OpenSea has been the OG NFT marketplace for a while now. In fact, despite some major concerns shared by some of its users, for many, OpenSea’s position in the market was unlikely to be usurped.

Until recently.

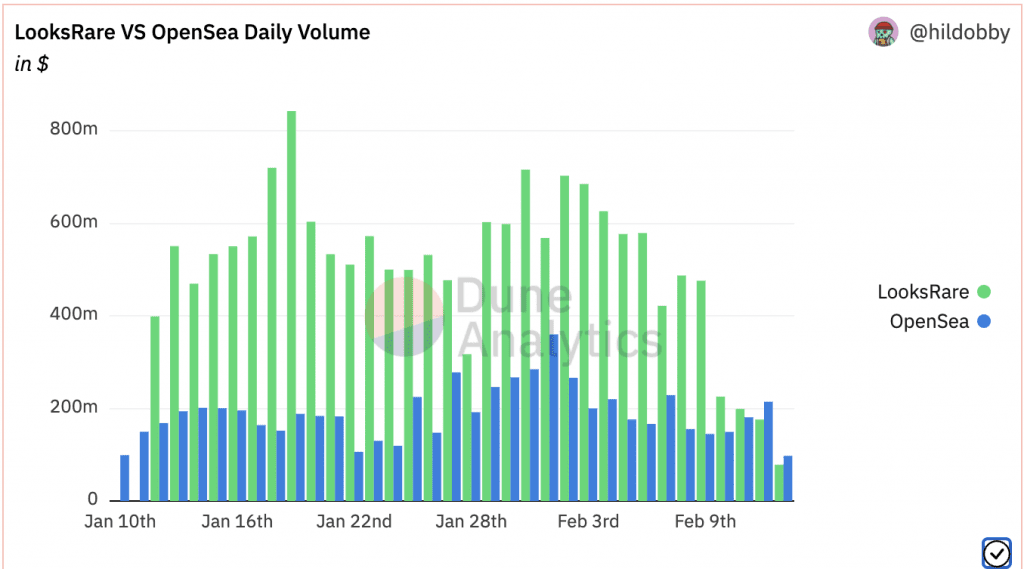

January saw the launch of LooksRare, and the space hasn’t been the same since. In fact, soon after its launch, LooksRare was in the news after it overtook, repeatedly, the OG’s daily volume. This status quo was maintained consistently from 12 January to 11 February.

Needless to say, such evidence is likely to fuel speculations that OpenSea’s time in the sun may be done. Maybe. Maybe not. What is clear, alas, is that OpenSea isn’t sitting still. In fact, according to reports, it’s working towards integrating Solana-based NFTs plus Phantom wallet support.

Phase 2 – A halving of fortunes?

However, that would be digressing from the point because it is time to look at LooksRare more closely. Over the past few weeks, a lot has been claimed about the new upstart. Now, we won’t expand on all that here, but check out what’s been written about the allegations of wash trading against it, for instance.

On the ecosystem front, LooksRare was in the news recently after it went through with Phase 2. Under the same, LOOKS rewards, both for trading and staking, have been reduced by over 50%. Thanks to the same, there are now fewer LOOKS in circulation. Furthermore, some LOOKS will be reallocated towards long-term Uniswap V3 liquidity. The next rewards halving is scheduled for less than 90 days.

How is LooksRare coping then? Well, it hasn’t been the best of times if certain datasets are taken into consideration. Especially when juxtaposed against the numbers seen in January. The same was the subject of the latest Santiment Insights report.

Probably not according to plan…

In the days after the halving, LooksRare’s user count, trading volume, and fees generated all fell to their lowest point in over a month. The last 24 hours actually saw OpenSea overtake LooksRare’s daily volume for the first time in a month.

Now, will this be enough to bring the LooksRare train to a halt in the near-term? Probably not, with one analyst actually claiming that the APR is attractive enough for wash traders to keep it running for the next 90 days.

However, it would be too simple and unreasonable to consider one set of metrics alone. What do other metrics say?

The metric side of things

Consider the question of Supply on Exchanges, for instance. As can be seen from the chart below, over the past few weeks, the supply of LOOKS on exchanges is steadily rising. Usually, the accumulation of a token’s supply on exchanges is a sign of growing sell pressure.

This is the case here as well, with the same corresponding with a fall in the altcoin’s price. While some had hoped the rewards halving would perhaps slow this descent, that hasn’t happened.

Then there’s the question of Network Growth, a metric that has fallen dramatically since the latter quarter of January. According to Santiment,

“Probably due to most people having claimed their LOOKS and moving on. Currently, there’s just not enough new demand to prop up the prices.”

Is it all bad news for LOOKS though? Well, not really.

Active addresses 1hr for LOOKS, for instance, has been normalizing of late.

Finally, there’s the small matter of the balance on the staking contract too. As highlighted by the crypto-analytics platform, the balance on the same has continued to rise over the past few days, despite the fall in the alt’s price. In fact, with the same seeing huge inflows lately, almost 85% of all LOOKS are staked.

“… which may suggest that whales and strong hands are not fazed by the price action.”

It’s difficult to say where LOOKS and LooksRare will head from here. What is evident, however, is that there is a long way to go before the “competition” between OpenSea and LooksRare can stay as one.