The world’s largest cryptocurrency Bitcoin (BTC) continues to remain under pressure after losing the $40,000 support last Saturday. In a further price correction, the BTC price took a dive under $38,000 before recovering back again.

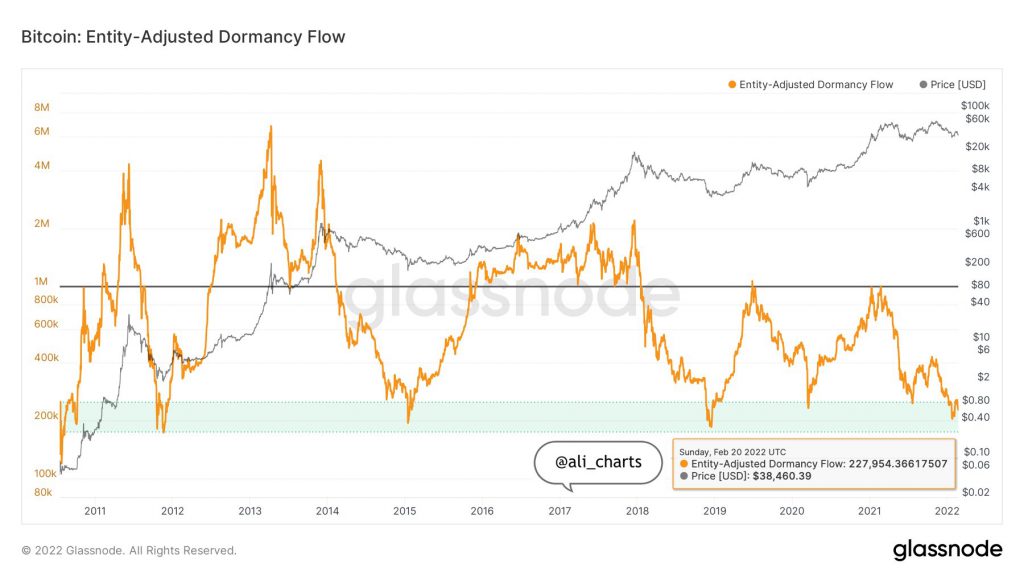

While the bitcoin price remains highly volatile, we are looking at some of the on-chain metrics that can help decide on the future price action. Citing data from Glassnode, crypto enthusiast Ali Martinez points out some entity-adjusted dormancy flow for Bitcoin. He writes:

Entity-Adjusted Dormancy Flow shows that old hands have significantly reduced their $BTC spending behavior. A dormancy value of 250K or lower, suggests #BTC is a good historical buy zone. Since Jan. 06, #Bitcoin dormancy value dropped below 250K and currently sits at 228K.

However, it won’t be an easy path for Bitcoin on the road to recovery. It will have to break past some crucial resistances on its way to surge past crucial resistance of $40,000 and more.

The Downside Risks for Bitcoin

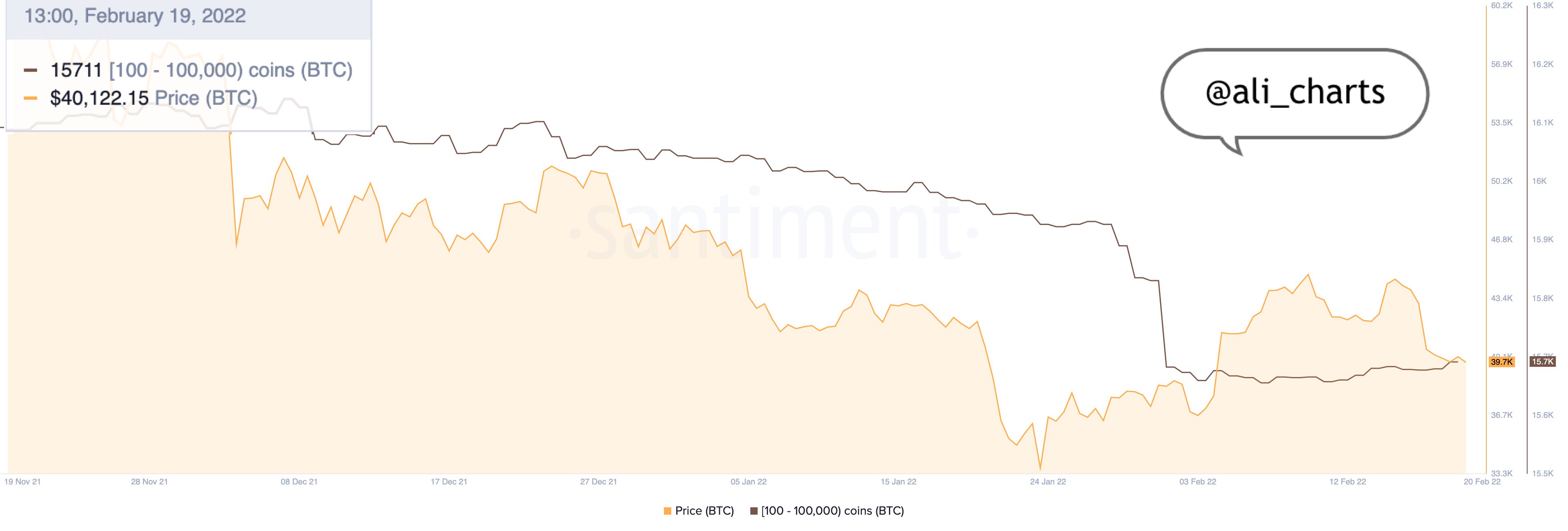

The Bitcoin whale behavior recently suggests that we could be heading for a major correction going ahead. Citing data from Santiment, crypto analyst Ali Martinez explains:

The number of whales on the network with 100 to 100,000 $BTC has remained flat since Feb 1. These wealthy market participants do not appear interested in buying #BTC at the current price levels and could be expecting to buy #Bitcoin at a discount.

Furthermore, the analyst also predicts the Bitcoin price trajectory based on the technical charts, Martinez writes:

Bitcoin could be looking to find support around the 200MA on the 3-day chart at $37K or it may test Tom DeMark’s setup trendline at $33.5K. Failing to hold above this crucial support zone could trigger a cascade of liquidations in the futures market, pushing $BTC further down.

Looking at the recent Bitcoin price action, many analysts believe that we could be at the beginning of the next “crypto winter”. Recently, CEO of crypto exchange Huobi said that we should not expect a Bitcoin bull run until late 2024 or early 2025.