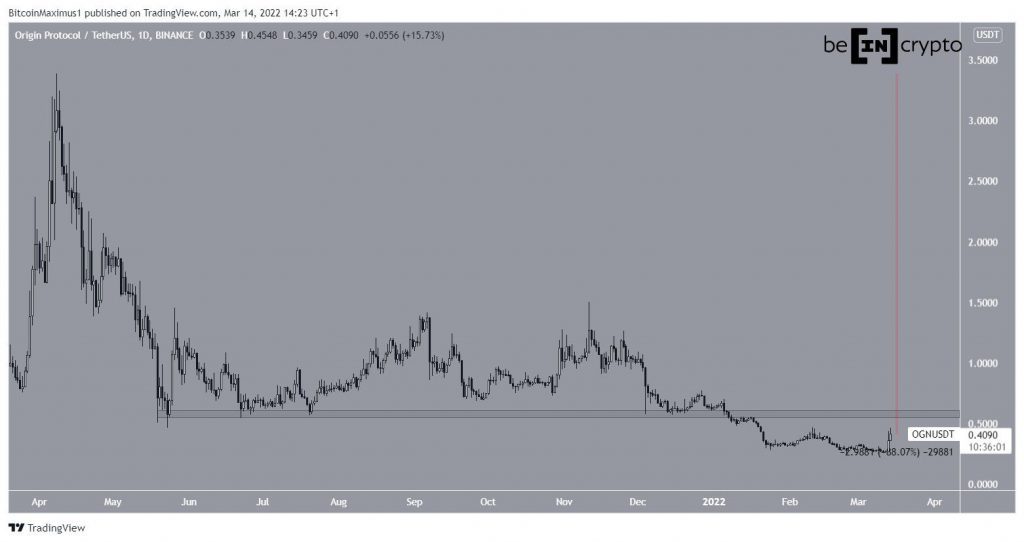

Origin Protocol (OGN) has been moving upwards since Feb 23 and managed to clear an important resistance level on Feb 28.

OGN has been correcting since reaching an all-time high price of $3.38 on April 8. So far, the downward movement has led to a low of $0.28 on Feb 23.

From May – Dec 2021,the price held on above the $0.575 horizontal support area. However, the price broke down on Jan 7, leading to the aforementioned Feb low. Now, the $0.575 area is expected to act as resistance.

Currently, OGN is trading 88% below its all-time high price.

Potential breakout

The daily chart provide a more bullish outlook.

Firstly, it shows that OGN has broken out from a descending resistance line that was in place since Nov 11. Prior to the breakout, the line had been in place for 109 days. Afterwards, it returned in order to validate it as support, before initiating an upward movement on March 13.

Secondly, both the RSI and MACD have generated bullish divergences (green line). Such divergences often precede bullish trend reversals, as has been the case for OGN so far. Finally, the RSI has moved above 50, which is considered a sign of bullish trends.

The closest resistance area is at $0.72. This is both a horizontal resistance and the 0.382 Fib retracement resistance level.

If OGN gets there, it would reclaim the previously outlined long-term resistance area.

OGN/BTC

Cryptocurrency trader @CryptoNTez tweeted a chart of OGN/BTC stating that an upward movement has begun.

The OGN/BTC chart shows a similarly bullish outlook. The price has broken out from a 324 day resistance line before validating it as support and initiating an upward movement.

If the increase continues, The main resistance area would be at 1700 satoshis, a level that previously acted as support.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.