Key Takeaways

- Yuga Labs is the company behind the uber successful Bored Ape Yacht Club NFT collection.

- In its efforts to go big, Yuga Labs has taken money from Silicon Valley titans, chased corporate partnerships, and paid itself enormous sums through its own token.

- Chris Williams argues that Yuga Labs is more of a Web2 company than truly decentralized projects like Nouns and Yearn.Finance.

Share this article

a16z, Adidas, influencers, PR spends, dodgy token allocations: there are a lot of reasons to question Yuga Labs’ efforts recent efforts to take over the NFT space.

Why Yuga Labs Is a Web2 Company

This year, Yuga Labs’ staggering ascent has been impossible to miss in the NFT space; only a week ago, I described it as “the world’s premier NFT brand” in one of our newsletters. The Bored Ape Yacht Club creators have struck gold with a formula that every other PFP project envies, but that doesn’t mean that Yuga Labs is a true Web3 organization. Allow me to explain.

Last night, we got the big news that had been rumored for weeks when a16z announced it had led a $450 million Yuga Labs raise, putting the 14-month-old company’s valuation at an eye-watering $4 billion. a16z is no stranger to crypto, having dug deep into its billion-dollar reserves to invest in products like Uniswap—it’s known to own and have sway over a boatload of UNI tokens—in the past. As Jack Dorsey has very publicly warned, Silicon Valley has become increasingly interested in crypto and “Web3” over the last few years, and Yuga Labs is well aware of this: a leaked 90-page pitch deck boasted of how the firm made $137.5 million with a 95.5% profit margin in 2021 in hopes of securing a big investment.

But Yuga Labs’ has reached beyond the Bay Area in its bid to go global. Back in December, the company partnered with Adidas and a couple of NFT OGs for an initiative dubbed “Into the Metaverse.” Adidas announced that it had acquired a Bored Ape on a Twitter Spaces call (its team’s excitement sounded forced and cringeworthy as hell), then leveraged that to sell ape-inspired NFTs. At that point it was already obvious that Yuga Labs was laser-focused on securing big bucks, even if it meant cosying up to corporates looking to cash in on the NFT trend.

Besides the Adidas partnership, one big ingredient for Bored Ape Yacht Club’s astonishing popularity has been the influencer effect. Paris Hilton and Jimmy Fallon showed off their apes on one of the world’s biggest chat shows, The Tonight Show, in January, but big names were “aping into” the collection long before that. MoonPay facilitated ape buys for the likes of Fallon and Post Malone; the payments company also organized a Bored Ape scavenger hunt with Yuga Labs at Art Basel Miami last year.

Even when apes were trading at around 12 Ethereum, Instagram superstars with big followings and no prior interest in NFTs were buying in. Sorry if this sounds blunt, but you’d be naive to think all of this happened because they all just loved the cartoon monkey images. As much as Bored Apes have become the Internet’s hottest status symbol, it wasn’t that way a few months ago (hint: companies often employ business development people who are paid to get the rich and famous to make their products popular).

Most crypto people won’t be aware of this, but Yuga Labs also has a dedicated PR team (Crypto Briefing has received their pitches in the past). In other words, just as it could have done with the celebrities, it pays other people to get eyes onto the project. That’s why you can always find The Verge covering any Bored Ape-related announcements ahead of time. There are crypto companies that put a lot into marketing to get their message out, then there are others that let the innovation speak for itself. Similar to powerhouses like Solana, Crypto.com, and FTX, Yuga Labs leans on marketing to get users. Bitcoin doesn’t do this, and neither does Ethereum. That’s because they are legitimately decentralized projects.

Many apes rejoiced earlier this month when Yuga announced that it had acquired the IP rights to CryptoPunks and Meebits, but as prominent critics like DCinvestor pointed out, they were missing the bigger picture: if Larva Labs sold out to one of its more successful competitors like this, what’s to stop Yuga Labs from doing the same to Disney somewhere down the line?

back in my day, we folk who have been around laughed at cryptos which required heavy corporate involvement to create and sustain a value proposition (e.g., XRP)

now we put jpegs on them and worship the issuers as infallible

welcome to web3

— DCinvestor.eth ⌐◨-◨ (@iamDCinvestor) March 23, 2022

The same week, Yuga Labs teased a new project with Animoca Brands; it’s believed that it will sell plots of land for a Metaverse world called Otherside in two sales worth another few hundred million this year. It made interested buyers go through a KYC process to register. Still, people did it, and they probably won’t take long to sell out.

Very few people talk about this stuff because they are either not aware of it or it’s not in their interests to dig deeper. Ape holders are typically the last to criticize the project, and who can blame them? After all, they’ve been rewarded with multiple lucrative airdrops in exchange for showing loyalty to the brand.

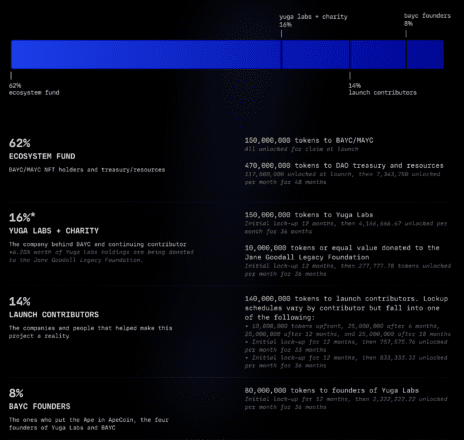

The most recent of these giveaways came with last week’s APE token launch. Bored Ape holders received over 10,000 tokens, the equivalent of about $100,000 on the first day. “Yuga Labs” got around 10% of the 1 billion token supply after its charity donations, and “BAYC founders” got 8%. Combined, that’s another $500 million or so to add to its pot (“Launch contributors,” whoever they are, also got 14%).

Now you might argue that I’m just bitter I didn’t get into apes early enough, and I can’t deny that I wish I owned one (I even signed up for the Animoca project to see what it’s all about and potentially flip for a quick buck). Bored Ape Yacht Club has been one of the greatest investment opportunities of all time, far outpacing my bags (i.e. Ethereum) and practically every other asset on earth. The forthcoming Otherside project should only benefit the Bored Ape community too.

Last week I said that I wouldn’t bet against Yuga Labs right now, and I still stand by that. But you’re fooling yourself if you think the company shares the same Web3 spirit as crypto’s most decentralized, community-run projects. Go and check out Nouns, Yearn.Finance, Ethereum, or Bitcoin if you’re still not convinced.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies. They also had exposure to YFI and UNI in a cryptocurrency index.

Share this article

Investing Survey: Win A $360 Subscription To Pro BTC Trader

We’re doing this because we want to be better at picking advertisers for Cryptobriefing.com and explaining to them, “Who are our visitors? What do they care about?” Answer our questions…

Yuga Labs Raises $450M at $4B Valuation

Yuga Labs, the company behind the Bored Ape Yacht Club, has reached a $4 billion valuation via a $450 million raise that was led by the venture firm Andreessen Horowitz….

Bored Ape Yacht Club’s Yuga Labs Has Acquired CryptoPunks

After much speculation across the NFT community, Yuga Labs has confirmed that it has acquired CryptoPunks and Meebits collections from Larva Labs. Yuga Labs Buys CryptoPunks Yuga Labs, the creators…

Is the New Bored Ape Token Worth $15B? Apes Say Yes

As the dust slowly settles on ApeCoin’s extremely volatile launch, the Bored Ape Yacht Club-affiliated token appears to be entering price discovery mode. After dropping to a low of $6.21…