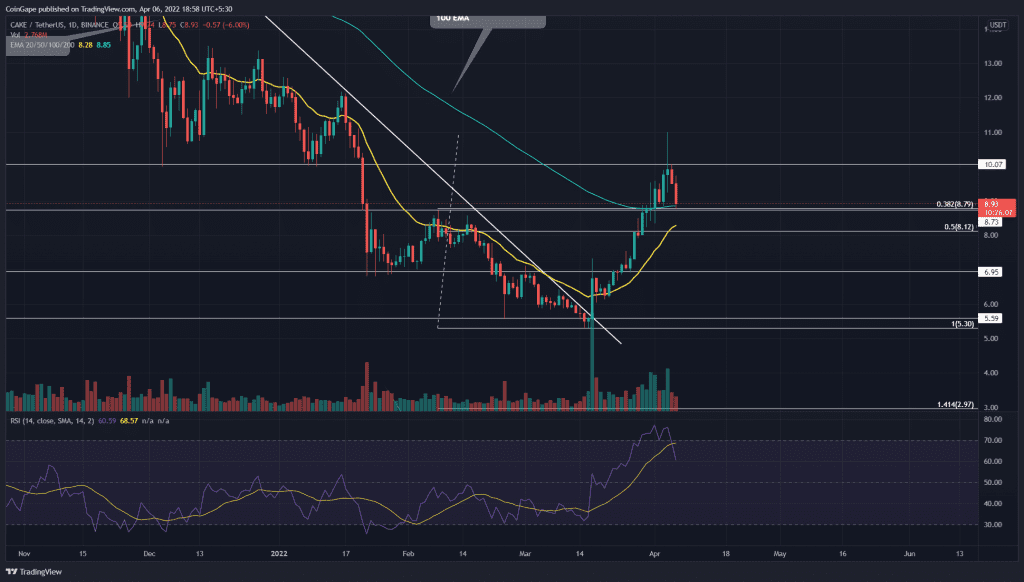

The long tail rejection candle at $10 resistance suggests the Pancake(CAKE) buyers are exhausted from the recent recovery. A failed attempt to breach this resistance triggered a minor retracement and plunged the coin price to $8.75 flipped support. Will buyers continue the ongoing recovery, or there’s more in the correction phase?

Key points:

- The CAKE price retests a confluence of multiple support levels.

- The intraday trading volume in the CAKE token is $277.8 Million, indicating a 16% loss.

Source- Tradingview

The previously downtrend tumbled the CAKE price to a low of $5.32. However, responding to bullish divergence in the daily RSI chart, the coin rebounded from the bottom support with a massive greed candle on March 17th.

Moreover, the altcoin breached a highly influential descending trendline on the same day, indicating the focus has shifted to the upside. As a result, the post-retest rally pumped the CAKE price to a $10 psychological level, registering a 62% ROI.

Furthermore, the buyers tried to continue to bull run with a $10 breakout, but the sellers asserted absolute dominance and forced a candle closing below the resistance. The follow-up correction plunged the coin by 17.6%, hitting the confluence support of $8.75, 0.326 FIB, and 100-day EMA.

This cluster of technical support and decreasing volume activity suggests a good step-up for the price to bounce back. However, if they do, a bullish breakout from $10 is needed to provide additional confirmation.

Alternatively, if the correction continues, the traders could find another strong support at $7.

Technical analysis

The daily-RSI slope shows a sudden dip from the overbought region and beneath the 14-SMA; however, the indicator value above the neutral line maintains a bullish bias.

Moreover, the rising 20-and-50-day EMA aligned $8 physiological indicates the buyers possess more support level on the downside, suggesting the path to minimal resistance is upwards.

- Resistance levels- $10, $13.2

- Support levels- $8.75 and $7