PancakeSwap (CAKE) is approaching the end of a neutral short-term pattern. Whether it breaks out or down could determine the direction of the future trend.

CAKE had been decreasing underneath a descending resistance line since Aug 2021. The downward movement led to a low of $2.48 in June 2022.

The price has been increasing since and managed to break out from the line the next month. At the time of the breakout, the line had been in place for 336 days. Breakouts from such long-term structures are usually catalysts for considerable increases.

However, that has not been the case here, since CAKE has barely increased above its breakout level. Moreover, the weekly RSI has not yet broken out from its descending resistance line (black line). This would be required in order for the bullish trend reversal to be confirmed.

If an upward movement transpires, the closest resistance area would be at $10.

Current CAKE pattern

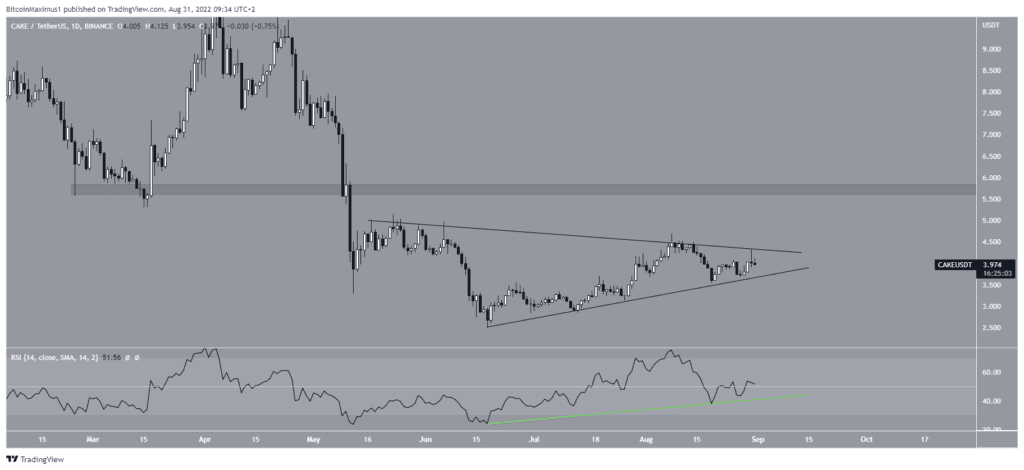

The DeFi platform @HorizonProtocol tweeted a chart of CAKE which shows a symmetrical triangle that has been in place since May.

The symmetrical triangle is considered a neutral pattern, meaning that both a breakout and breakdown from it could occur. The price is approaching the point of convergence between resistance and support, so a decisive movement is expected to occur soon.

Technical indicator readings are mixed, since the daily RSI is right at the 50 line, a sign of a neutral trend.

However, the indicator is still following an ascending support line (green) and creating higher lows. As long as the line is in place, the validity of the bullish structure still remains.

Moreover, this possibility is strengthened by the fact that CAKE has broken out from a long-term resistance line prior to being mired in the triangle.

If a breakout occurs, the next closest resistance would be at $5.80. Conversely, a breakdown below the support line of the channel would likely take CAKE to a new yearly low.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.