BeInCrypto takes a look at the seven altcoins that decreased the most over the past seven days, from Nov 5 to Nov 12.

These altcoins are:

- OMG Network (OMG) : -27.61%

- Arweave (AR) : -18.59%

- NEM (XEM) : -17.70%

- THORChain (RUNE) : -17.58%

- Audius (AUDIO) : -16.95%

- Cosmos (ATOM) : -15.98%

- SushiSwap (SUSHI) : -14.58%

OMG

On Nov 3, OMG broke out from a descending parallel channel and proceeded to reach a high of $20.12 two days later.

While it decreased afterwards, it seemingly found support above the previous resistance area at $15.80. However, on Nov 12, it decreased by 30% in a matter of minutes. The decrease was very sharp, and was likely caused due to the BOBA token airdrop, since holder sold after the snapshot at 00:00 AM.

In order for the bullish structure to remain intact, OMG has to create a long lower wick and bounce above the resistance line of the channel and ideally the $15.80 area.

If it does not, the trend will be considered bearish.

Therefore, the daily close is crucial in determining the direction of the future movement.

AR

AR has been decreasing since reaching an all-time high price of $91 on Nov 6.

Despite the drop, it is still holding above the $66 horizontal area. Previously, the area acted as resistance (red icons) thrice, and is now expected to act as support.

If it does, AR could increase towards the next resistance at $99.

XEM

XEM has been following an ascending support line since June 22. This led to a high of $0.243 on Sept 6.

After a short downward movement, XEM bounced at the support line once more and reached a high of $0.234 on Nov 5. This served to validate the $0.24 area as resistance.

Currently, the token is returning to the ascending support line once more and could potentially bounce once it gets there.

If a breakout above the $0.24 area were to occur, the next resistance would be at $0.41.

RUNE

RUNE has been increasing since breaking out from a descending resistance line on Oct 22. The upward movement culminated with a high of $17.27 on Nov 2.

While the token has been decreasing since, it is potentially in the process of validating the $12 area as support (green icons).

If it is successful in doing so, the next resistance would be at $20.

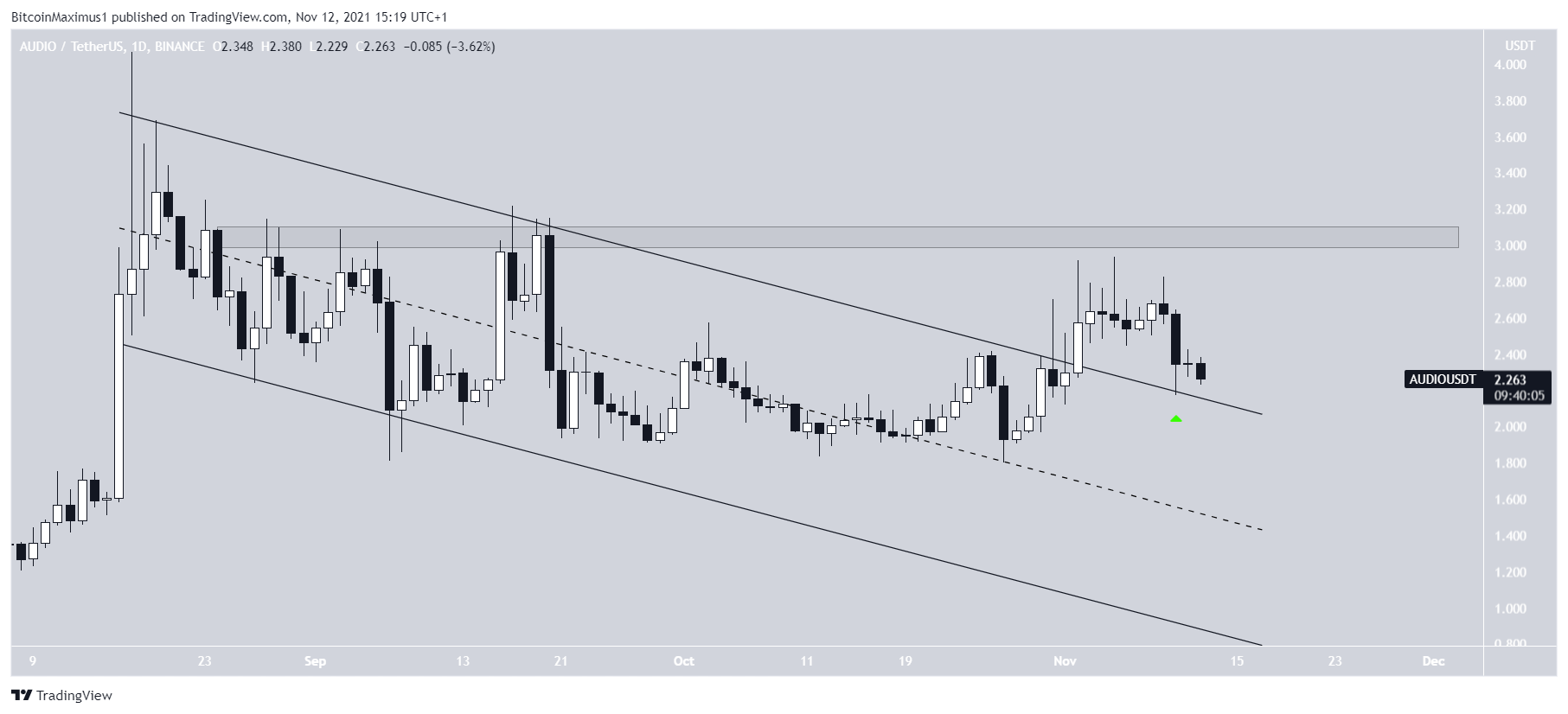

AUDIO

AUDIO had been moving downwards since Aug 17. The downward movement was contained inside a descending parallel channel. Such channels usually contain corrective structures, meaning that a breakout from them is expected.

