Avalanche has manged to stay in the limelight thanks to the numerous collaborations the network has undergone. However, the Avalanche network, as of 29 October, also announced their new update to improve the functioning of its subnets.

When Subnets can more easily interact and share data, builders have more options to create solutions tailored to their users.

Banff 1 expands upon the Elastic Subnet capabilities to include VM2, a new VM <> VM communication tool that builds towards full Subnet interoperability. https://t.co/v7UERztPAh

— Emin Gün Sirer🔺 (@el33th4xor) October 28, 2022

_____________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for Avalanche for 2022-2023.

__________________________________________________________________________

A new update in the pipeline

On 29 October, Emin Gün Sirer, CEO of Avalanche posted a tweet that gave information about Avalanche’s Banff technology. This technology would unlock the ability for Subnet creators to activate Proof-of-Stake validation. Furthermore, the update would also improve upon multiple factors in its technology.

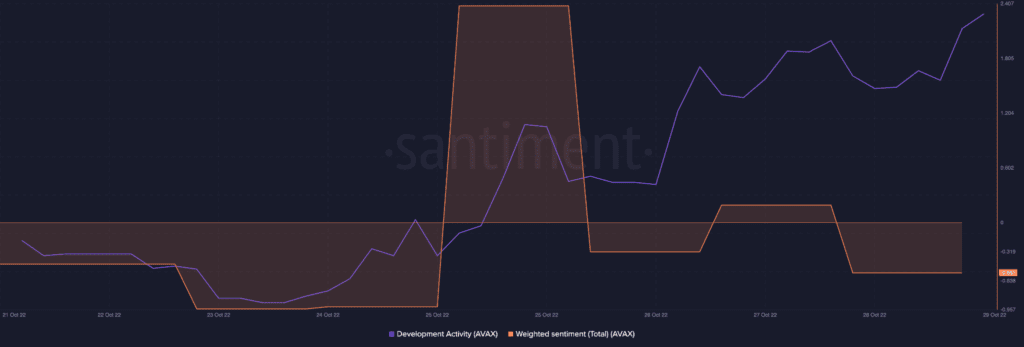

In lieu of this, Avalanche’s development activity, grew considerably over the past few days. As can be seen, from the image below Avalanche’s development activity continued to grow. This indicated that further updates and upgrades on the Avalanche network could be on their way in the near future.

Unlike the development activity’s steady growth, the weighted sentiment for Avalanche witnessed a lot of volatility. Despite the market condition, the overall sentiment around Avalanche was mostly negative. This implied that the negative sentiment superseded the positive sentiment around AVAX over the last few days.

Some negative repercussions?

