Otherside NFT sales have experienced a substantial decline in sales volume due to the effects of an overall bearish crypto market.

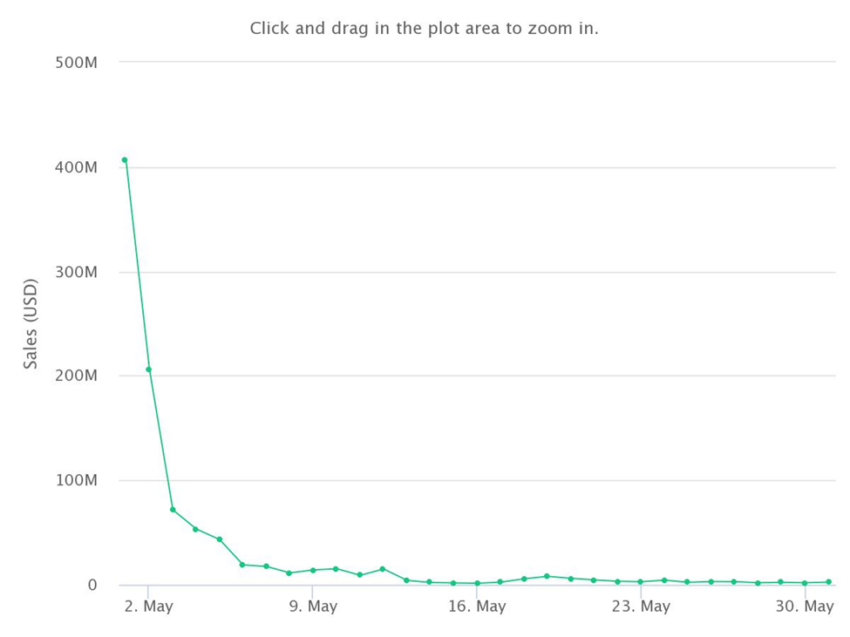

Otherside has climbed into the top-10 rankings with regards to the biggest NFTs by all-time sales volume. In just two months, the digital collectibles have roughly $995.61 million in combined sales volume.

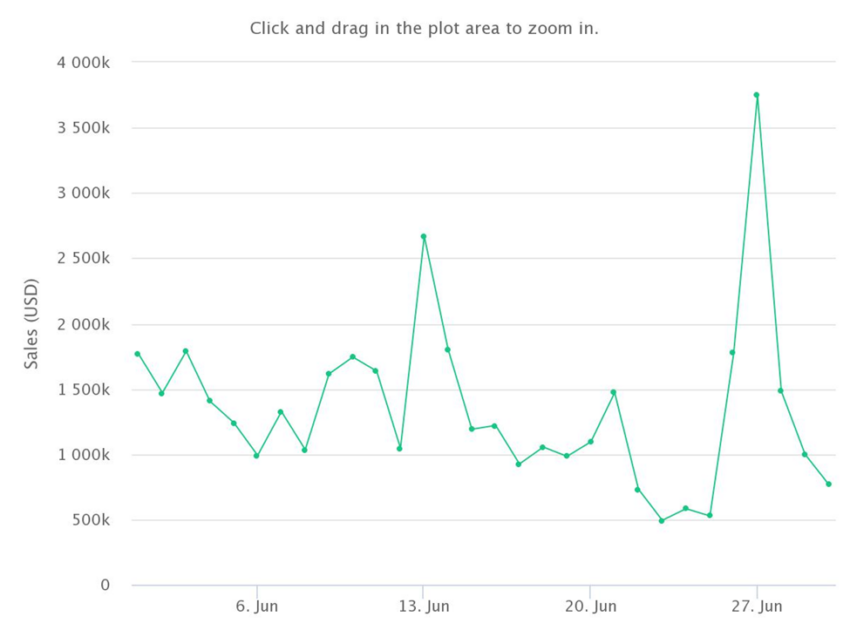

According to Be[In]Crypto research, Otherside had a sales volume of approximately $40.55 million in June.

Although this figure may seem high due to the decreased sales recorded by Meebits, VeeFriends, NBA Top Shots, Axie Infinity, Moonbirds, and Mutant Ape Yacht Club (MAYC), it was a 95% decline from May’s volume.

In May, sales were about $943.71 million.

New to Otherside?

Launched on April 30, 2022, by Yuga Labs (same developer behind Bored Ape Yacht Club, Mutant Ape Yacht Club, and ApeCoin), the Otherside Metaverse aims to be a huge multiplayer online role-playing game that will be linked to the ecosystem of BAYC.

With this, approximately 10,000 participants can simultaneously play together using playable NFTs.

Why the tumble in sales?

Looking at the fall in the number of unique buyers from June 2022, the dip in sales volume led to the digital collectibles’ plunging transaction counts, with 3,225 unique buyers, and 6,646 transactions.

In relation to May 2022, when the collection reached a peak in monthly sales, there were 20,514 unique buyers, and this corresponded to 42,098 transactions.

By recording less than $50 million, Otherside reached a new low in 2022 which was a 903.16 million decrease in sales from May.

Moreover, there was a 27% drop in average sale value from $22,417 in May to $6,102 in June.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.