Paris Saint Germain (PSG) continued to cross milestones in the global fan token space after extending its lead as the top fan token by sales volume.

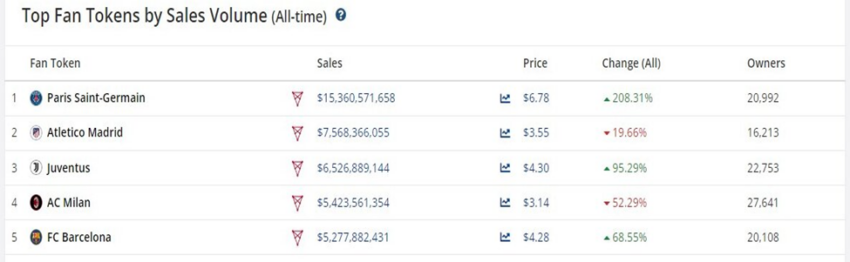

Paris Saint Germain is the most popular global fan token thanks to the global soccer stars that represent the French club. According to Be[In]Crypto Research, PSG had a total sales volume of approximately $15.36 billion as of June 14.

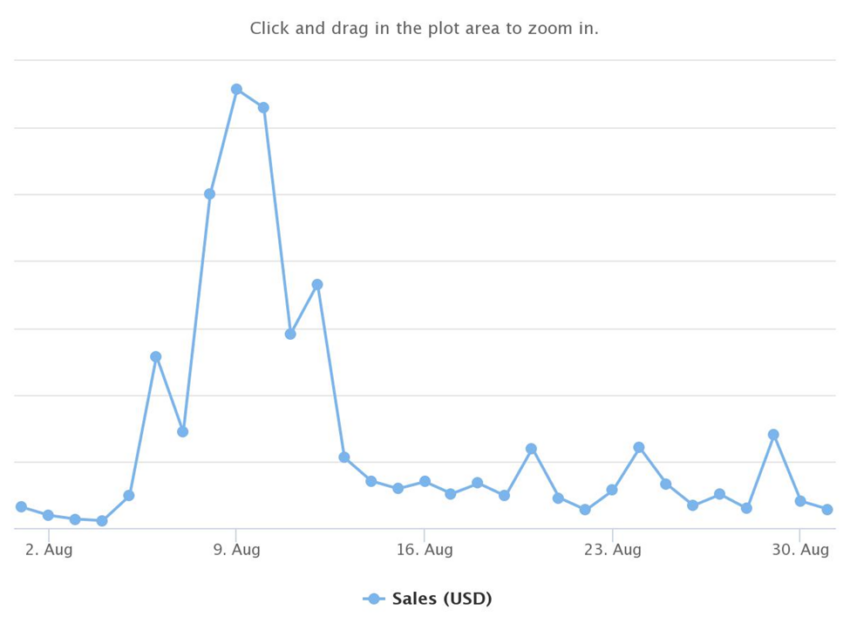

This comes as a huge boost to the sales of global fan tokens after May’s monthly volume of $2.87 billion failed to surpass the yearly high of around $3.51 billion in March.

This milestone puts Paris Saint Germain ahead of Atletico Madrid, Juventus, AC Milan, FC Barcelona, Manchester City, Inter Milan, AS Roma, Galatasaray, Valencia CF, and Arsenal.

What caused soaring token volume?

The transfer of global soccer megastar Lionel Messi from FC Barcelona to PSG in Aug 2021, coupled with the impressive performance of sales in April and May of the same year led to the spike in token sales of the club.

Messi had spent roughly 21-years with Barcelona before joining PSG. The six-time Ballon d’Or winner moved to the French club on a two-year deal – with an option for a third – worth $30 million per year after tax, plus bonuses.

There was a 343% increase from March 2021’s $539.09 million to $2.39 billion in April 2021. Sales spiked in May and by the end of the fifth month of 2021, the volume was $1.74 billion.

In August, token sales reached an all-time high of $4.19 billion, and this corresponded to a market capitalization in the region of $93.05 million.

Other months which made significant contributions to PSG fan tokens were July 2021 ($646.85 million), Sept 2021 ($836.19 million), Nov 2021 ($622.32 million), Feb 2022 ($542.93 million), and May 2022 ($644.43 million).

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.