The much-hyped Ethereum London Hard Fork has gained ground in 2022, particularly with its EIP-1559 which has seen an increment in the number of coins burned since August 2021.

Ethereum Improvement Protocol (EIP) 1559 has been an essential part of the London Hard Fork since its launch on Aug. 4, 2021.

The primary aim of this particular upgrade is to stabilize the high gas fees that emanate from the scalability problems associated with Ethereum’s proof-of-work (POW) network.

This was seen as a way of cementing the value of the native asset of the Ethereum ecosystem and to help combat the inflation rate associated with miner rewards.

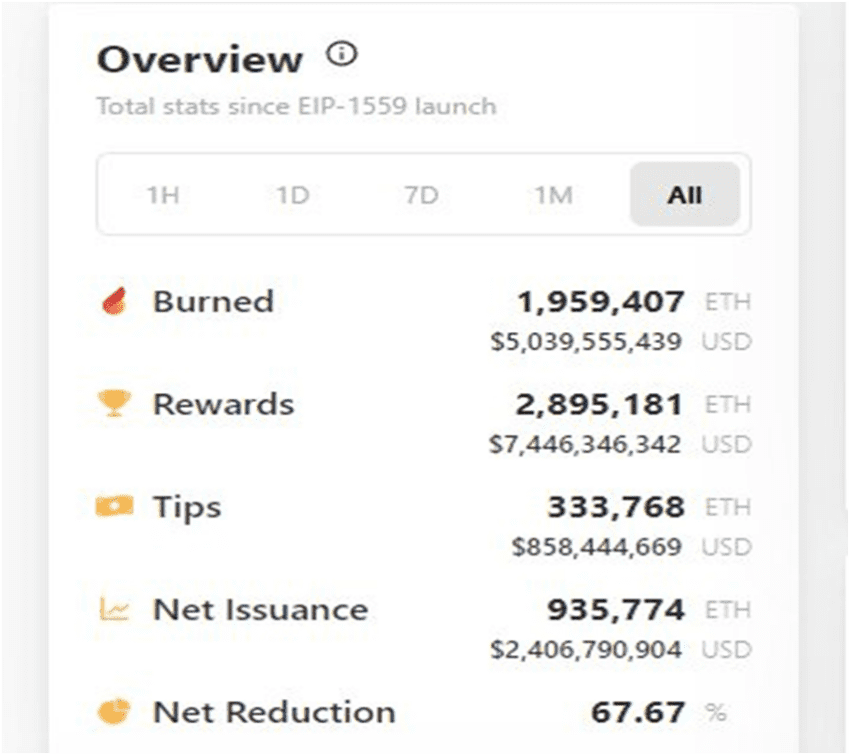

Since EIP-1559 was implemented in August 2021, approximately 1,959,407 ETH in base fees ─ worth more than $5 billion at the exchange rate in March 2022 has been burned, according to BeInCrypto Research.

What this means is that more than 1.9 million coins have been permanently removed from the circulating supply.

Burned ETH surpassed 500% in six months

On Sept. 15, 2021, the total number of ETH burned was approximately 297,000. Per the statistics mentioned above, the total number of burned coins has increased by 559% as of March 2022.

Since the burning of coins is largely associated with fees, much of this figure is largely attributed to an increment in the demand for non-fungible tokens (NFTs) like CryptoPunks and Bored Ape Yacht Club and for use on decentralized exchanges such as Uniswap and SushiSwap.

EIP-1559 heading towards its burn target

The primary milestone of EIP-1559 after its launch was to have 2,560,000 ETH burned within one year (August 2021 to August 2022).

The difference between the total number intended to be burned and the total number already burned so far is more than 600,000 ETH.

This means approximately 76% of the forecasted coins have already been burned with approximately 24% left to be burned on or before the end of August 2022.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.