Coinbase Exchange saw a further decline in monthly volume in February, as OKX Exchange saw an 85% increase in volume over the largest exchange by volume in the United States.

February proved to be a tough period for crypto products. Several areas of the space were hit strongly and exchanges were not spared.

According to Be[In]Crypto research, OKX and Coinbase was able to generate approximately, a combined volume of $751.38 billion. Although such a figure seems high due to the low combined volumes of several exchanges, the total volume of the two exchanges for February was down.

The difference between January and February 2022’s volume was $134.38 billion, a 15% decrease.

Trading volume still decreasing from 2021

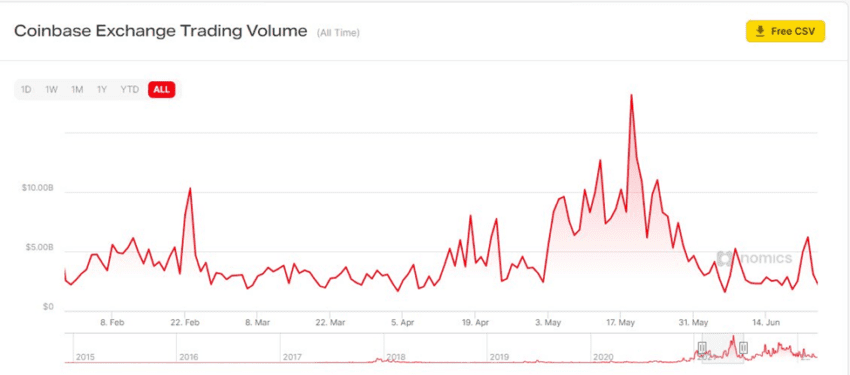

The total volume of Coinbase over the past year was down by 27% since February 2021, which saw approximately $128 billion in volume recorded, according to Be[In]Crypto research.

Coinbase monthly high plummeted by more than $160 billion

At the peaks of the markets in May 2021 when coins such as Ethereum (ETH) and Internet Computer (ICP) reached new all-time highs, Coinbase, like several exchanges, reached new milestones in volume. The total volume for Coinbase as of May 31, 2021, was approximately $255 billion, according to Be[In]Crypto research.

With a plunge in the price of digital assets during the third quarter of 2021 which continued towards the end of that year, approximately $108.51 billion was wiped off May’s high on Dec. 31, 2021.

With a bearish engulfment encircling the market in February 2022, a staggering $162.91 billion was shed off Coinbase Exchange’s monthly high in May of last year (a 63.65% decrease in 9 months).

OKX continues to surpass Coinbase

Although Coinbase managed to record $93 billion in February volume, OKX managed to record $658 billion. Following in the footsteps of Coinbase, volume for OKX decreased by 13% from January 2022.

January 2022 saw OKX brings forth a total volume of $761 billion.

In contrast to the misfortunes of Coinbase, OKX saw a year-on-year monthly increase for February. Last year, it saw $562.81 billion in volume recorded, with 2022’s figure increasing by 16.97%.

Cryptocurrency exchange users still prefer OKX

As of March 2022, Binance is still the largest cryptocurrency exchange by daily trading volume. Based on the statistics provided by Be[In]Crypto research, OKX remains the clear favorite over Coinbase and after Binance.

Before the trading volume decline of both exchanges in February, January 2022 saw OKX volume outpace Coinbase by 83.62% and December 2021 saw OKX surpass Coinbase by 78.77% in volume.

During their respective all-time highs back in May 2021, OKX surpassed Coinbase by 69.11%. OKX was the clear favorite in February 2022, with 85% more volume than Coinbase.

What is the cause of monthly volume declines?

To understand the decline in monthly volume across the crypto exchange space, we should focus on the outlook of the market in general in the first quarters of 2021 and 2022.

Negative market outlook

Although exchanges such as OKX saw year-on-year monthly growth, centralized exchanges such as Binance and Coinbase’s trading volumes have not reached the highs of 2021 due to the bearish outlook of the market.

In contrast to the same time in 2021 where Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and others were testing new high highs daily, 2022 has seen a recovery of the market from the new lows experienced towards the end of 2021.

Indeed, NFTs began to gain serious grounds in the crypto finance space in the early months of 2021. This led to huge demand for cryptocurrencies such as Ether (ETH) and the novel tokens of other smart contracts-backed blockchain technologies.

The same thing cannot be said for 2022 as several NFT marketplaces such as NBA TopShot, continue to see decline in monthly volumes.

In addition to this, there were several speculations in 2021 about the consideration by several countries to research about the prospects of central bank digital currencies (CBDCs).

The aforementioned bolstered the crypto finance market strongly in 2021 and led to a spike in the demand for crypto assets by sophisticated and unsophisticated traders and investors.

Although negative crypto market sentiment is not good, there are positives, such as the increase in the trading of stablecoins such as Binance USD (BUSD), United States Dollar Coin (USDC), and United States Dollar Tether (USDT).

Trading of stablecoins is largely a way of protecting holdings from large percentage losses. This has been detrimental to the fortunes of cryptocurrency exchange Coinbase but has improved the volume of OKX greatly in 2022.

What caused the differences in monthly volumes?

To understand the differences in monthly volume, you have to account for the number of coins, markets supported, and the trading volumes of those individual markets on OKX and Coinbase.

As of March, Coinbase supports approximately 123 cryptocurrencies, and 509 markets. The top markets on the exchange as of writing were BTC/USD, ETH/USD, AVAX/USD, WLUNA/USD, and SOL/USD.

The combined volume for these markets was $1.26 billion.

As of March, OKX supports approximately 343 cryptocurrencies, and 28,113 markets. The most popular markets on the exchange as of writing were BTC/USDT, LUNA/USDT, BTC/USD, and ETH/USDT.

The combined for these markets were $2.06 billion.

From the statistics provided, it is clear as day that the number of coins on OKX is more than twice the number of coins on Coinbase. Aside from that, the number of markets on OKX is 55 times that of Coinbase.

The top markets on OKX are dominated by the largest stablecoin by market capitalization, USDT while Coinbase continues to rely on USD pairings to keep up with other exchanges in the market.

Put simply, OKX has more volume because more stablecoin pairings are making up its top 100 markets.

Traders have taken advantage of the variety of stablecoin markets on the exchange to protect their holdings from the large percentage dips brought forth by the negative sentiment of the crypto market in the first three weeks of February in addition to the Ukraine-Russia conflict towards the end of the second month of 2022.

As of the second week of March, the total trading volumes of OKX and Coinbase have surpassed $250 billion and $30 billion respectively.

As things stand, there is a huge chance OKX could outpace Coinbase in volume by the end of March 2022.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.