the same rate.

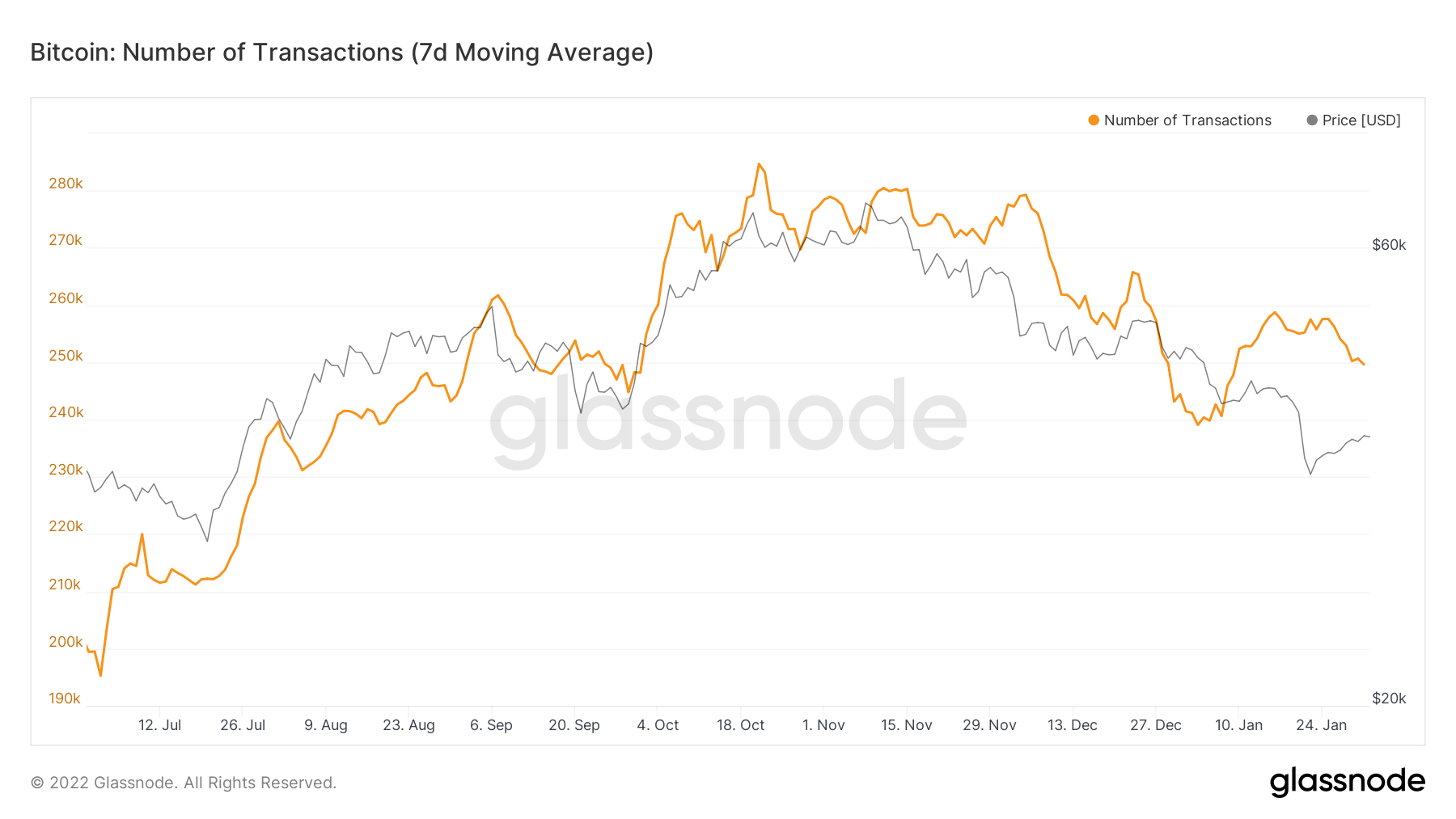

While the BTC price is very close to its July lows, the number of transactions is not. It is currently at 250,663, considerably above the 195,224 lows of July 2021.

