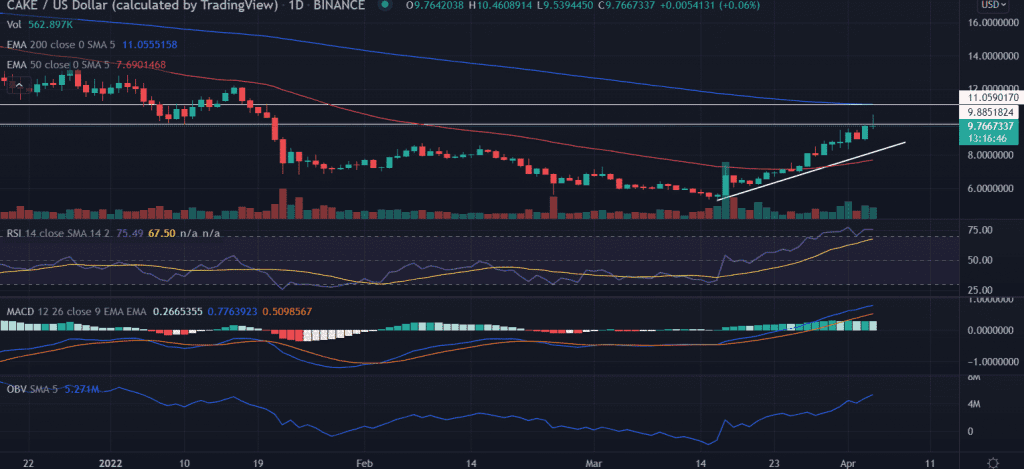

CAKE price struggles near the $10.0 level after logging gains in the previous session. The price remains range-bound with no meaningful price action. Investors await confirmation to continue with the upside bias.

- Cake price consolidates after the previous session’s gains.

- Expect more gains above the 200-day EMA near $12.0.

- The downside remains capped near the ascending trend line at $8.60.

As of press time, CAKE/USD is trading at $9.53, down 0.16% for the day. The 24-hour trading volume is standing at $385,901,758 with gains of 65%.

CAKE price looks for the upside

On the daily chart, the CAKE price attempts to extend the previous session’s gains but remains pressured near the higher levels. The price trades along the ascending trend line from the lows of $5.65. Further, the CAKE price surged almost 100% from the mentioned level. The trading volume remained supportive of the bullish momentum in the asset.

Now, a sustained buying pressure would push the price toward the critical 200-EMA (Exponential Moving Average) at $11.05.

An extended buying will next bring the psychological $12.0 into play.

On the contrary, if the price fails to sustain the session low then it would negate the bullish arguments for CAKE price. On moving lower, the first downside target could be found at $8.80.

Further, a break below the bearish slopping line could retest the 50-day EMA at $7.60.

Technical indicators:

RSI: The daily Relative Strength Index trades near the overbought zone with a neutral bias. Currently, it reads at 75.

MACD: The Moving Average Convergence Divergence holds above the midline. However, the bullish momentum slows down indicating some retracement in the price.

OBV: The On-balance volume indicator approaches the overbought zone that shows the demand increased as the price continues to gain.