On Oct 31, AUDIO broke out from this channel. Afterwards, it returned to validate its resistance lien as support (green icon) before bouncing.

The closest resistance area is at $3.05.

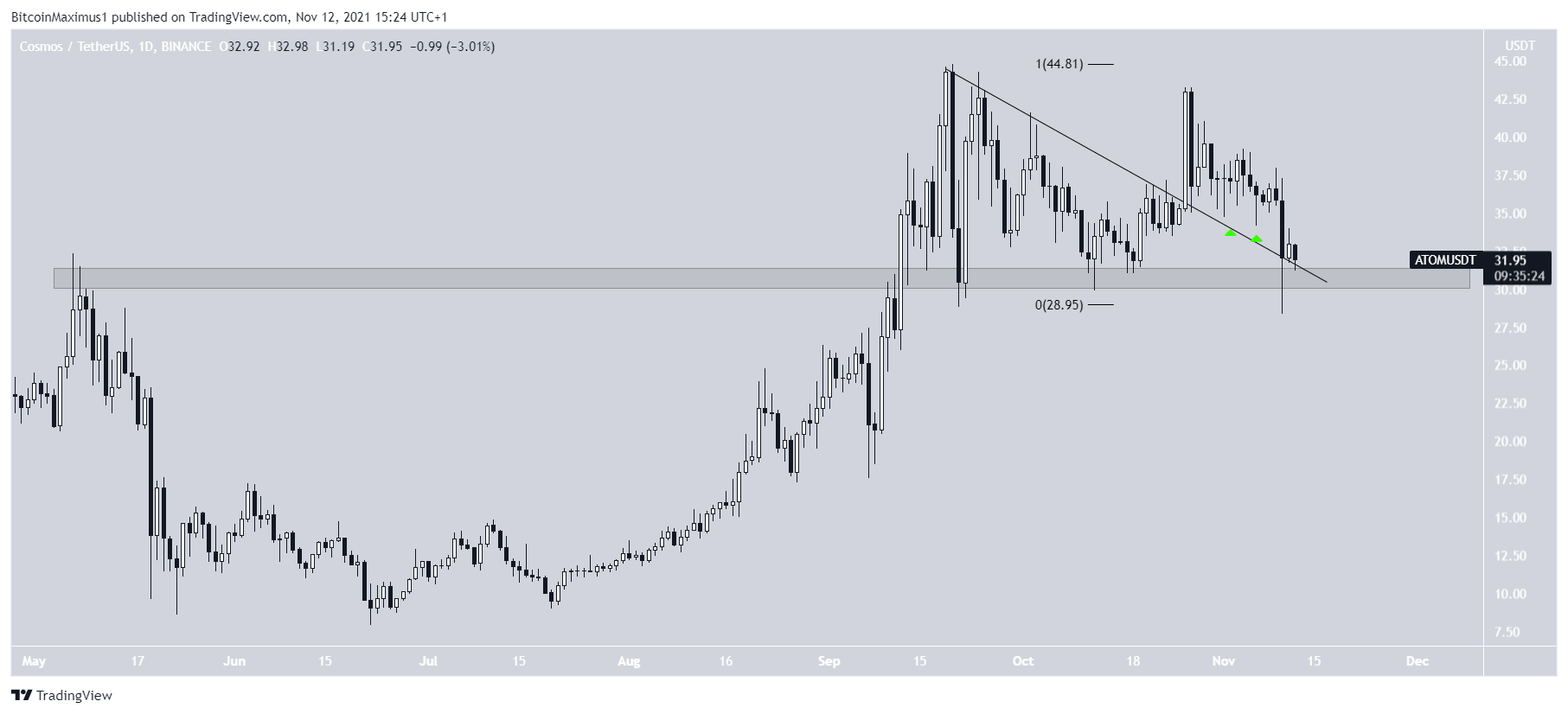

ATOM

ATOM broke out from a descending resistance line and reached a high of $43.26 on Oct 26. However, it has been moving downwards since.

On Nov 11, it reached a low of $28.32 and bounced. The bounced served to validate the previous resistance line and the $30.50 area as support.

As long as the token is trading above these levels, the bullish trend remains intact.

SUSHI

SUSHI has been decreasing alongside a descending resistance line since March 12. So far, it has been rejected thrice (red icons) by this line, most recently on Nov 5.

It is currently decreasing towards the $8.50 horizontal support area, which could initiate a bounce and potentially another breakout attempt.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.