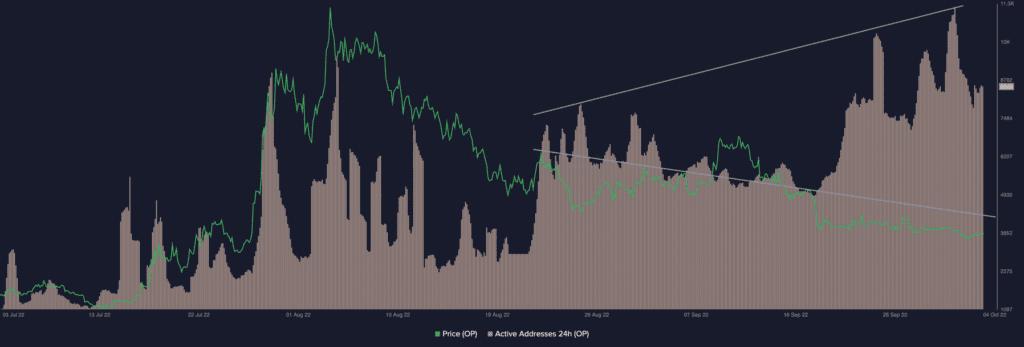

According to data from on-chain analytics platform Santiment, since its inception in May, OP, the native token of the Layer 2 scaling solutions provider Optimism, has registered growth in its on-chain activity.

Interestingly, despite the surge in on-chain activity, OP’s price has failed to follow suit and post gains. Data from Santiment revealed a consistent decline in OP’s price since 4 August. Trading at $0.871 at press time, the crypto asset’s price witnessed a drop of 58% since August.

However, the count for active addresses that have since traded OP rallied. The count witnessed a growth of over 100% within the same period.

Similarly, while OP’s price fell, network growth did witness an upsurge.

According to Santiment, the count for daily active addresses and new addresses on the OP network “are at the highest levels since $OP’s inception in May.” Furthermore, their disparity with the asset’s price was a classic case of price/on-chain activity divergence.

Assessing OP on the chain

A look at OP’s Mean Dollar Invested Age (MDIA) revealed that the period when its price embarked on a decline coincided with the MDIA going up. A rise in an asset’s MDIA implied that there was stagnancy on the network, which can make it difficult for the asset’s price to grow.

Furthermore, as per Santiment, OP’s MDIA spiked by over 1000% since 16 August. This showed severe stagnation on OP’s network despite the growth in daily active addresses and new addresses.

With a continued uptrend of the MDIA, OP’s price may fail to log any significant growth in the days to come.

A blessing in disguise

As for whale accumulation behavior, weathering through the continued fall in price, the count of holders of 10,000 to 1,000,000 OP tokens went up, as per data from Santiment.

In fact, since 4 July, the number of whales that held 10,000,000 OP tokens and more shot up by 140%. But, to the dismay of investors, this failed to result in any significant growth in the price of the asset.

While a number of OP holders continued to hold at a profit, the size of profitable OP investments shrunk considerably since 30 July. OP’s market-value-to-realized-value (MVRV) since fell from 4317% to 66.57% by press time.

Furthermore, a persistent fall in the price of the asset also led to a drop in its weighted sentiment. It was pegged at -0.226 at press time.