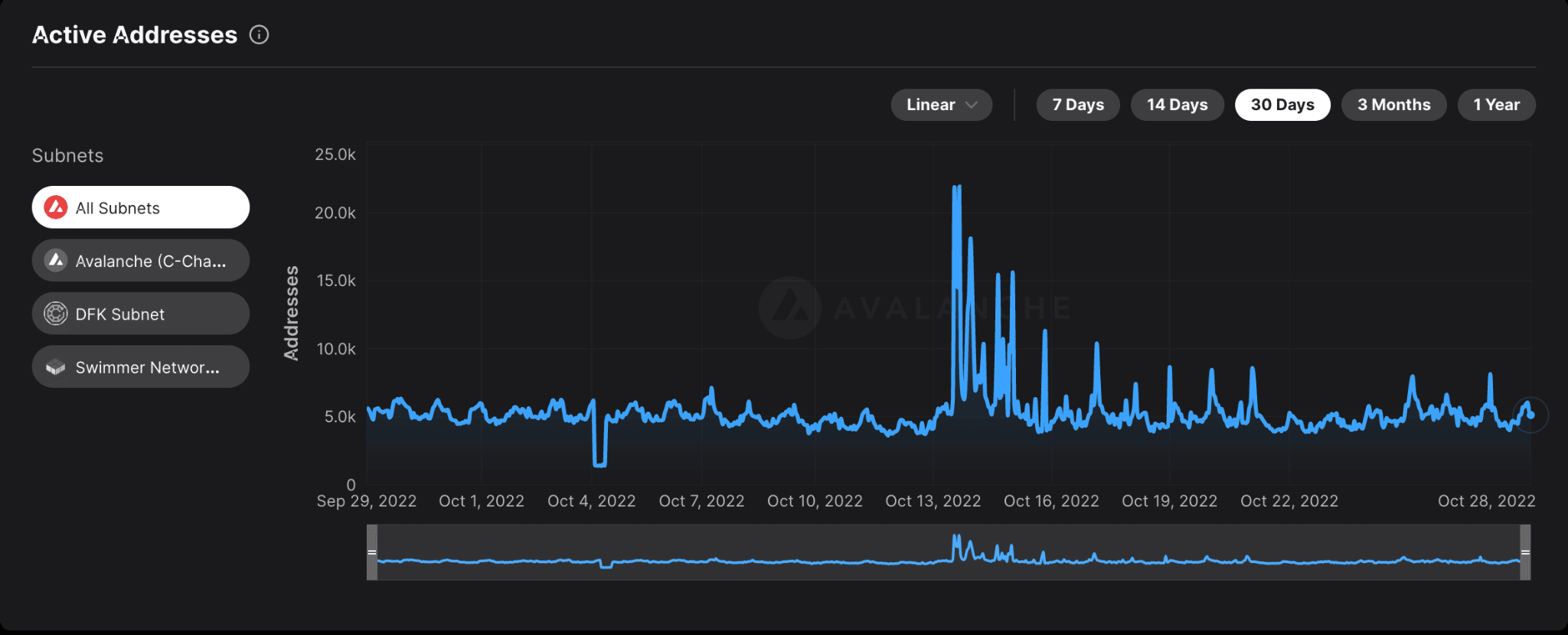

The negative sentiment translated into declining activity on the network. As can be witnessed from the image below, the number of active addresses on the Avalanche network witnessed a drop over the past few days.

However, despite the decline in the number of active addresses on the network, the number of monthly transactions witnessed growth. At press time, the number of transactions made on the Avalanche network stood at 56 million.

Furthermore, despite a growth in the number of monthly transactions, Avalanche was not able to show improvements on some other fronts.

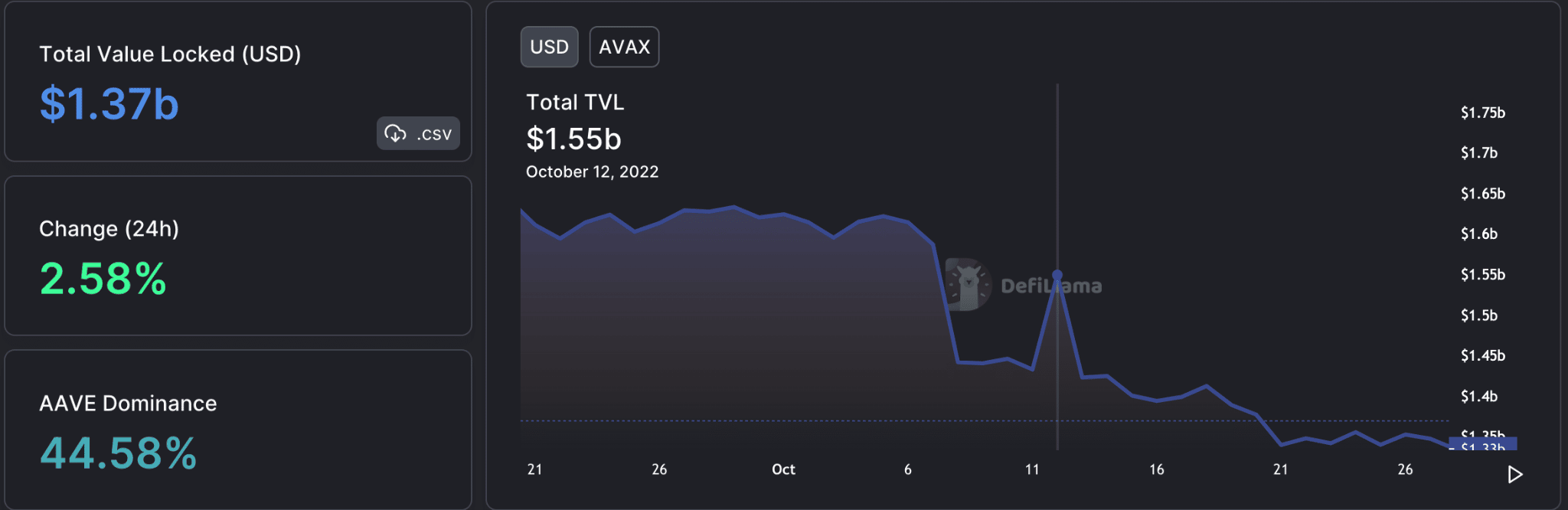

The network didn’t witness any noteworthy performance in the DeFi space, as can be seen from the image below. Avalanche’s total value locked (TVL) declined significantly over the past month. At press time, the TVL stood at 1.37 billion and it had appreciated by 2.58% in the last 24 hours.

With both positive and negative factors affecting AVAX, it would be difficult to predict where the price of AVAX will go in the future.

At the time of writing, AVAX was trading at $18.46 and had appreciated by 7.78% in the last 24 hours according to CoinMarketCap. Its volume also increased significantly and went up by 7.73% during the same period. Its market cap also went up by 8.03% and at press time AVAX had captured 0.5% of the overall crypto market.