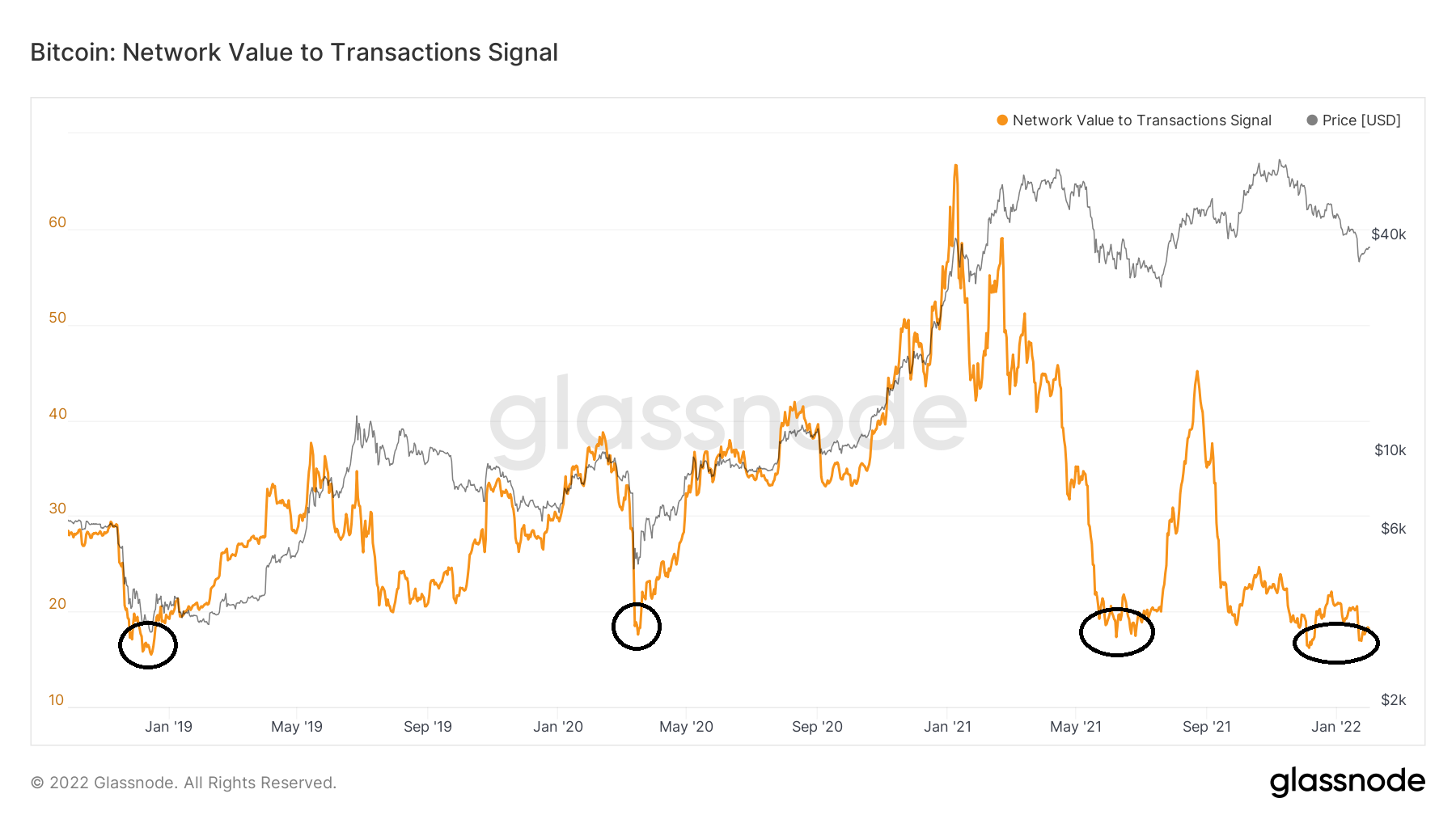

NVT signal

The NVT signal is a slightly different indicator, which uses a 90-day moving average (MA) of the transaction volume instead of the raw data.

Since the 2018 bottom, NVT has fallen below 20 only four times (black circles). Most recently, it did so on Jan 24, when a low of 16.9 was reached. The previous three drops below 20 all led to considerable upward movements.

Therefore, it is possible that a similar upward movement will follow this time around.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.